The Great Awakening in Muni Bonds

The changing demographics of the municipal bond market in recent years, coupled with their reliable tax-free income stream, has made munis a compelling core allocation for today’s fixed-income investors.

Munis were once a sleepy corner of the bond market where retail investors held mostly illiquid issues. But times have changed. Today, a flood of institutional and foreign investors are using munis to shore up their balance sheets, which has vastly improved liquidity, says Ozan Volkan, portfolio manager for Oppenheimer Investment Advisers.

Munis were once a sleepy corner of the bond market where retail investors held mostly illiquid issues. But times have changed. Today, a flood of institutional and foreign investors are using munis to shore up their balance sheets, which has vastly improved liquidity, says Ozan Volkan, portfolio manager for Oppenheimer Investment Advisers.

While the Federal Reserve is committed to tightening monetary policy, he expects a measured and orderly rise in interest rates. That means the current tightening cycle is unlikely to mirror past periods of rising rates in its pace and increments—good news for muni bondholders.

In an interview, Volkan explains why he believes the Fed rate hikes are far less perilous than investors think and how President Trump’s proposed tax reform won’t undercut the benefit of owning munis. For more on where municipal bonds fit in a portfolio, how monetary and public policy will influence his outlook and why he favors general obligation bonds with a favorable pension funding profile, read on.

What are the chief benefits of including municipal bonds in an investor’s portfolio?

What are the chief benefits of including municipal bonds in an investor’s portfolio?

Municipal bonds provide tax-free income and high taxable-equivalent yields. Historically, munis have exhibited lower volatility and lower default rates than other bonds. On average, munis have also exhibited higher credit quality than corporate bonds and mortgages (Source: Moody’s U.S. Municipal Bonds Defaults and Recoveries 1970-2015.) In the municipal bond market, the deterioration of credit fundamentals and distressed debt situations—such as bankruptcies and restructurings—tend to unfold gradually with a lot of warning signs. Further, many muni bonds could be considered socially conscious investments, in that the projects they finance provide essential public services such as education, hospitals, housing, public transportation, clean water, sewers, bridges and tunnels.

What positive changes in the municipal bond market have you observed?

What positive changes in the municipal bond market have you observed?

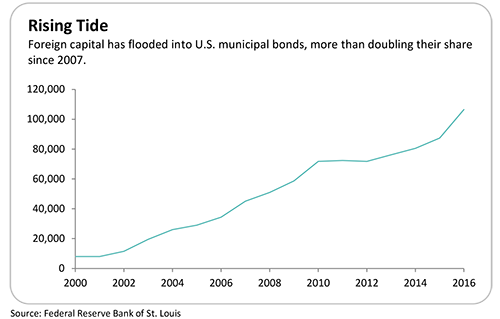

Historically, municipal bonds have been less liquid and owned mostly by retail investors (Source: SEC Report on Municipal Securities July 2012.) A high number of issues and smaller par amounts outstanding caused wider bid/offer spreads. However, a lot has changed in the last decade. The proliferation of SMAs and strong interest from crossover buyers—banks, insurers, money market funds, ETFs and even foreign investors—has vastly improved liquidity. We believe this “institutionalization” of the muni market will only accelerate with more banks treating munis as high-quality liquid assets on their balance sheets. Further, the perceived safety and attractive yields of U.S. munis have beckoned foreign investors who can’t find comparable yields in their home countries. What had been a domestic asset class due to the tax exemption has gone global.

Disclaimer

The opinions expressed herein are subject to change without notice. The information and statistical data contained herein has been obtained from sources we believe to be reliable. Past performance is not a guarantee of future results. The above discussion is for illustrative purposes only and mention of any security should not be construed as a recommendation to buy or sell and may not represent all investment managers or mutual funds bought, sold, or recommended for client’s accounts. There is no guarantee that the above-mentioned investments will be held for a client’s account, nor should it be assumed that they were or will be profitable. The Consulting Group is a division of Oppenheimer Asset Management Inc. (OAM). OAM is an indirect, wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc. (Oppenheimer), a registered broker dealer and investment adviser. Securities are offered through Oppenheimer. OAM053117CM2

For information about the advisory programs available through OAM and Oppenheimer, please contact your Oppenheimer Financial Advisor for a copy of each firm’s ADV Part 2A.

Adopting a fee-based account program may not be suitable for all investors; anticipated annual commission costs should be compared to anticipated annual fees.

Risk Factors

The success of an investment program may be affected by general economic and market conditions, such as interest rates, the availability of credit, inflation rates, economic uncertainty, changes in laws and national and international political circumstances. These factors may affect the level and volatility of securities prices and the liquidity of a portfolio’s investments. Unexpected volatility or illiquidity could result in losses.

Investing in securities is speculative and entails risk. There can be no assurance that the investment objectives will be achieved or that an investment strategy will be successful.

Special Risks of Foreign Securities

Investments in foreign securities are affected by risk factors generally not thought to be present in the US. The factors include, but are not limited to, the following: less public information about issuers of foreign securities and less governmental regulation and supervision over the issuance and trading of securities. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Special Risks of Small and Mid Capitalization Companies

Investments in companies with smaller market capitalization are generally riskier than investments in larger, well established companies. Smaller companies often are more recently formed than larger companies and may have limited product lines, distribution channels and financial and managerial resources. These companies may not be well known to the investing public, may not have significant institutional ownership and may have cyclical, static or moderate growth prospects. There is often less publicly available information about these companies than there is for larger, more established issuers, making it more difficult for the Investment Manager to analyze that value of the company. The equity securities of small and mid capitalization companies are often traded over-the-counter or on regional exchanges and may not be traded in the volume typical for securities that are traded on a national securities exchange. Consequently, the Investment Manager may be required to sell these securities over a longer period of time (and potentially at less favorable prices) than would be the case for securities of larger companies. In addition, the prices of the securities of small and mid capitalization companies may be more volatile than those of larger companies.

Special Risks of Fixed Income Securities

For fixed income securities, there is a risk that the price of these securities will go down as interest rates rise. Another risk of fixed income securities is credit risk, which is the risk that an issuer of a bond will not be able to make principal and interest payments on time.

Special Risks of Master Limited Partnerships

Master limited partnerships (MLPs) are publicly listed securities that trade much like a stock, but they are taxed as partnerships. MLPs are typically concentrated investments in assets such as oil, timber, gold and real estate. The risks of MLPs include concentration risk, illiquidity, exposure to potential volatility, tax reporting complexity, fiscal policy and market risk. MLPs are not suitable for all investors.