Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Take It Back to Where You Once Belonged

We quote the Beatles after the S&P 500 index stopped

short of making a new all-time high

Market dynamics are generally forward looking but much of last week’s action stateside and abroad reminded us that sometimes the goal is just getting back to where you once were before you can move ahead.

My eyes adored you… so close so close and yet so far…

Stateside after the non-farm payroll number was released on Friday the S&P 500 moved above its May 20, 2015 record high closing price on an intraday basis only to back off and frustratingly close a fraction below its elusive all-time closing price level of 2130.82 ending the week at 2129.90.

Meanwhile “across the pond” voters in the UK were finding that “you can’t turn back the hands of time” as their country’s leadership dismissed hopes they’d consider some 4,000,000 petition signatures proposing a “redo” of the June Brexit referendum.

Brexit, while not likely to become an economic tragedy, will most likely be disruptive beyond current assumptions due to the complexities of the unwinding necessitated to effect the UK’s divorce from the EU.

As with most divorces that are rife with contention, the only certainty this early in the process appears to be that the lawyers and negotiators will profit handsomely from it and that businesses and individuals will ultimately bear the costs of the process to growth near term.

In meetings last week in the UK and on the Continent with professional investors we found most were as we’d been─taken by surprise by the results of the referendum. The very impracticality and economic cost of initiating an exit from a regional trade agreement of the magnitude of the UK’s membership of the EU would have seemed to dissuade pragmatic individuals from opting for such an exit.

In hindsight the reality is that when it comes to politics, it seems that nationalism, populism, emotions and fear of the unfamiliar too often reign and that pragmatism falls by the wayside or is at best placed far down the line for consideration in making important decisions.

In the aftermath of the referendum the UK business people we spoke with who import goods from the EU had almost immediately found their costs rising as the value of the pound fell. They were also finding next to nil opportunity to pass their increased costs onto their UK customers who were grappling with their own post Brexit vote concerns.

Citizens of the EU residing and working in the UK for domestic companies over the past few years are suddenly finding themselves wondering how their status as EU citizens working in the UK will be defined in the new order that comes from the exit process. Others working for firms that are likely to move headquarters to the opposite side of the channel are also dealing with incertitude.

Overall there was a feeling of disappointment and even sadness at the results of the referendum vote as well as a concern over what it portends in the months and even years of adjustment that lie ahead.

The issues surrounding immigration and sovereignty appeared to be understood (even empathized with) by those who had opposed Brexit. The thought generally was that voting to exit the EU was an overly drastic response to concerns over issues tied to immigration and sovereignty particularly when considering the economic repercussions near term and perhaps through much of the process of the exiting.

However, beyond the concern that we came across in our conversations was generally a feeling that somehow historic precedence, the mechanisms of trade and the markets, along with ongoing and future negotiations would prevail, providing a workable solution for the UK and the EU. The problem lies in the uncertainty that hangs over the landscape for now.

In our talks with investors last week they were finding diversification including investments in US stocks offering a suitable offset to the challenges in Europe and the UK. The recent resurgence in the strength of the dollar has also helped to boost returns from their investments in the US.

Meanwhile, back in the USA…

Stateside last week stocks got a boost from the release of the non-farm payroll number for June which at 287,000 jobs added (versus a Bloomberg survey of economists that called for 180,000 jobs) substantially exceeded expectations.

Investors reacted positively to the release pushing stocks higher (near record highs respectively for the Dow Jones Industrials and the S&P 500) regaining earlier losses from the Brexit results and from other earlier growth concerns.

Fed funds futures jumped on the news with prospects rising to 20% for a Fed hike as early as December. We had been and continue to be of the opinion that the Fed will raise once this year in December and then no more than 25 bps.

As much as the Fed might like to push the normalization of rates ahead, the strength of the dollar, slow growth abroad, low rate of wage reflation and worldwide lust for yield (which could push the dollar higher) keep the Fed highly sensitive of the landscape.

Other economic data that helped to support the rally in stocks last week included the nonmanufacturing ISM index, which rose in June to a level of 56.5, which was above consensus expectations and was up from 52.9 in May. That data pointed to the economy’s main driver’s resilience to weakness in manufacturing (caused by the dollar and sluggish global growth) as well as helped ease concerns about the possible effect of Brexit on the US consumer.

The initial jobless claims for the week ending July 2nd came in below expectations with the four-week average near the lows last registered in the early 1970s. The indication is that employers continue positive on the sustainability of the economic expansion.

Also supportive of stocks last week was a further decline in yields among fixed income product as the 10-year Treasury yield fell to a new alltime record low of 1.36% last Friday (see figure below).

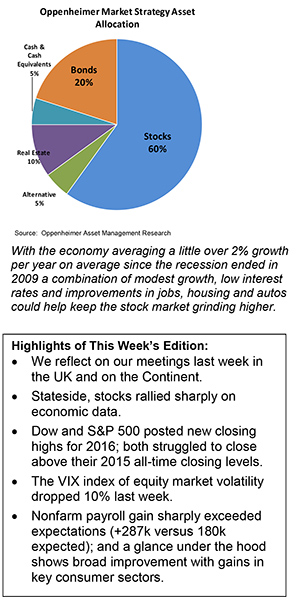

With the economy averaging a little over 2% growth per year on average since the recession ended in 2009 a combination of modest growth, low interest rates and improvements in jobs, housing and autos could help keep the stock market grinding higher.

Last week the MBA Mortgage applications jumped 14.2%.

A mantra we’ve adapted since the recession ended in 2009 and the economy’s and the market’s performance improved with resilience and consistency has been, “no boom, no bubble, no bust…we’ll take it.”

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.