Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Not All is Lost in Translation

Strong Dollar Puts Many Foreign Stocks “On Sale”

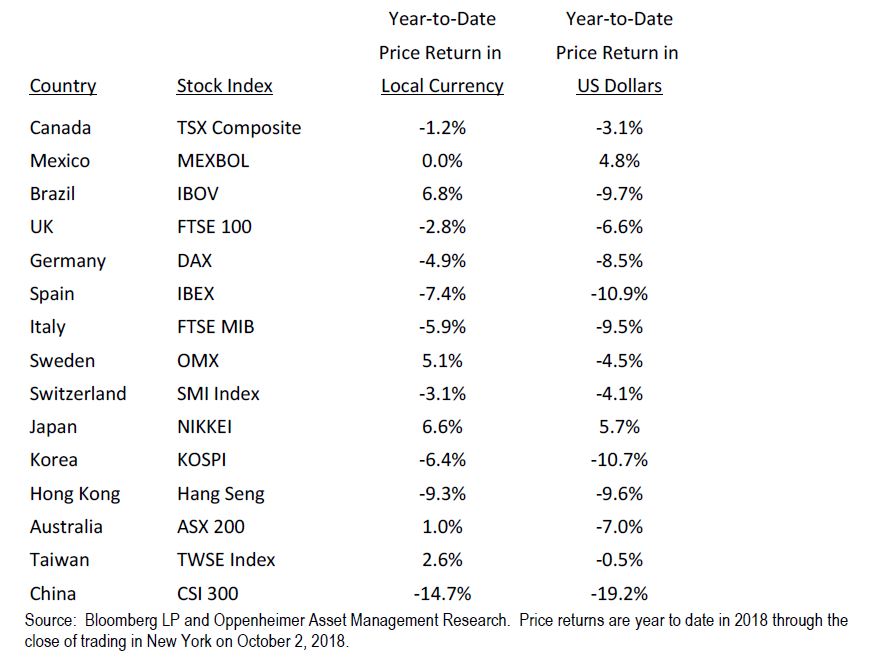

The appreciation of the US dollar since late March has dampened returns for US investors on most foreign stocks. We show below the sharp difference in price returns on foreign stock market indexes priced in those nations’ local currencies versus returns in US dollar terms in the year to date. In many markets, local currency returns exceed those priced in dollars (Mexico and Japan are exceptions).

The export dependency of many foreign economies underscores the vulnerability of these nations to a protracted trade war. Fears of a lingering stalemate in negotiations have in many cases impacted both the currencies and tradeable assets of these countries. As we believe that trade issues will be resolved sooner than many expect (as illustrated by the US-Canada-Mexico deal over the past weekend), developed and emerging international markets may be close to an inflection point.

In our view, the current pricing presents American investors the opportunity to buy foreign stocks while they’re “on sale” with a strong US dollar. While we can’t predict with any certainty that this is the high for the US dollar (or a low for foreign stocks priced in dollars), it nonetheless feels like an opportunistic time to buy. Should the dollar retreat in the coming months and years, translating these stocks’ performance and their earnings back to dollars could add to returns.

Many index mutual fund and exchange traded fund providers offer diversified portfolios of foreign stocks available to US investors,(including those based on the MSCI EAFE Index, composed of developed nation stocks excluding those of the US and Canada, and the MSCI Emerging Markets Index).

For the complete report, please contact your Oppenheimer Financial Advisor.

Important Disclosures and Certifications

The published date of the recommendations contained in this report can be found by accessing disclosures (https:// opco2.bluematrix.com/sellside/MAR.action). This report was produced at October 3, 2018 07:27 EDT and disseminated at October 3, 2018 07:27 EDT.

Strategist Certification - The author certifies that this investment strategy report accurately states his/her personal views about the subject securities, which are reflected in the substance of this investment report. The author certifies that no part of his/her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this investment strategy report.

The strategy provided in this report is provided by Oppenheimer Asset Management Inc., (“OAM”) a registered investment adviser affiliate of Oppenheimer & Co. Inc. (“OPCO”). It reflects analysis of fundamental, macroeconomic and quantitative data to provide investment analysis with respect to U.S. securities markets. The overview in this report is provided for informational purposes and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security or investment advisory services. The report is not intended to provide personal investment advice. The investments discussed in this report may not be suitable for all investors. Investors should use the analysis provided by this report as one input into formulating an investment opinion and should consult with their Financial Advisor. Additional inputs should include, but are not limited to, the review of other strategy reports generated by OAM, its affiliates, and looking at alternate analyses. Securities and other financial instruments that may be discussed in this report or recommended or sold by OPCO or OAM are not insured by the Federal Deposit Insurance Corporation and are not deposits or obligations of any insured depository institution. Investments involve numerous risks including market risk, counterparty default risk and liquidity risk. Securities and other financial investments at times may be difficult to value or sell. The value of financial instruments may fluctuate, and investors may lose their entire principal investment.

Strategist Certification - The author certifies that this strategy report accurately states his/her personal views about the subject matter reflected in the substance of this report. The author certifies that no part of his/her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this strategy report.

Potential Conflicts of Interest: Strategic analysts employed by OAM are compensated from revenues generated by the firm. The strategists authoring this piece also contribute to an OAM managed portfolio product that relies on and trades on the information contained herein. The managed portfolio strategy trades frequently, both ahead of and after the publication of this report. OAM generally prohibits any analyst and any member of his or her household from executing trades in the securities of a company that such analyst covers. Additionally, OAM generally prohibits any analyst from serving as an officer, director or advisory board member of a company that such analyst covers. In addition to 1% (or more) ownership positions in covered companies that are required to be specifically disclosed in this report, OPCO may have a long positon of less than 1% or a short position or deals as principal in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon and makes a market in the securities discussed herein. Recipients of this report are advised that any or all of the foregoing arrangements, as well as more specific disclosures set forth below, may at times give rise to potential conflicts of interest. Third Party Research Disclosure OAM has a research sharing agreement with OPCO pursuant to which OPCO provides OAM Strategy thought pieces to its institutional and retail customers. OPCO does not guarantee that the information in OAM Strategy reports is accurate, complete or timely, nor does OPCO make any warranties with regard to the strategy product or the results obtained from its use. OPCO has no control over or input with respect to opinions found in OAM strategy pieces. OAM is a registered investment adviser affiliate of OPCO. Additional Information Please write to Oppenheimer Asset Management Inc., 85 Broad Street, New York, NY 10004. Attention: Compliance Department, with any questions or requests for additional information. Other Disclosures: This report is issued and approved by OAM, a registered investment adviser, for use by its affiliates OPCO, Oppenheimer Europe Ltd. and Oppenheimer Investments Asia Limited. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. This report may be further distributed by OPCO for informational purposes only, to its institutional and retail investor clients. OPCO transacts business on all principal Exchanges and is a member of SIPC. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of OAM or its affiliates. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The analyst writing the report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such recommendation is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. OAM will not treat non- INVESTMENT STRATEGY 2 client recipients as its clients solely by virtue of their receiving this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal. OAM accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but OAM does not represent that any such information, opinion or statistical data is accurate or complete (with the exception of information contained in the Important Disclosures section of this report provided by OAM or individual research analysts), and they should not be relied upon as such. All estimates, opinions and recommendations expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser. This report may provide addresses of, or contain hyperlinks to, Internet web sites. OAM has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. Indices are unmanaged, hypothetical portfolios of securities that are often used as a benchmark in evaluating the relative performance of a particular investment. An index should only be compared with a mandate that has a similar investment objective. An index is not available for direct investment, and does not reflect any of the costs associated with buying and selling individual securities or management fees. The Volatility Index (VIX) shows the market's expectations of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. The VIX is a widely used measure of market risk. This strategy report may also be distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This strategy report is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This strategy report is for distribution only to persons who are eligible counterparties or professional clients. It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. https://opco2.bluematrix.com/sellside/MAR.action This strategy report may be distributed in Hong Kong by Oppenheimer Investments Asia Limited (OIAL) to professional investors, persons whose business involves the acquisition, disposal or holding of securities, whether as principal or agent. OIAL, an affiliate of Oppenheimer Asset Management Inc., is regulated by the Securities and Futures Commission for the conduct of dealing in securities and advising on securities. Professional investors in Hong Kong should contact researchasia@opco.com for all matters and queries relating to this report. The above is for informational purposes only and should not be considered as an offer, or solicitation, to deal in any of the investments mentioned herein. OAM does not warrant the accuracy, adequacy or completeness of the information and materials contained in this document and expressly disclaims liability for errors or omissions in such information and materials. Some of the information in this document may contain projections or other forward looking statements regarding future events or future financial performance of countries, markets or companies. These statements are only predictions and actual events or results may differ materially. The reader must make his/her own assessment of the relevance, accuracy and adequacy of the information contained in this document, and make such independent investigations, as he/she may consider necessary or appropriate for the purpose of such assessment. Any opinion or estimate contained in this document is made on a general basis and is not to be relied on by the reader as advice. Neither OAM nor any of its agents have given any consideration to nor have they made any investigation of the investment objectives, financial situation or particular need of the reader, any specific person or group of persons. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the reader, any person or group of persons acting on any information, opinion or estimate contained in this document. OAM reserves the right to make changes and corrections to its opinions expressed in this document at any time, without notice. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of OPCO and/or OAM. Copyright © Oppenheimer & Co. Inc. 2018.