Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

What Are the Markets Telling Us?

Market Strategy Musings Near Year’s End

Without a tax incentive to sell or some other downside catalyst appearing out of the blue, stocks are likely to drift higher in this holiday-abridged week or at worst churn in place.

We look for a lazy week in the markets with many investors and denizens of Wall Street still on holiday through the New Year holiday observed next Monday.

When the calendar page turns to the New Year, anticipation of what will come after Inauguration Day (on January 20th) could cause the market to pause before it likely rekindles and extends its fourthquarter rally into the first quarter.

There are potential risks to that route, of course, among them those tied to:

As well as an assortment of risks tied to:

In other words, sometime after the holidays the stock market likely “gets real again.”

For now and from our vantage point on the market radar screen, it appears likely that stocks will cross the 2300 threshold for the S&P 500 by early January if not before the end of the year.

The mix is in for 2016, and it confirms to us that the fundamentals indeed have improved over the last year both in terms of economic data and corporate earnings results.

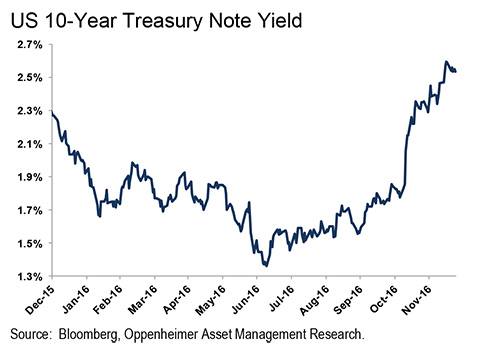

Interest rates, though recently on the rise, are still not substantially higher from where they started this year with the 10-year US Treasury yield at 2.55% as of last Friday versus 2.27% on January 1 (see figure below).

When we hear some investors fret about the recent increase in yields, we remind them that yields had fallen to a record low on the 10-year Treasury–dropping to 1.36% on July 8th of this year –before beginning their recent ascent.

In our view, the bond market (as reflected in the yield of the 10-year Treasury) essentially started the year priced about right relative to where inflation was, but then fell dramatically to a record low in July based on what we believe was bond investors’ misperception of the economy’s relative strength, compounded by the effects of foreign investors’ hunger for the higher yields available stateside.

To put it differently, the bond market started out the year fairly valued, then become overpriced just past mid-year on growth fears and greed-foryield, only to get oversold in the fourth quarter on fears of higher inflation projected onto a point somewhere beyond the visible horizon with a potential fiscal stimulus yet to be defined, let alone passed by Congress and implemented.

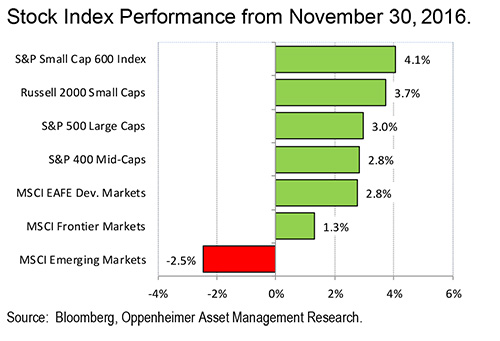

Last week’s action in the equity market saw stocks stateside edge higher with the S&P 500, the S&P 400 (mid-caps), the S&P 600 (small-caps) and the Russell 2000 (small-caps) adding 0.25%, 0.35%, 0.35% and 0.54%, respectively.

Those respective gains are more impressive when considered from the end of November: up respectively 2.96%, 2.83%, 4.06% and 3.72%.

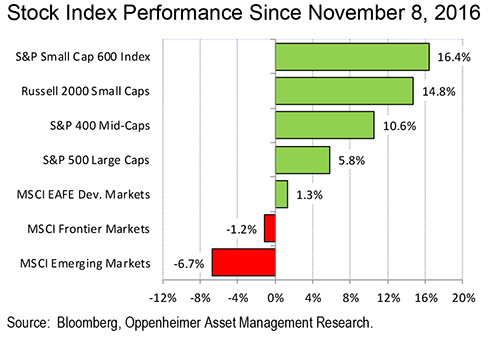

From Election Day on November 8th the aforementioned indices’ performance was even more impressive as they advanced respectively 5.81%, 10.59%, 16.39% and 14.76% (see figure below). To us these advances provide a clear indication of investors’ enthusiasm and hopes on back of the results of the US presidential and congressional elections resulting in what has been dubbed “the Trump rally” by some investors and commentators.

While last week’s relatively modest gains have some questioning the endurance of the Trump rally much beyond Inauguration Day, we think the rally could persist through the latter part of the first quarter (albeit given normal daily markets’ ups and downs) supported by annual retirement contributions being put to work in qualified accounts that occur each year through April 15th.

For now from a stateside perspective, we’ll continue to emphasize cyclical exposure over a defensive stance and keep an eye on the relative valuation and performance of market capitalizations, styles and sectors as we go into the New Year.

Foreign markets have not done as well as US markets since the election, pressured by perception of a less friendly attitude held by the President-elect toward the current process of globalization, particularly as it relates to trade.

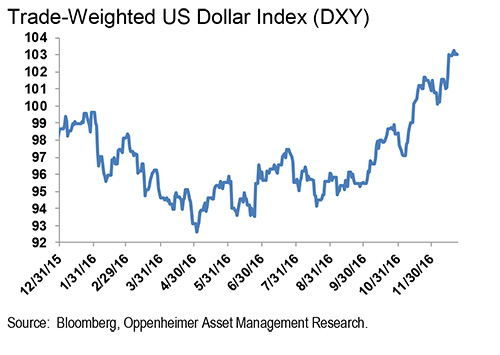

The strength of the dollar (the trade-weighted DXY index is up 5.26% since the election) adds to that pressure on foreign stocks (see figure below).

Since the election the MSCI EAFE index (consisting of developed market stocks excluding Canada and the US) has gained 1.31% while the MSCI Emerging Markets index has dropped 6.74%. The MSCI Frontier Markets index has slipped in the same period some 1.16% (see figure above).

The same foreign indices’ relative performances from the end of November, however, shed an improved light on the story with those same indices delivering respective performances of up 2.75%, down 2.46% and up 1.3%.

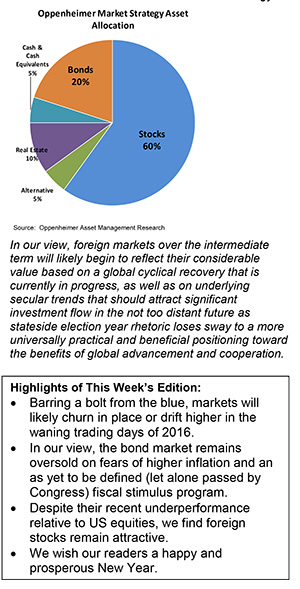

In our view, while foreign markets near term reflect greater uncertainty in the aftermath of the US election, they likely will over the intermediate term reflect their considerable value based on a global cyclical recovery that is currently in progress, as well as on underlying secular trends that should attract significant investment flow in the not too distant future as stateside election year rhetoric loses sway to a more universally practical and beneficial positioning toward the benefits of global advancement and cooperation.

From a global investment perspective we look for the US to move toward trade agreements that acknowledge a more level competitive playing field among developed and emerging nations (due to advancements in technology and globalization trends) rather than toward protectionism.

Thus, we continue to recommend international exposure to equities as well as stateside exposure to equities moving into the New Year.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.