Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Old Dawgs Can’t Learn New Tricks

Or so folks say...but not us.

As to the market? so far “more of a trim than a haircut.”

When it comes to Warren Buffett, we think “that dawg knows how to hunt” – being that he’s well known for learning new tricks in the process of seeking quivers for his bow. The latest evidence of that came last week on news that the “Oracle of Omaha” had recently added around a billion dollars of Apple Computer (AAPL, Perform-rated) shares to Berkshire’s portfolio of stocks.

Notwithstanding Mr. B’s long term reputation for generally not owning tech stocks, we are reminded of his love for what he considers unappreciated value, which well explains this latest move as indicated by his firm’s stock purchase filings. We also see Mr. Buffett’s interest in Apple stock as a formal acknowledge-ment of the ubiquitous presence of technology throughout the business and consumer world.

Apple stock advanced 5.2% last week as value investors positioned to mimic the master’s move. The S&P 500’s Information technology sector “felt the love,” rising 1.42% on the week. The sector is the third worst performer among the 10 sectors of the benchmark – off 1.98% from the start of the year but up near 11% from the market’s low on February 11th.

Consumer Staples Giant Surprises

Also in the “positive surprise for the markets column.” last week Wal-Mart (WMT, Not Rated) reported better than expected results with revenue in the latest quarter rising 0.9%. This exceeded analysts’ forecasts and suggesting that its efforts to maneuver around a tough environment for traditional retailers are working.

Recent improvements that range from a boost in employee compensation to a tweaking of store layouts has led to the company seeing a boost in customer engagement in the store.

While 1 percent revenue growth at the retailing giant was not taken as an “all clear” signal by the market against the challenges that Wal-Mart and other stores face in the retail space, it did serve last week as motivation to reward “progress if not perfection” and raised enough investor enthusiasm for the stock to close last Friday some 10.6% above where it had closed just two days prior.

Post Fed Minutes

With last month’s FOMC meeting’s minutes read, digested, pondered and regurgitated, the consensus opinion now seems to have turned around from little expectation of more than one Fed hike this year to concern that the Fed may well be determined to raise at least twice in 2016, and in the process choke off the current level of modest growth.

This change in sentiment has turned pundits’ focus away from worries about disinflation and deflationary trends instead to focus towards signs of enough inflation to cause the Fed to hike rates more than once and perhaps at a pace too severe for the current economic expansion to live with.

We think the shift in consensus focus and attention is perhaps overdone and reminiscent of what the market has experienced numerous times over the last few years -- going from worries about the potential for a recession to worries about economic growth being strong enough to cause the Fed to make a policy mistake.

With the first read on Q1 GDP in the U.S. at 0.5% and Q1 earnings season through last week (with nearly 96% or 478 companies in the S&P 500 having reported) signaling negative growth in revenues and earnings of of 1.9% and -8.35% respectively, we think the Fed is likely to stand pat for now and push out further prospects of rate hikes (interest rate normalization via hiking the Fed funds rate).

Add to that thought prospects for the dollar to gain further strength on back of another Fed rate increase (no matter how nominally small) and the potential for a subsequent increase in the disparity between stateside interest rates and interest rates abroad, the Fed would seem to us more than likely to wait until September if it is going to raise more than once in 2016 and not wait until its last meeting of the year in December.

Already some U.S. multinationals have made mention that this year’s earlier decline in the dollar has boosted their competitive stance in doing business abroad and that it increases the likelihood of improved earnings in the quarters ahead----so long as the dollar does not take to moving to higher ground.

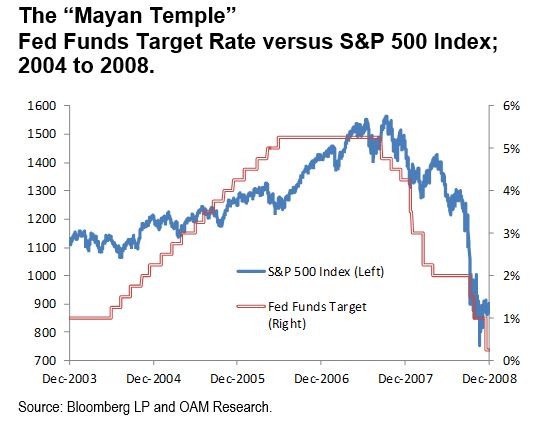

With last week’s jump in expectations for the Fed to raise rates sooner than later, we provide a view via our “Mayan Temple” of the last time the Federal Reserve was in rate hike mode between the end of June 2004 and the end of June 2006.

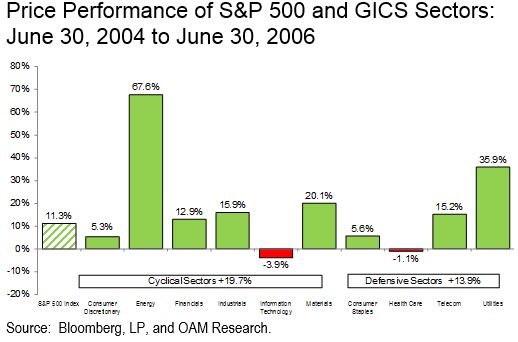

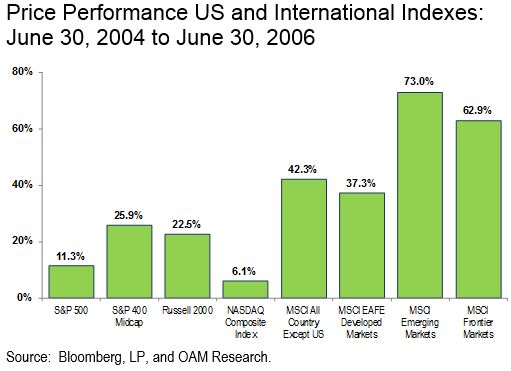

While stocks did not move higher in a straight line during the process of interest rate normalization, the Fed raised its benchmark rate 17 times in equal increments of 0.25bps between June of 2004 and June, 2006 (taking the benchmark rate from what was then a 45-year low of 1%, to 5.25%), the S&P 500 advanced 11.3% in the period. The S&P 400 (mid-caps) and the Russell 2000 (small caps) rose respectively 25.9% and 22.5% in the same period (see chart on next page).

While we are not suggesting that the stateside major benchmarks will necessarily repeat their performance of the last Fed Funds hike cycle, we are prone to recall the adage attributed to America’s great author Mark Twain that, “ History may not repeat itself but it often rhymes”.

So far “more of a trim than a haircut”

With stocks ending last week off 2.4% from their recent 2016 high of 2102.4 on April 20th, we’ve heard concerns that the S&P 500 is stuck below its record high of 2130.82 reached on May 21, 2015. Some investors think this might signal negatively for the market beyond the current weakness seen.

Given the impact of some renewed strength in the dollar; modest economic growth stateside; sluggish to mixed growth abroad; volatility in currency and commodity prices; geopolitical risks abroad; and election year uncertainty stateside, our take is rather to focus on the market’s significant resilience since it came off its highs in April.

From our perspective and with the aforementioned headwinds taken into consideration, the resilience seen in the price of the broad market amidst intra-day volatility could likely indicate the market is discounting better things ahead rather than pricing in darker days to come.

Stay tuned.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.