Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

There’s Got to Be a Morning After

Like many of our fellow Americans, we poured the coffee strong this morning after staying up into the early morning watching the election returns that led to President-Elect Donald Trump’s acceptance speech shortly after 3am.

Our first thought as to the outcome of last night’s election was that professional polling as we have known it will likely never be the same. First it was Brexit in June and now with the US presidential election that respected and well-known pollsters broadly failed to capture an accurate read on just what the voting public’s opinion really was. In market parlance, “Talk about a big miss.”

Was it bad “algos” (algorithms) or simply bad tea leaf readings that caused the pollsters to get it so wrong? Either way, it’s back to the drawing board for the pollsters if they are to regain their former perch of prominence in the process of calling an election.

We believe what happened this time around was that candidate Trump had over the course of the election process been so vilified (albeit at times brought upon by his own actions) in traditional media as well as in social media that Mr. Trump’s supporters were often reluctant to tell pollsters whom they planned to vote for.

We can also imagine that many of those who turned out for Mr. Trump on election night had simply not come up on pollsters’ radar screens as “likely voters.”

As a result, pollsters were probably much of the time operating in the dark when it came to Donald Trump’s chances of winning.

In our recent travels (we have been on the road almost endlessly since September traveling to client events and company meetings throughout the country), we had noticed that Trump supporters (including clients, advisors, as well as individuals unrelated to our business travel) had with increasing frequency as election day grew nearer revealed to us in unsolicited fashion and usually on a one-to-one basis and with considerable enthusiasm that they were planning to vote for Mr. Trump.

This unsolicited sampling of opinion being primarily anecdotal and not driven by pollster professionalism we took as happenstance rather than powerfully material. The lesson for those of us who were surprised by yesterday’s election outcome might well be to never underestimate the power of a grass roots movement.

Beyond that we add that when real show business stands toe to toe with traditional politics in a standoff in the proverbial O.K. Corral, it can be wise to put your money on show biz (anyone remember Ronald Reagan?).

Already in his acceptance speech in the wee hours of the morning President-Elect Trump began to release the proverbial flock of doves of amelioration to those whose candidate lost. Stunned Democrats can pick themselves up and move forward knowing that an olive branch has been extended their way. The election is indeed over.

The old guard of the Republican party, which had to some extent abandoned Trump by the last days of the campaign (even to the extent that they had staged their respective election-night parties in venues away from the Trump campaign), might begin to realize that the Republican Party of the last ten years or so is thought by a large part of the electorate to be about as fresh as yesterday’s newspapers.

The initial downside drama that unfolded on election night in the futures markets as a Trump victory became a reality was quickly digested and ameliorated as bets were right-sized and earlier trades positioned for Democratic victory expected just hours before were unwound. As the day unfolded the pullback that was felt in Asia morphed into a rally in Europe and stateside as the world turned on its axis.

As we had pondered earlier, the market’s machinations from Friday, October 28th, to Friday, November 4th, appeared to have served as a dress rehearsal in what came to pass, as prospects of a near-certain Clinton victory faded into

the reality of Mr. Trump’s late momentum.

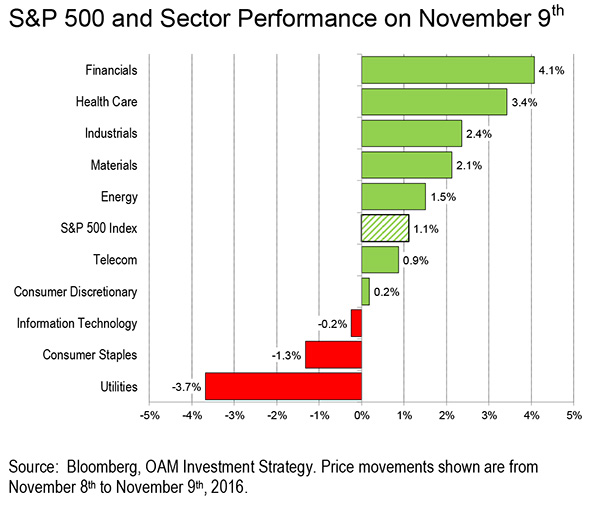

Rallies by stocks in the Financials, Health Care and Energy sectors, which had been considered at risk in the event of a Clinton victory, suggest a likely change of fate under a Trump administration.

Prospects for a reduction rather than increase of regulations, an opportunity to see tax cuts for individuals and businesses (including the likelihood of an incentive for US multinational corporations to return profits stateside that were earned abroad) could improve the outlook for business, employment, and the overall US economy.

Admittedly, it’s a long distance between an idea, structuring a solution, and its successful execution─ but the wheels are in motion now.

Prior to Election Day we had thought that either party’s plans for infrastructure would be good for stocks in the Materials, Industrials, Consumer Discretionary and Information Technology sectors. The Trump victory supports our earlier thoughts and favors those sectors.

We also expect his election will be a positive for Financials, Health Care and Energy (though Energy will remain under pressure via technological advances, which make supply plentiful, as well as efficiency gains in business and consumer use).

Internationally President-Elect Trump has to communicate his message more diplomatically and in greater detail. That said, the rallies in Europe and the overall moderate losses in Asia and in Latin America on Wednesday indicate to us that there is considerable hope for negotiation to navigate what lies ahead in addressing global trade with those regions.

The Federal Reserve, we continue to believe, will likely raise rates in December so long as the economic data continue to support that action.

Some nervousness about previous remarks by the President-Elect about the leadership of the Fed is warranted, but could ease in the days ahead with the process of communication and transition forthcoming.

As Donald Trump and family exited the stage after his acceptance speech last night, the music of the Rolling Stones called out the lyrics:

You can't always get what you want But if you try sometimes well you just might find; You get what you need.

The market at least for today appears to agree.

In the weeks ahead perhaps the new theme will become Sly and the Family Stone’s classic, We got to live together.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.