Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Taking the Show on the Road

More questions from the road and a Boomer’s musings on retirement

The last few months have seen Market Strategy “hit the road,”traveling to meetings and special events with Oppenheimer advisors and their clients in offices and other venues across the US.

For us it’s an opportunity to meet and speak with individuals and institutions with often similar but sometimes quite varied investment needs and objectives.

Among our favorite segments in our presentations on the road is the Q&A session.

We value hearing what investors have on their minds including what intrigues them, concerns them, or what simply causes an investor to pause for thought about what’s going on in the markets and on the economic scene. In our experience, this is the stuff that can ultimately move markets in a given direction.

On a recent trip to Houston, Texas we were asked two questions from the floor that stand out in our memory; these were two inquiries that we had not heard before in our travels and which struck us as important to share with our readers. In our response we suggested that even though inflation does not appear to offer the same degree of risk that it did in previous economic and market cycles over the last 30 or 40 years stateside, things can change and factors that today contribute to disinflation—including issues of overcapacity in production, services, labor and commodities—could recede and be displaced by mirror-image factors that could include a tightening of the labor pool, demographic shifts or changes in the workplace including rapidly rising wages, shortages in key commodities, issues restricting global trade, as well as other factors that could lead to inflation surfacing at unwanted levels.

Although for now we believe that interest rates are likely to remain low for longer than traditional savers and bond buyers would like to see, conditions on the economic landscape could change sufficiently to justify interest rates rising higher and further than currently projected.

In our view it’s important to remember that trends that favor one asset class over another have been historically shown to shift over time causing dislocations resulting in periods in which an asset class that was formerly popular and highly valued to fall out of favor.

As industries evolve to reflect changes driven by technology and consumer demand—whether from bricks and mortar to internet and back again “for an experiential shopping experience,” or changes in governmental environmental policy that can negatively impact an industry (as happened to the US coal industry over the last decade), or the broader trend of robotics on the factory floor and algorithms in the office space—valuations invariably adjust to reflect those changes. If there is one thing that is a constant in the economy, the markets, and in life: it’s change.” The second question from our recent visit to Houston:

A parent with two daughters in their early 20s who had recently graduated from college and had begun their respective business careers asked if we thought his daughters were making the right decision to start saving and investing for their retirements even at such an early age.

We answered without hesitation that in our view based on personal experience and professional observation, it’s never too early to start saving and investing for retirement—the earlier the better we say.

In a world that continues to see businesses eliminate traditional “defined benefit” pension plans in favor of “defined contribution” plans, getting a head start on retirement planning is key to success in achieving one’s goals.

Additionally, concerns about social security funding for future generations and the prospect that future participants in that program will have to work longer to earn maximum benefit levels add incentive to start investing for retirement at an earlier age than prior generations did.

Back on the Ranch in New York

Back home in NYC last week, in a meeting with a baby boomer professional nearing retirement age, we heard concerns that she felt she had not saved enough and was worried about maintaining the life style she had become accustomed to.

We noted that from our perspective on the radar screen she had plenty of company among members of her generation who felt similarly.

We suggested she persevere, not dwell on the past, and no longer procrastinate in addressing her savings shortfall concerns. We urged her to make a plan with her financial advisor and follow through with it, recognizing that investing is not limited to a particular age group but rather only limited by an investor's qualifications and ability to invest within their financial position, needs, experience and objections.

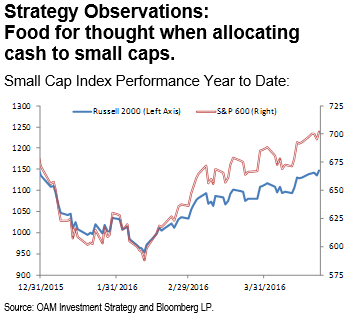

Small cap indices are not created equal. Consider the difference in performance between the S&P 600 (small caps), which are up 4.52% in price terms (and 4.96% on a total return basis, according to Bloomberg), and the Russell 2000 small caps, which are up just 0.95% in price and 1.40% if dividends are reinvested.

The difference is considered to be a question of relative size and quality by many investors. Though both indices are positively correlated in our chart, performance can be considerably different over various time periods. For example, from the February 11th market low, the Russell 2000 index

stocks rose 20.23%, slightly outpacing the S&P 600 index, which saw gains of 19.35%. From this we would conclude that in times of market uncertainty (the roughly six weeks of 2016 until February 11th), quality mattered quite a lot, but when a broad rally began, the rising tide lifted boats of all sizes and shapes.

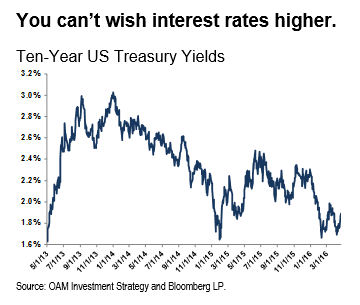

Our chart this week on the 10-year US Treasury note yield going back to 2013 illustrates that it takes time for interest rates to normalize.

Our chart this week on the 10-year US Treasury note yield going back to 2013 illustrates that it takes time for interest rates to normalize.

In early May, 2013 then-Fed Chair Ben Bernanke announced that the Fed might begin tapering what was then its monthly bond buying program. At the time the 10-year yield was at 1.63%. The market moved in reaction to the Fed’s tapering announcement (the “taper tantrum”), pushing bond prices lower and yields higher. By the end of 2013 the yield on the 10-year stood at 3.03% even though the Fed had yet to begin reducing its bond purchasing.

Ironically, after the Fed announced on December 18, 2013 that tapering would begin in 2014, bond prices rose and yields fell as the market recognized that inflation was not running high enough to justify a 3% yield on the 10-Year Note.

On last Friday (April 22nd 2016) nearly three years after Mr. Bernanke introduced the concept of tapering, the 10-year yield stood at 1.89%.

With tapering completed since the fall of 2014, and the Fed’s first interest rate hike toward normalization made on December 16, 2015, the yield on the 10- Year last Friday stood closer to a round trip from where it was in May of 2013 than where it stood on December 2013.

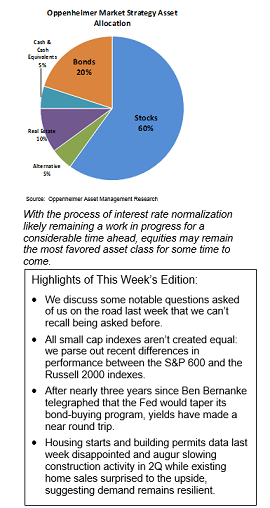

With the process of interest rate normalization likely remaining a work in progress for a considerable time ahead, equities may remain the most favored asset class for some time to come.

Stay tuned.

For the complete report, please contact your Oppenheimer Financial Advisor.