Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Rock Steady

Investor patience required as multiple transitions move ahead

There’s no shortage of action in the markets as 2016 draws closer to year end. Oil, the dollar and the markets’ perception du jour of the effect of stimulus (yet to be even defined or applied) on the economy have bullied the bond market and jostled stocks. We think patience is required of investors in the near term.

As we went to press with this week’s market strategy commentary, news crossed the tape that the Italian electorate had voted against proposed reforms which would have reined in the power of the Italian Senate.

Bloomberg news reported that Italian Prime Minister Matteo Renzi acknowledged defeat in the constitutional referendum that took place and that he would turn in his resignation.

Soon after the news broke, the Euro fell to its lowest level since March of 2015 before paring its losses. The Italian vote marks yet another victory for populist trends that have popped up across the globe victorious in 2016 elections.

The outcome of the Italian election adds an additional level of concern that the global markets will have to ponder and digest.

Stateside last week saw oil prices recover and move higher on the back of an agreement by members of OPEC and other producers including Russia to curtail production to support the price of oil.

As of the close last Friday the price of WTI (West Texas Intermediate) stood at $51.68 bbl. or 12.2% higher than where it had closed on the prior Friday.

The Energy sector of the S&P 500 moved higher last week on the back of the surge in the price of oil with oil stocks rising 2.64% on the week. The sector has advanced 9.42% since November 4.

Stocks traded mixed last week with the blue-chipladen Dow Jones Industrial average edging 0.1% higher on the week while the S&P 500 and the NASDAQ respectively slipped 0.97% and 2.65%.

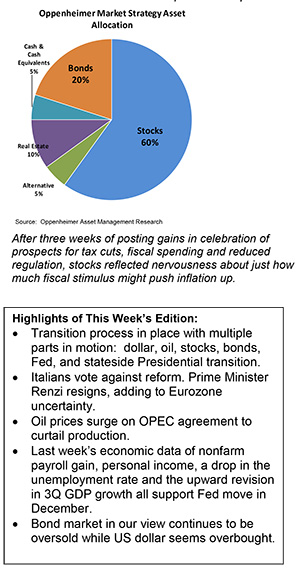

After three weeks of posting gains in celebration of prospects for tax cuts, fiscal spending and reduced regulation, stocks reflected nervousness about just how much fiscal stimulus might push inflation up. Investors also turned to consider what effect a more aggressive trade policy might have on US multinational trade relationships.

The bond market has taken a drubbing since the election on concerns about the effects of the yet to be defined (let alone implemented) stimulus programs.

Since November 8th the 10-year Treasury note’s yield has jumped 27.6% from 1.86% to close at 2.36% last Friday. The 30-year Treasury bond in the same period saw its yield move 16.7% higher from 2.62% to 3.03% as of last Friday’s close.

Beyond the aforementioned activity and drama the markets appear to be reacting well considering the transitions that are currently taking place.

Consider that the market has also processed so far this quarter:

The last in the series of known “main events” for 2016 is just nine days away when the Fed will announce its decision on whether or not it will raise its benchmark rate.

We look for the Fed to raise its benchmark rate by 25 bps on December 14th and have expectations that the stock market will likely respond positively to the Fed’s action. From our perspective 25 bps will be relatively easy for the economy to digest and will also send a message to market participants from the Fed to keep animal spirits in check and expectations right sized.

As to the bond market and the dollar? We continue to believe that the bond market is oversold and the dollar overbought. In such times of transition, perception and projection can often distort sentiment negatively in the short term.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.