Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

On The Road Again

Travels and meetings in the UK and Europe last week yielded productive dialog

Last week we traveled to the UK and Europe for meetings with institutional investors. We found that much like their stateside counterparts most were enjoying the rewards of a year that has been good to the equity markets and in many cases has proven less disruptive and more benign than expected to the fixed income (bond) market even as central banks around the world began or at least considered deploying the process of interest rate normalization.

We found in this latest trip abroad that the professional international investors we met with had similar concerns as their US counterparts.

Their most widely held concerns and our responses to their questions follow:

1) How much longer could the bull market that began in 2009 run? A. We expect the current bull market will run for at least the next 12 months not withstanding any interim pullbacks or corrections. In our opinion the sustainable economic expansion currently in progress along with continued revenue and earnings growth are likely to keep investors’ interest in stocks. Bull markets do not come with an expiry date stamped on them.

2) Might the process of interest rate normalization derail economic expansion? A. We do not expect the Fed’s interest rate normalization to impede the economy or the equity market so long as rate increases do not rise too dramatically or in too rapid sequence. So far the Federal Reserve has shown to be sensitive to the modest rate of economic expansion and has posted rate increases which have been fairly digestible to the economy and the markets.

“We expect the dollar to stay at moderate levels and even weaker further against many currencies as the US expansion progresses and economies improve abroad.”

3) Will Central Banks avoid making mistakes made in prior cycles such as tightening too soon or too late? Only time will provide that answer but “so far so good” since the process of the recovery began in 2009. Looking ahead there will likely be some level of uncertainty for the markets with the transition of leadership at the Fed that will take place in February. We expect it will take the markets some time to become accustomed to the change in Fed leadership. That would not be unusual. Still, the newly nominated candidate for Fed Chair is expected to be sensitive to the need for as seamless a transition as possible considering inflation remains below the Fed’s target.

4) Could US stocks see P/E multiples expand further? We expect the current trailing 12-month P/E multiple could likely move slightly lower from where it currently stands (as of last week around 22.5 times trailing 12- month earnings) as earnings should continue to expand in 2018. That said, the likelihood of a continuation of the process of capitulation by bears and skeptics of the bull market (which we believe has recently started to take place) could see the market’s P/E multiple expand even further as greater demand could force higher the price of each dollar of earnings. The key to how much more multiples might expand will likely be tied to how much further bond yields rise. Stocks and bonds tend to compete for investors’ attention. At current levels most bond yields do not provide much competition to stocks in our view. While this could change, current levels of inflation would appear not to provide justification for yields to rise dramatically further or rise and then stick at much higher levels.

5) Will the dollar likely rally further (after weakening overall in 2017)? We expect the dollar to stay at moderate levels and even weaker further against many currencies as the US expansion progresses and economies improve abroad. About 69% of US economic growth is attributable to the consumer, and Americans have a strong appetite for imported goods. This could increase demand for foreign currencies. As foreign economies see a jump in export demand and as their economies improve their currencies would likely strengthen.

6) Will global earnings be able to improve further? We believe the process of economic recovery internationally by region and individual countries will feed into revenues and earnings globally. We expect both emerging and developed markets to benefit from this process. The current US expansion should benefit as well and help underpin early expansions emerging in Europe and Asia.

7) Can tax reform deliver the growth the Administration and the Republican Congress say it can? Again, only time will tell. There are wide differences of opinion on this outside of the Republican core and the Administration. As for our view? First we need to see the final version delivered and congress will need to vote that into law. For the moment it’s a work in progress. More details are expected from Washington this week.

8) Will the US be able to find a way to fund a much needed infrastructure program? Funding is the challenge for this piece of the fiscal stimulus puzzle. A clearer idea of what can be done will be known after the tax reform package is settled on. The good news on infrastructure is that it appears to be likely the easiest to find acknowledgement of the need for it from both sides of the political aisle as well as among their many constituencies.

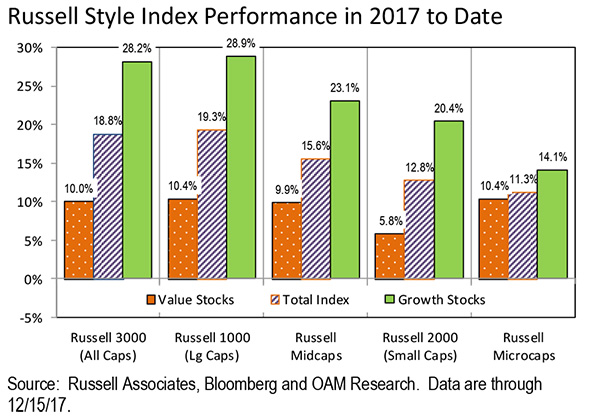

9) Could growth stocks continue to outperform value stocks in 2018? We expect value’s performance to improve in 2018 as demand for stocks continues to rise and as investors look to diversify away from their marked preference for growth this year. That said we recommend that investors use a barbell approach to continue exposure to growth even as they rebalance to increase their exposure to value stocks.

10) Will oil prices rise further? Economic recoveries in countries dependent on oil exports have seen a rise in demand for oil that has provided strength to prices. That said the potential for OPEC to loosen its reins on production as well as the opportunity for US producers to increase production will likely place a cap on the current trajectory of the price of oil.

11) Will the US equity markets see a more normal level of volatility in the New Year? We and others have expected a rise in market volatility to more normal levels for some time. Yet even when volatility has returned it has persisted for just short periods. The market will likely eventually find a catalyst to return to more normal levels and periods of volatility. We believe that will likely come when interest rates and the yield curve return to more normal levels.

12) Can the US avoid a recession next year? We are not forecasting a recession in 2018 at this time. The momentum of the economy, revenues and earnings stateside (and in the international realm) point broadly to continued expansion—not contraction—in our view.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.