Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Fundamentals Provide the Muse

We initiated an S&P 500 price target of $3,000 in 2018 based on economic and earnings outlook

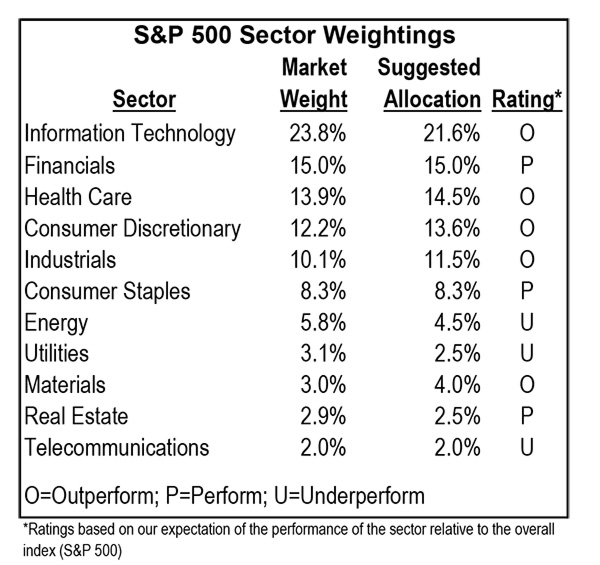

On Friday December 8, we initiated our price target for the S&P 500 for 2018 and also updated our sector weightings. We recap that piece below for our Monday morning readers.

As the calendar rolls into year-end with the S&P 500 hovering around our $2650 target (initiated on July 31st 2017), we provide a 2018 outlook with estimates and projections. Our original year-end 2017 target of $2450 (initiated in mid-December of 2016) was crossed in mid-June; our revised target of $2650 from last July was realized on Friday December 8th when the benchmark closed at $2651.50.

Going forward we expect many of the same thematic factors from 2017 to apply in the New Year as investors look to determine whether improving economic conditions and corporate fundamentals can boost stock markets higher for a third straight year.

With bears and skeptics having found ample opportunities to curb investor enthusiasm as markets notched numerous all-time highs in 2016 and 2017, we look to remind our readers that bull-markets do not have expiration dates but rather often turn on expectations of a slowdown in the economy, an actual slowdown in the economy, weakening of corporate fundamentals, or deterioration in credit.

We believe the expectation of 2–2.5% GDP growth in the long-run, a strong employment picture (see our commentary below on Friday’s nonfarm payroll report for November), accommodative monetary policy and modest inflation without signs of overheating offers an economic landscape that provides further support for additional gains in equity prices in the year ahead.

With Q3 earnings season having shown ~9.8% growth in year over year operating earnings, the S&P 500 has now delivered five consecutive quarters of EPS growth. Bottom-up estimates for Q4 2017 point toward double digit year-over-year growth and we continue to believe 2017 operating earnings will end the year at $129.

“We continue to believe the relative/risk reward for US equities remains attractive. Low inflation—which we believe to be a result of an increase in technological innovation and globalization—have kept long-term rates in check, flattened the yield curve, and even resulted in greater near-term risk for bonds than for equities.”

We initiate a year-end 2018 price target for the S&P 500 of $3000 or 20.5x our 2018 EPS estimate of $146. While we do not directly take into account potential growth from tax reform as conclusions are yet to be arrived at by legislators in Washington, we believe an expected reduction in tax liabilities and opportunities for repatriation and deregulation would ultimately support margin expansion or share buybacks.

We place a 20.5x multiple on 2018 earnings as we continue to believe the relative/risk reward for US equities remains attractive. Low inflation—which we believe to be a result of an increase in technological innovation and globalization— has kept long-term rates in check, flattened the yield curve, and even resulted in greater near-term risk for bonds than for equities.

We believe 20.5x 2018 earnings can be reached as the Fed and other central banks around the world deliver a process of interest rate normalization with less disruptive results for markets than many expect. We remain constructive on further improvement for corporate fundamentals and see opportunity for growth in both the top and bottom-line. We expect forward guidance from corporate management teams to remain positive as global economies continue to improve at a sustainable rate of growth. US multinationals should benefit from this process particularly should the dollar remain at relatively moderate and competitive levels.

In our opinion skeptic and bear capitulation appears to have just begun in the fourth quarter of 2017 and contributed to the number of this year’s equity benchmark record highs. We believe that it is early in this process and multiples could expand further than we currently anticipate should the capitulation gain momentum.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.