Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Market Flirts with New Highs

As Cyclical stocks continue to outperform the Defensives in 2017

Last week stocks crossed new record highs with the Dow Jones Industrials closing above 20,000 on Wednesday, the NASDAQ Composite closing at a new high on Friday and the S&P 500 crossing intraday through a record level of 2,300 (2,300.99) on Wednesday but failing to close at or above that level last week.

The upward trajectory for stocks coincided with the new President’s first week in office. A flurry of activity in the oval office last week including actions taken tied to promises made on the election campaign trail and a first visit from the UK’s Prime Minister Theresa May which appeared to us to go well enough for the markets on both sides of the pond.

The rally in stocks stateside drew on reported earnings results, a spate of M&A announcements as well as on the market’s anticipation for fiscal stimulus, a reduction in regulation, lower taxes and the potential for repatriation of funds held by US multinationals abroad—all possibilities on the horizon.

All in all it was a week that showed a reinstatement of the “risk-on” mode for stocks stateside that pushed stocks to close higher on the week that further confound skeptics and bears who had looked for the rally to fade earlier in the month.

The Dow Jones Industrial Average, the S&P 500 and the NASDAQ Composite respectively added 1.34%, 1.03% and 1.9%. The S&P 400 (mid-caps) and the Russell 2000 (small caps) advanced 1.31% and 1.4% respectively in the same period.

Performance among the 11 sectors of the S&P 500 last week favored cyclicals with Materials, Information Technology, Financials, Industrials and Consumer Discretionary respectively posting gains for the week with each of those sectors outperforming the broad index.

A good number of foreign markets around the world posted gains moving key international benchmarks higher (in local currency and when translated into dollars).

On the week, the MSCI EAFE (developed markets ex-US and Canada), the MSCI Emerging Markets and the MSCI Frontier Markets posted respective gains on the week of 1.29%, 2.53% and 1.9%

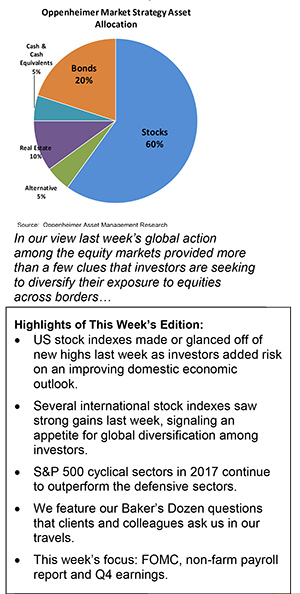

In our view, last week’s global action among the equity markets provided more than a few clues that investors are seeking to diversify their exposure to equities across borders as economic data points to an improvement in economies outside of the US and prospects for a global economic recovery led by a stateside economic expansion that increasingly shows signs of sustainability.

The proposed fiscal stimulus agenda of the new administration in Washington as outlined so far has helped push stocks higher even as detail, implementation and execution risks remain.

Issues tied to geopolitics, trade and immigration—which are highly politically sensitive as well as day to day challenges to traditional protocol from a new President with an unconventional style could cause hurdles to develop for the new administration’s agenda in the weeks ahead. Whether these challenges create speed bumps or detours to the market’s current upward trajectory will be found out as the weeks ahead unfold.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.