Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

And Now You Tell Me?

As we prepared to go to press with this week’s Market Strategy publication, news crossed the tape that FBI director James Comey had said in a letter this Sunday that the bureau is sticking to its conclusion that Hillary Clinton’s handling of her emails as Secretary of State wasn’t a crime. News reports suggested that the latest news could increase the chances of a victory for Hillary Clinton in Tuesday’s presidential election.

With no little irony, many investors had over the last week spent considerable effort increasing their hedges against the potential for Republican candidate Donald Trump pulling off an upset victory for the office of the presidency of the US─after candidate Hillary Clinton’s chances of victory slipped in the polls on back of an earlier letter the FBI’s director had penned informing Congress on Oct. 28 that the bureau was examining new e-mails potentially related to its investigation of Clinton’s use of a private e-mail server.

From news item to news item, barb to barb and accusation to accusation, the process of the US presidential election 2016 has become a near if not purely burdensome item on the horizon to an electorate that appears (from both sides of the aisle) to have grown increasingly desirous and eager to get this thing over and move on.

What began some 18 months or so ago with unprecedented lack of traditional election primary style from both sides of the political aisle initially captured voters’ attention, interest and even entertained them like no other presidential stateside primary and election of recent memory.

Since the major parties’ respective conventions in August, the tone of the debate, level of drama and rancor have increased to such levels as to make the political process seem increasingly burdensome.

With the aforementioned latest news item we’d expect that pre-election Monday will likely be clouded and obfuscated with conjecture, ponder, projection and pontification as to how this latest letter will affect or not affect the outcome of the presidential race this Tuesday.

From our perspective, the market’s machinations to the downside since the letter of October 28th have served to position the markets better in the event of a surprise outcome to the election.

The majority of pollsters had earlier pretty much in a pre-Brexit like manner predicted an easy and sizable victory for the Democratic presidential candidate. As of last week those earlier projections had been somewhat shaken up and even rightsized. The result has hopefully brought a touch of humility to the electoral landscape that might just serve the markets, pollsters, the electorate and even the politicos some good in the long run.

Don’t forget to vote for your favored candidates tomorrow, Election Day 2016.

Strategic Market Musings – there’s always an almanac anecdote somewhere…

Last week as traders’ expectations for a status quo outcome in which a Democratic victory in the White House would be offset by a Republican Congress might be at risk, the S&P 500 index slipped a total of just under 3% in aggregate over the course of eight back-to-back trading sessions. The sequential nature of the decline caused some observers to raise concern and note that the last time the S&P 500 had moved lower in eight straight sessions was in 2008.

The comparison to 2008 caused agita among some market participants who appeared to suffer from a lapse in memory as to what was happening midst the crisis of 2008 in comparison to the current economic expansion in 2016 (which based on last week’s economic data remains apparently sustainable for now).

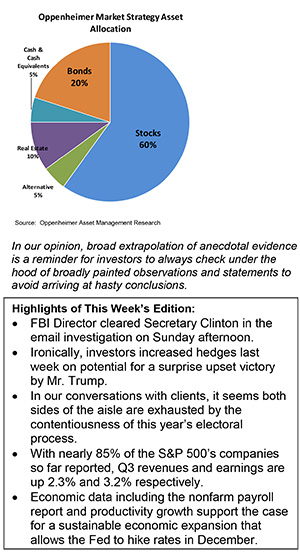

In our opinion, broad extrapolation of anecdotal evidence is a reminder for investors to always check under the hood of broadly painted observations and statements to avoid arriving at hasty conclusions.

With the nonfarm payroll number in the rearview mirror (and with upward revisions to the prior nonfarm payroll number) along with other economic data and even revenue and earnings for Q3 pointing to an increased likelihood of a Fed hike of 25 basis points in December (barring a bolt from the blue or an unexpected reversal of fortune), and with only one more day before Election Day 2016 uncertainties that have held the market hostage too long likely to fade soon, a relief rally may not be too far distant.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.