Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Sell in May and Go Away?

We don’t think so…

After a spectacular rally propelled by a weaker dollar, stabilization in the price of oil and other commodity prices, and (at least so far) a “better than consensus analysts’ expected” earnings season, stocks may be in for a pause and perhaps even a trim before they find a catalyst for their next broad move.

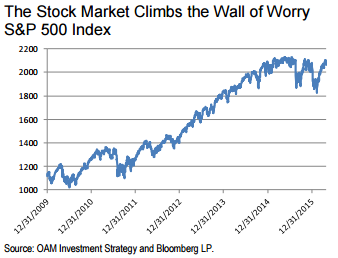

The substantial rally that began after the market hit a Q1 low on February 11th (carrying the S&P 500 12.9% higher through last Friday) ran not much challenged until late in April.

We think the rally could fade near term as markets experience some turbulence as short-term traders and investors consider recent disappointing stateside and global economic data and kick the tires on a stateside Q1 earnings season that has seen a preponderance of companies in the S&P 500 reporting better than expected results, even as earnings growth overall appears to have declined just under 9% in the period. (See page 7 of this report for our earnings season scorecard and commentary.)

From the perspective of the earnings season it would seem to make sense for skeptics to question just how good the broad beats of consensus expectations have been, considering that the quarter is yet another in a series of quarters in which analysts had slashed less pessimistic projections made earlier just before the start of the current earnings season.

Disappointments last week when a number of tech bellwether stocks reported results, including Apple (AAPL) and Microsoft (MSFT), helped turn investor sentiment a tad sour even as Facebook (FB) surprised in robust fashion to counter investor blues.

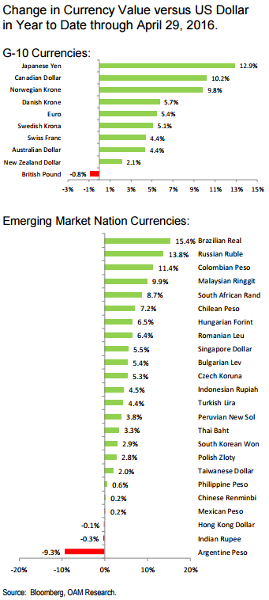

Market concerns about inflation risk had also been raised in the course of the last few weeks as commodity prices had powerfully rallied from what we believe were much oversold conditions as well as from support coming from a decline in the dollar against developed and emerging market currencies that made them attractive (see charts on next 2 pages) rather than from a surge in global demand.

No sooner had worry turned to inflation risk than deflation risk worries resurfaced with a spate of disappointing data that included evidence of sluggish wage growth, modest core inflation, a drop in durable goods orders, a drop in new home sales (even as existing home sales improved), weakness in manufacturing and a durable goods orders number that fell short of expectations.

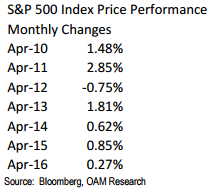

In short it appears to us that a mixed bag over the last few weeks took investors’ focus off of gains in March, when the S&P 500 soared 6.6%, only to fret over April, when the broad market stumbled from a 2016 peak of 2102.4 on April 20th to post an all too modest gain for many investors’ expectations of just +0.27% by month’s end.

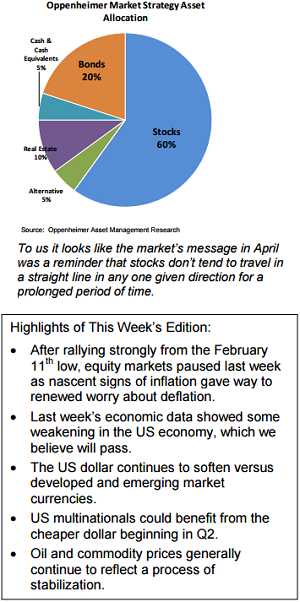

To us it looks like the market’s message in April to investors, traders, sideline observers, wellwishers and nay-sayers was a reminder that stocks don’t tend to travel in a straight line in any one given direction for a prolonged period of time.

Indeed the historic tendency of markets in our experience is for markets, much like life, to climb a wall of worry (see figure below).

We suggest that investors recall that the month of April has since 2010 shown a tendency to be a period of market reflection on where it has been and where it would like to go (see figures below). Depending on what conditions the market finds itself surrounded by at the time can lead to a jump in volatility.

The recovery process from 2009 through today points to the early-to-late spring period being a time when markets often become challenged, whether from developments abroad or stateside.

For now, we’d suggest investors exercise patience, fasten the proverbial seat belts in case of turbulence in the near term and consider portfolio weightings, exposures and overall diversification.

We remain pro-cyclical globally in our stance toward equities, believing that growth stateside remains sustainable if at a very modest pace, while abroad green shoots in economic growth appear intermittently as a recovery in Europe and a process of repositioning by authorities in China takes place.

Over the week just ended news flow from abroad showed that Europe’s economic growth in Q1 of this year outpaced US growth in the same period as the overall economy of the 19 countries in the euro zone advanced 0.6% versus US growth of 0.5% in the same period.

While 0.5% growth in Q1 for the US raised concerns that the expansion might be slowing, for Europe 0.6% growth marked the first time in eight years that the output of the region’s economy had exceeded its pre-crisis high.

As we went to press on Sunday night, China’s Manufacturing PMI showed a second month of improvement, signaling China’s economy may have begun to stabilize.

Stay tuned.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.