Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Stand Back and Move Away Slowly

Spike in Bitcoin price and a surge in inquiries signal caution

As investors return to their posts after the holiday weekend they will likely be focused on the last few names of the S&P 500 reporting results as well as the economic data crossing the transom leading up to the non-farm payroll number to be released on Friday. With a Bloomberg survey of economists pointing to expectations of 185,000 jobs added in May (vs. 211,000 in April) and expectations of a headline unemployment rate steady at 4.4%, we’d think that only a wide divergence from the anticipated number (either up or down) would cause any significant degree of drama.

Considering last week’s broad gains in the equity markets we would not be surprised to see a pause in the market’s upward progression to allow some time to digest the latest record highs in the S&P 500 and the Nasdaq composite as well as allow investors to ponder their next move.

Based on the market’s performance on May 17th when stocks moved down nearly 2% in one day (causing quite a ruckus amongst those with lapsed memories of markets past) only to bounce to new record highs in the next few days—we’d think the market could now seek out a catalyst to justify some profit taking ahead of the start of Q2 earnings season, which lies just a few weeks away.

Where might a catalyst come from to justify some profit taking or sector rotation is the question. With the US economy growing at an annualized pace of around 2 to 2.5% (see comments on the upwardly revised Q1 GDP number on page 5) and Q1 earnings as of last week up just under 15% on the back of nearly 8% revenue growth (see our earnings scorecard on page 4 of this report for details) there’s a perception at least among some investors that there’s a lot of good news already priced into the market. With economic fundamentals improving (albeit at a somewhat anemic pace stateside), the Fed’s normalization process is likely to remain at a moderate and measured pace and with signs of economic recovery becoming more apparent of late, any profit taking will likely be short term and best left to short-term traders.

“Global diversification remains a core element of our allocation decisions, driven by the US expansion, a data-dependent Fed, and improving economies abroad.”

With growth stocks leading the market higher since the start of the year and with value stocks lagging we’d expect a possible rotation into value as the calendar page turns into the new month and the summer months come onto the horizon. Baby Boomers who have eschewed the traditional role of dividend paying stocks for the rush of chasing “growthier” issues could discover the functionality of dividend paying stocks that have the potential to offer dividend income and the potential for capital gains.

While some investors have been knocking stateside stock market valuations the recent declines in the dollar could likely help drive revenues and earnings higher for US multinationals in the quarters ahead.

From our perch on the radar screen global diversification remains a core element of our allocation decisions particularly within equities, driven by the U.S. expansion, a data-dependent Fed, and improving economies abroad.

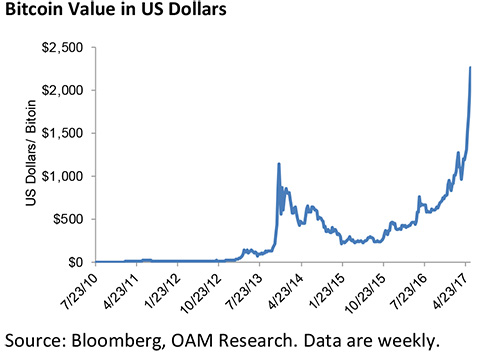

Bitcoin Looking Bubbly

One area of concern on our radar screen has been the recent jump in the price of Bitcoin and the number of inquiries we have received for our opinion regarding its sizeable run up.

In the past week alone we have been asked about Bitcoin by investors and market observers as diverse as relatives, casual and longtime friends, financial professionals and most telling from one of our favorite New York City doormen.

Our take on Bitcoin has from the start been that the mechanism or the algorithms that generate the Bitcoin encryption process are what look to be something of value and interest for payment platform providers. However, to the best of our knowledge, the process has no patent holder. In fact the creator of Bitcoin is only rumored to be known.

As to “the coin” itself and its “value?” We smell too much speculation, animal spirits, and irrational exuberance around the parabolic move it has experienced.

As strategists who deal with a hefty array of asset classes, the process of “mining” a Bitcoin as we understand it appears to be a digitally virtual “adventure.” We believe that currencies backed by governments offer levels of accountability and transparency that appear to be lacking in Bitcoin.

At the end of the day it is not even gold that stands behind the value of traditional currencies but rather the economic substance, transparency and accountability of the country that stands behind it.

For now we’ll recall the lyrics of the late great Gregg Allman whose southern classic “Stand Back” from the “Eat a Peach” album suggested, “stand back and move away slowly.”

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.