Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

When Good News Isn’t Enough

Global stocks, bonds and other asset classes move lower on interest rate and inflation risk

A misperception of risk is a thematic factor that can roil markets, rattle investors’ nerves and cause market observers to jump to negative conclusions that later in hindsight prove to have been misplaced and even erroneous.

Such misperception often surfaces in periods of transition (for example the current change of leadership at the Federal Reserve) or as the result of the emergence of a catalyst on the investment landscape (e.g. a jump in the 10-year Treasury yield) that causes markets to reverse an upward trajectory and move lower. Often such a reversal is accompanied by some drama fanned by none-to-few market observers as misperception generates some fear. The catalyst and reaction to the subsequent move lower in the markets in our experience is often taken out of context adding to the level of turbulence and causing the risk of further misperception(s) to linger.

Last week as the calendar page turned from the end of January into February, mostly better than expected economic data and broadly positive earnings results crossed the transom (if not without some disappointments).

Counterintuitively, sometimes the markets don’t celebrate good news as one might expect particularly if investors have drifted into a worried state of mind about something other than the day’s positive news on the fundamentals.

Prospects of inflation and higher interest rates had emerged as a worry for the market since last quarter even as the markets advanced into the first four weeks of the year.

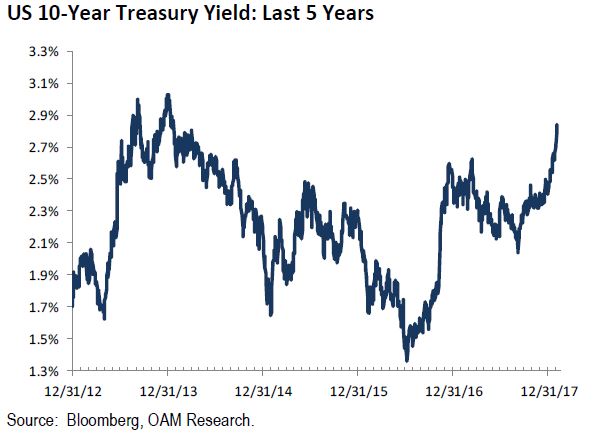

In our view the yield on the 10-year Treasury jumped higher not so much as a result of anything the Fed did (it didn’t raise rates at last week’s FOMC meeting) or anything the departing Fed Chair might have said in her last official comments.

That notwithstanding, the yield on the 10-year rose to 2.84% last Friday (up from 2.66% at the close of the prior Friday) and stocks, bonds, gold and publically traded real estate took a broad tumble.

“For all the gnashing of teeth that occurred over the four out of five days when the market moved lower last week, the major global equity indices stand higher from where they began the year.”

After four straight weeks since the start of the year when major equity indices stateside and around the world posted weekly gains and a large number of record highs, stocks moved lower worldwide on the week ending last Friday.

For all the gnashing of teeth that occurred over the four out of five days when the market moved lower last week, the major global equity indices stand higher from where they began the year (See pages 7 and 8 of this report for charts).

So far there has not been a sign of worrisome levels of inflation on the horizon nor has there been a broad deterioration of fundamentals (economic or corporate) in our view to warrant such negative extrapolation from what came to pass last week.

We’d expect that as the market had run as strong as it had since the fourth quarter into the first four weeks of the year it will take some piece of overwhelmingly positive economic data or corporate announcement(s) to cause the market to rally.

We don’t expect the market will return to its recent “every day’s a celebration” mode near term. For now, it looks to us that last week’s market move lower may have shaken investor awareness to conclude that equity markets may just have gotten “a tad” ahead of themselves. We are also reminded that anything that even suggests “a melt up” will be called to task at some point.

For the bond market the drop in bond prices will likely serve to remind bond investors that indeed we are in a period of price discovery in bonds that will probably ebb and flow for some time ahead—and likely for a longer period than many may expect as a process of reflation and interest rate normalization shepherded by the Federal Reserve takes place.

The dollar’s gain of 0.14% last week against the DXY index (a basket of currencies belonging to six major developed market trading partners of the US) was too small in our opinion to signal a reversal of the trend for a lower dollar. We continue to expect that as international economic fundamentals improve, that their currencies will strengthen further against the dollar. Such a move would not indicate to us that the dollar was in trouble but rather that the foreign currencies should reflect the strengthening of their economies, which have broadly lagged the US in recent years. In our view a weaker dollar is a more competitive dollar that should further benefit US multi-nationals doing business abroad.

The drop in the price of oil reflected in last week’s action is likely to be stemmed near term as the global economy continues to improve and demand recovers. We believe however, that the price of oil will find its ceiling when oil prices rise high enough for OPEC and US producers to open the valves and increase production. We believe that time is not as far off as many believe.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.