Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Don't Change Horses in the Middle of the Stream

Beyond the equity market's current "ponder" and rotation, we expect to be rewarded

What’s the market telling investors? Is the Bull “tired” as some say or is it waiting for a catalyst to appear on the scene to make its next decisive move? Without hesitation we think it is the latter.

With the US Presidential election just 15 days away and the Federal Reserve’s December FOMC meeting only 51 days away it appears to us that the market is biding its time until it can put the outcome of the two aforementioned sources of uncertainty behind it.

For now the market appears to be biding its time in a process of rotation from defensive stocks (particularly those considered “bond proxies”) into cyclical stocks—companies that are more sensitive to economic growth and those that are often considered better able to navigate an increase in interest rates.

The thought is that when the Fed raises rates the act of moving rates higher can be taken as confirmation that the central bank believes the economy is strong enough for the Fed to pursue its process of interest rate normalization without derailing the economy or the markets. That is, so long as policy makers don’t hike them in large increments, too frequently, or ultimately too high.

So far the market’s transition from overweighting defensives to overweighting cyclicals has been remarkably smooth even as it creates somewhat of a churning sensation.

The first half of the year (1Q and 2Q) was led by defensive sectors made up of stocks which often serve as bond proxies. The Telecom services and Utilities sectors of the S&P 500 rose 21.8% and 21.2% respectively in the first half of the year.

Driving those sectors higher in the first six months of the year in no small part was investors’ demand for investments that could provide current income as bond yields fell further than many had expected.

With the third quarter came expectations among some investors that bond yields had fallen about as far as they could go. Concerns were also rising that the Fed was nearing a rate hike based on improving economic data and increasingly hawkish “Fedspeak” (comments by Fed officials).

At least some investors who had earlier diversified their income-generating holdings into bond proxy stocks (traditionally defensive sectors including telecom, utilities and consumer staples) took some profits in those positions from the first half of the year and rotated the proceeds into cyclical sectors, among which there are also many dividend-paying stocks (thus providing income).

From the start of the third quarter to the start of the fourth quarter the telecom services and utilities sectors moved from being the first and second best performing sectors in the first half of the year to become the worst-performing sectors in 3Q, falling respectively 6.6% and 6.7% between June 30th and September 30th.

As the two leading sectors from the first half moved to the bottom of the S&P 500 sector performance rankings, technology and financials, which had been the worst performers (off respectively 1.17% and 4.6% in the first half), rallied to become the top performers rising respectively 12.44% and 4.03% in 3Q.

Since the start of the fourth quarter as the rotation is digested by the market, the few remaining weeks to Election Day and the Fed’s FOMC meeting have increasingly garnered investors’ attention and even concern.

Even as earnings declines in the energy sector remain a drag on overall results, other sectors have been posting positive results that are above expectations (see the earnings score card on page 4 of this report for greater detail).

While the S&P 500 often takes up greater mind share among investors, we find it worth noting that the mid-caps (the S&P 400) and small cap stocks (as tracked by the S&P 600) have outperformed the S&P 500 in the first half of the year (rising 7.0% and 5.45% respectively in 1H vs. the S&P 500’s gain of 2.7%); and in the third quarter (rising 3.73% and 6.9% respectively vs. the S&P 500’s gain of 3.3% in the same period).

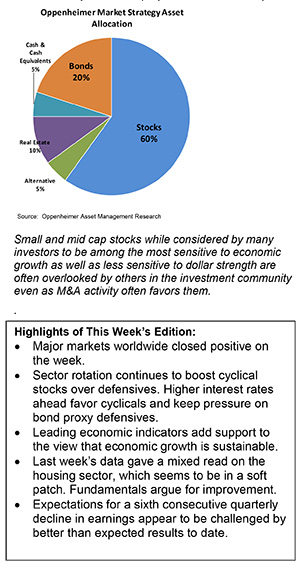

Small caps and mid cap stocks while considered by many investors to be among the most sensitive to economic growth as well as less sensitive to dollar strength are often overlooked by others in the investment community even as M&A activity often favors them.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.