Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Fed Speaks versus Fed Action

There's a considerable difference between what the FOMC members say and what the FOMC does.

Fed Speak vs. Fed Action – there’s considerable spread between what is said by individual members of the Fed and how the Fed acts in agreed to policy.

Even a highly transparent Fed is subject to have its intentions and statements too often misinterpreted or distorted by market perception.

For now we believe that:

We think it best for investors of bullish persuasion to remain committed to their cause, “stick to their guns” and “not race from one side of the boat to the other” in trying to stay in fashion with the latest whims or worries pumped through digitalized channels of information that can be influenced too easily in the moment by vested interests and un-vetted “tweets”.

We continue to hold the mantra of “don’t fight the Fed” in high regard.

That said,we believe it’s important to recognize the key risks facing the markets at this time.

We believe they include:

Not exactly a short list of risks even when outlined in bullet points.

Near term the market has to work its way through these issues:

We believe the Federal Reserve as well as many of the central banks around the world recognize this and are acting accordingly to foster growth (even if at a relatively moderate pace) via monetary policy.

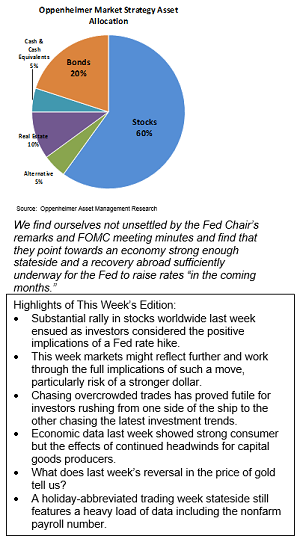

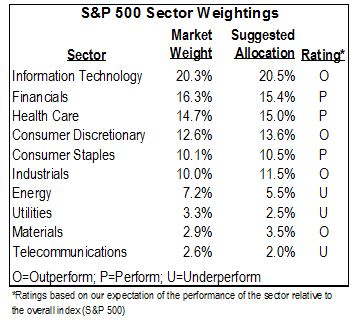

Our investment strategy reflected in our sector weightings favors select cyclical (economically sensitive) sectors over defensive (counter cyclical) sectors. We remain:

Market Activity:

So far this year with Fed and investors highly data dependent it’s not been easy being a bull but from our perspective it’s been even tougher to be bearish in our opinion.

Since February 11th it appears to us that a combination of improving fundamentals via economic data along with expectations of improvements in revenue and earnings growth for corporations in the quarters ahead have provided the equity market with a degree of resilience that has so far been difficult for bears to overwhelm.

As of market close last Friday, the S&P 500, the S&P 400 (mid-caps) and the Russell 2000 (small caps) were 2.7%, 6.7% and 1.3% respectively higher on a year to date basis. In the week ended last Friday the same indices advanced respectively 2.3%, 2.9% and 3.4% (see pages 9 and 10).

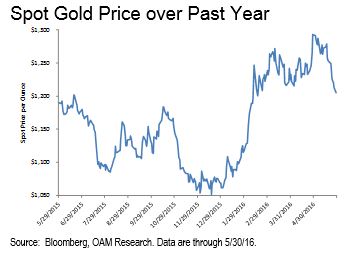

Gold took a hit last week

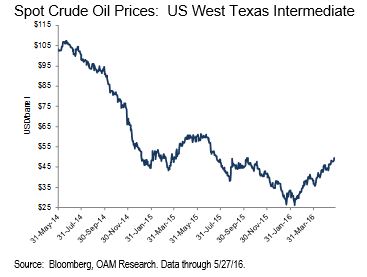

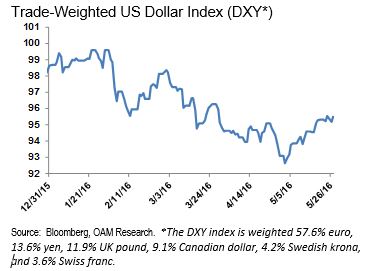

While stocks have “shown brightly” so far in May (with only one trading day remaining in the month), gold’s luster has faded as expectations of a Fed rate hike sooner than later provided an earlier in the year weakened dollar with a second wind.

As stocks and the dollar advanced last week, the price of gold fell 3.1% as the shiny metal lost a degree of its luster with investors on prospects of the Fed raising rates higher and more than once this year.

Included among items that threw cold water on the bear case for equities and the economy last week was a packet of economic data that included:

What’s gold telling us?

Gold is off 6.8% from its recent peak at the end of April. Even with last week’s decline, the price of gold is still up 13.6% since the start of the year (see figure above).

The current decline tells us that perhaps too many investors had crowded into gold as it advanced sharply from the start of the year. The change in status of the metal has contributed to the recent rally in the dollar and has pushed the shiny metal from its perch of $1,292.99 per oz. (just reached at the end of last month) as expectations of higher rates stateside caused the metal to lose its favor with investors.

To us this should serve investors as a reminder that “follow-the-pack" trades too often end badly.

Most recently this has been illustrated by crowding in a long dollar trade at the beginning of the year just before the dollar began to weaken. That was followed by crowding to a “short the dollar" trade just as the dollar was about to rally having reached oversold conditions.

Crowded trades are akin to investors racing from “one side of the boat to the other” chasing the latest broadly identified short-term trend. Such action has caused more pain this year to impatient and nervous investors than many would care to admit.

It’s not hip to be square in numerous venues but in the market sometime the contrarian out of fashion viewpoint can have its advantage.

“What, me worry”?

Here’s a partial list of what we see as legitimate concerns that may prove less detrimental to stock prices if unrealized:

From “Don’t Fear the Fed” last week possibly to “Fear the Fed” this week

As we went press on Memorial Day 2016 headlines crossing the tape signal emerging market currencies moving lower against the dollar and in a process of extending their “worst monthly decline since August.”

It would seem that at least some investors are having second thoughts on last week’s broadly positive market reaction to Fed Chair Janet Yellen’s remarks last week.

We recall that the process of markets’ digesting comments of Fed chairs or the reading of FOMC minutes is seldom without second thoughts or questioning.

We find ourselves not unsettled by the Fed Chair’s remarks and FOMC meeting minutes and find that they point towards an economy strong enough stateside and a recovery abroad sufficiently underway for the Fed to raise rates “in the coming months.”

The recent history of the Fed's actions throughout the Financial Crisis and Great Recession, through the recovery process, and now within an economic expansion causes us to remain positive on the future outcome of its actions ahead notwithstanding the possibility of some speed bumps along the way.

Stay tuned.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.