Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Still Runnin’ Against the Wind

The bull market is older now, but still runnin’…

Is this the end of the bull market? Or is this merely a pause that ultimately refreshes? Since its peak on September 20th the S&P 500 index is off 10.2%. At the same time, some market observers are expressing concern that a recession is just around the corner.

After a record-setting nine-and-a-half year run, some fear that marks the end of the economy’s expansion and the US stock market’s epic rally. We don’t think that’s the case. In fact, in pretty much every year of this powerful (and so far resilient) bull run, dramatic setbacks have led investors to ask this very same question in every year since the bull began its remarkable run in 2009 (see our drawdown chart on page 4 of this report).

Why should this time be different?

Transitions can be difficult for markets to digest initially—particularly when what has essentially been “nearly free money” becomes “dear money” (less cheap to borrow). We believe that what matters is not that interest rates have moved up but rather by how much and just how expensive borrowing has become (i.e. the steepness of the nominal increase).

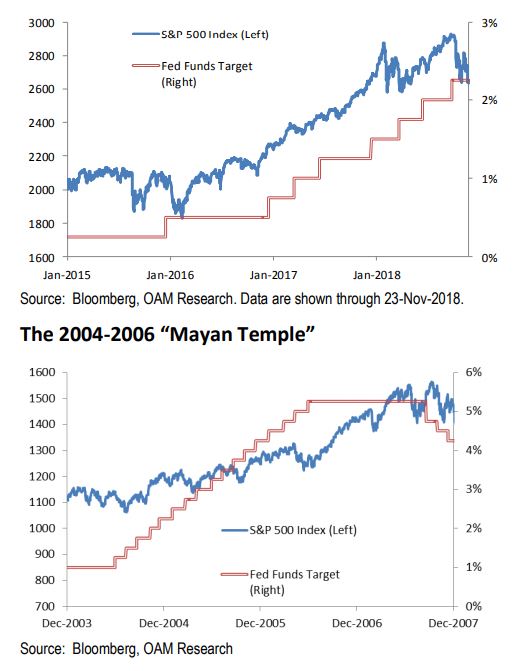

Consider that the last time the Fed embarked on a Fed Funds hike cycle it raised its benchmark rate 425 basis points in 17 separate hikes over the course of a two year period from the end of June 2004 to the end of June 2006. The Fed Fund rate went from 1% at the start of the hike cycle to 5.25% (see top figure on next page).

In the current cycle the Fed has raised its benchmark rate only eight times so far in just under three years—from December 2015 through September 2018—taking its benchmark rate in that period of time up from a band of 0-0.25% to 2.00-2.25%. If it raises the band by another 25 basis points in December, the Fed Funds rate at the high end of the band will be slightly less than half of where it had been at the end of the last Fed hike cycle (see second figure on next page).

“Much of the current angst about the Fed may lie with the market’s typical reluctance to take a new Fed chair at his or her word. ”

The Current Normalization Cycle

Reports of the Bull’s Demise Have been Greatly Exaggerated

Extremes in terms of negative projection as to where the markets are headed have not been uncommon in recent history and since the economy and the market began the recovery process from the financial crisis in early March of 2009.

From March of 2009 to the end of the year many expected the nascent economic recovery and market rebound would fail—some even predicting a double dip to take hold. Efforts by the Fed to stimulate the economy were expected by many observers and market participants to fail. Some equated the Federal Reserve’s efforts to restore economic growth to a sustainable level to be akin to “pushing on a string”.

Remember in 2010 when the Greek debt crisis surfaced? At the time many market pundits expected it would lead to the expulsion or exit of Greece from the EMU, the demise of the singular currency (the euro) and the disbanding of the European Monetary Union. It didn’t happen. And still hasn’t happened notwithstanding new challenges including immigration, populist election victories and a dose of economic sluggishness tied we’d think to global trade concerns more than regional issues.

In 2011 one of three major rating agencies downgraded US Treasury debt below its long-envied AAA rating. Many observers predicted US debt would lose its popularity among investors as a result. Didn’t and still hasn’t happened.

In 2012 a “fiscal cliff” driven by higher taxes was widely expected to cut economic growth (GDP) and lead the US into a recession in 2013. It didn’t happen.

In May, 2013 then Fed Chair Ben Bernanke said the economy was doing well enough that the Fed might consider tapering its monthly bond buying program. The bond market reacted negatively with the collective thought that the Fed had misjudged inflation (“fallen behind the curve”) and that the central bank would likely begin to raise rates aggressively. The “taper tantrum” ensued: the bond market sold off as a result from May through the end of 2013 with the 10-year Treasury yield nearly doubling from 1.6% in May to 3.02% by December 31st. By the start of 2014 the bond market had determined there wasn’t enough inflation to justify a 3% yield on the 10 year Treasury. Not until March 2018 did we see 3% on the 10 year again—this time supported by improved economic conditions apparently warranting the higher yield.

In 2014 the equity markets ran into turbulence that included a number of dramatic sell-offs and rebounds in the month of October again on worries about inflation and a more aggressive Fed. By the end of the month the S&P 500 had rebounded to new highs.

In 2015 China devalued its currency for the first time in quite a number of years causing some investors to negatively overproject the potential for a hard landing in China that could have repercussions for the rest of the world. The market was essentially flat in 2015, down just 0.73% and China didn’t have a hard landing that year or so far since.

In the first seven weeks of 2016 the S&P 500 corrected after China devalued its currency for a second time and the price of oil fell to $26.21. Stocks then rebounded from the February low only to run into further turbulence in June when the UK voted to leave the EU. Despite the rollercoaster ride at the start of the year, the S&P 500 ended 2016 up a little more than 9.5% while oil ended the year at $53.72.

2017 was as close to what we’ll call “a free hall pass” for investors as we can recall since the recovery from the financial crisis began. Volatility seemed to take a holiday and the S&P 500 advanced just under 19.5% in the year.

2018 has been challenged by what we believe remain unfounded fears of a Federal Reserve mistake. Ever-present doubters of the Fed vacillate between worrying that the Fed will fail to raise interest rates sufficiently to curb inflation or that the central bankers will raise rates too high too fast and derail the US economic expansion.

So far that has not happened.

“What Me Worry?”

So far economic and corporate fundamentals have not experienced worrisome deterioration. Economic growth continues to appear sustainable albeit at a modest pace (and perhaps even better for now) while corporate revenues and earnings growth in the third quarter have surprised to the upside. With 483 of the S&P 500’s member companies having thus far reported through last Friday earnings in the third quarter of this year were up just over 26% on back of 8% revenue growth. (See page 7 of this report for further details)

As for what’s been rattling the markets since the start of the fourth quarter on a day to day basis, we’d cite four key concerns that include:

A rose by any other name

The longer the trade war between the US and China goes forward the less practical it is likely to seem for both sides to continue it. History has in our opinion proven that trade wars hurt all sides and curb the economic growth of all combatants.

That said, the current trade war has emerged out of frustration with trade practices by China in its relationships with the US as well as with other partners. Unfair trading practices have often been overlooked if not accepted in dealing with emerging market partners. China by the size of its successes, power, and wealth must know that it can no longer expect to be treated as an emerging partner in trade. Already it has begun to take some steps to reduce some of the more onerous tenets of joint venture agreements and other pre-requisites for doing business that the US and other trade partners have cited.

We continue to expect some progress toward a resolution of the trade conflict that may come out of the G20 meeting that begins this week in Buenos Aires. We look for a resolution of some kind (even if just a curtailment of further escalation of the trade war) by the end of this year followed by an agreement by the end of the first quarter of next year.

Chinese leaders have their “Made in China 2025” goals to consider and the US has an agenda beyond trade that includes infrastructure, drug and healthcare costs, and a national election in 2020.

No Honeymoon for Fed Chairs

From our perspective on the market radar screen: we’d consider that the Federal Reserve appears to have avoided making a serious mistake since it first introduced a methodology to bring back the US economy from the brink of the Great Financial Crisis of 2008, there’s a good chance it might continue on a similar path of proving sensitive to both strengths and vulnerabilities of the economy.

It would seem to us that Chairman Jerome Powell has so far managed to continue with a process of good communication and high transparency with the markets established by Ben Bernanke and later practiced by Janet Yellen.

Much of the current angst about the Fed may lie with the market’s typical reluctance to take a new Fed chair at his or her word. In our experience, (which spans over 30 years in the market), we can never recall a honeymoon period between a new Fed chair and the markets. We believe it takes years for the markets to begin to feel comfortable—if ever—with a Fed Chair no matter how communicative or transparent in managing policy they may be.

Does Oil Price Drop Signal Recession?

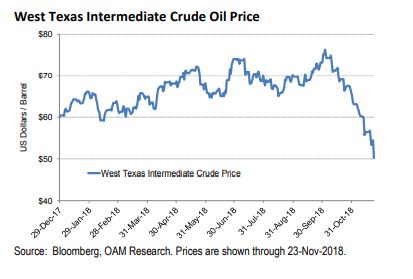

One additional worry we’d cite is the decline in the price of oil. West Texas Intermediate oil has dropped 33.5% from its peak this year on October 26th through last Friday (see figure below).

Some think the drop in the price of the commodity that essentially lubricates the gears of economic growth portends a sizeable drop in economic growth ahead. Beyond that, economic growth in a number of countries outside the US (including recent data from China and Germany) has shown signs of slowing.

The drop in the price of oil to us seems more tied to increased production among OPECs members, Russia and the US than a decline in demand for oil. The recent increase in production started with efforts to offset a drop in oil supply from Iran tied to sanctions but also has its source in the desire of oil producers around the world to recover the costs of at least some of their investments made in the global oil patch over the past few years. The discipline that oil producers have practiced over the past few years to elevate and maintain the price of oil was bound to be tested, and in our opinion has been.

The Week Ahead

Look for the markets this week to stay focused on the G20 meeting for any indications of a breakthrough in trade as US and Chinese leaders meet in Argentina. We’d also watch for any comments from Fed officials for signals on December’s FOMC meeting as well as for any words from Saudi Arabia, OPEC members and Russia on oil production.

We suggest investors stay focused on the fundamentals and keep an eye out for any babies thrown out with the bath water.

Our mantra for this fourth quarter has become “a detour does not a journey end.”

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.