Investment Process

In this article:

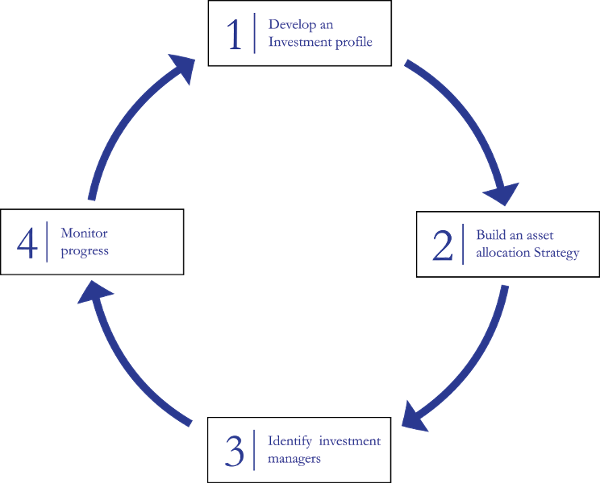

Constructing a sound investment strategy begins with developing an investment plan -- an important cornerstone to your financial success. Oppenheimer Asset Management professionals will help you build an investment plan through a systematic, four-step process designed to help achieve your goals.

1 - Developing an Investment Profile

The process of building your investment plan begins when you complete our confidential Client Questionnaire with the help of your Oppenheimer Financial Advisor. This document helps familiarize us with your financial situation, your understanding of the financial markets, and your tolerance for risk. Once it is completed, your Oppenheimer Financial Advisor works with a team of investment professionals from Oppenheimer Asset Management to determine which of our services we believe will best help you achieve your goals. At your request, we also provide a detailed Investment Policy Statement that includes a discussion of your objectives, risk tolerance and other financial circumstances. Your Investment Policy Statement serves as the roadmap for building your investment plan.

2 - Building an Asset Allocation Strategy

Based on our knowledge of your specific requirements and objectives, we craft an asset allocation strategy to guide the selection of investments for your portfolio. Through a policy of strategic asset allocation, we strive to build an enduring framework for a strong portfolio based on your individual financial situation, which determines the degree of reward potential you can pursue. We combine a personal assessment of your unique circumstances with a deep understanding of the technical nature of each asset class, in order to develop an asset allocation strategy that is geared toward meeting your objectives.

3 - Identify Investment Managers

The next step is to identify investment vehicles and managers that are appropriate for your needs. Diversification is at the heart of every portfolio we construct; we believe that diversification is key to managing volatility and reducing risk. Oppenheimer Asset Management supports your core investment strategies with the Consulting Group, which offers access to independent world-class investment advisers and funds, and with Oppenheimer Investment Advisers, our own highly regarded money managers. Nontraditional opportunities are available for qualified investors through the Alternative Investments Group.

4 - Monitoring Progress

Once an investment plan is in place, we use a formal review process to ensure your plan is aligned with your investment strategy. We regularly review your investment objectives with you, and make any necessary changes to your portfolio. Through ongoing due diligence, we monitor the managers and funds in which you have invested, to ensure they remain appropriate for you. In addition, we work with you to determine when and how portfolio rebalancing should occur, if necessary. You have ready access to your Oppenheimer Financial Advisor and other investment professionals to answer questions and keep you up-to-date on any changes that might affect your strategy. And every quarter, we send you a detailed, customized Quarterly Portfolio Review (QPR) that includes performance data and market commentary. Through QPR, you have a full picture of your portfolio’s performance.