Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

As The World Turns

Voters in Germany opted for pragmatism versus populism in Sunday's vote

Sunday’s elections in Germany proved a victory for Angela Merkel and her party even as results showed a weakening in her base of support due largely to voter opposition to her policy on immigration. This resulted in some worrisome gains for the German right wing.

That said, Merkel’s winning a fourth term as Germany’s chancellor racks up a third victory for pro-EMU, pro-EU and pro-business constituencies in Europe. Notwithstanding concerns expressed at the beginning of the year the elections in the Netherlands, France and now in Germany have not resulted in a radical change.

So far 2017 has proven to be from an election perspective in our opinion positive with neither a “Nexit” (that could have come from elections earlier this year in the Netherlands) nor a ”Frexit” in France nor a radical change in Germany. We can’t help but wonder whether Britain’s Brexit vote outcome last year may have served as a model of “what not to do” for voters elsewhere in Europe this year.

From our perspective on the market radar screen we say that so far in 2017 voters in Europe have for the most part “passed” on populism and “opted” for pragmatism. More than likely the improvements in the European economic landscape have served as a bromide in the polling booth.

We’d say politicians of all stripes in Europe as well as in the US this year so far appear to have been put on notice by voters that radical ideological rants and stagnation are “out” and economic progress for business and labor are ”in.”

Nine months into the year the message from the markets appears to be that it likes what’s been “going on” at the polls. Market gains this year look to us at least in part to be a resounding “I like it” with stock markets rising around the globe reflective of improved economic conditions that have positively affected business and labor.

Perhaps things are not as good as some might expect they should be or even as good as they might be but at the end of the day things appear a lot better economically than they were over the course of the greater part of the last decade.

“So far this year voters in Europe have for the most part ‘passed’ on populism and ‘opted’ for pragmatism”

In the week ahead

Early this week the Administration in Washington is expected to present the framework of its tax overhaul. We remain skeptical of prospects for tax reform with so many vested interests and conflicted opinions represented in Congress. We consider tax reform to be nearly as contentious a topic as health care reform in the halls of Congress or around the Beltway.

That said we expect that the effort toward tax reform will morph more simply into tax cuts for corporates and individuals with the greatest benefits for the former. That should mean that any announcements this week could have at least some effect on the markets. The recent improved performance of small and mid-cap stocks has at least in some part signaled increased prospects for something to get done with the administration’s tax agenda.

On Tuesday the S&P/Case-Shiller housing price data and newhome sales numbers for August are due, along with consumer confidence for September.

Wednesday brings durable goods orders for August. On Thursday look for the final estimates on Q2 GDP.

Friday brings personal income and spending data.

Throughout the week “Fedspeak” will be an item for market observers and investors to focus on as Fed Chair Yellen and a number of Federal Reserve Presidents are slated to speak around the country.

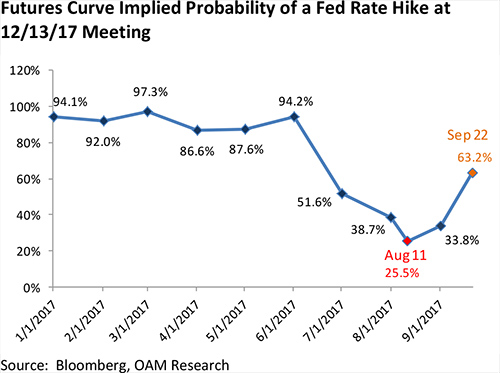

The probability of a rate hike (as measured by Fed funds futures) increased last week to 63.2%. After the central bank’s FOMC policy meeting Fed Chair Janet Yellen announced that the Fed would begin to trim its balance sheet in October. She also suggested that the Fed would likely raise its benchmark rate in December (something we have been expecting).

Fed funds futures have been signaling a higher probability of a December rate hike since hitting a low of 25.5% on August 11. Since then an improved mix of economic data including an upward revision to GDP growth, positive earnings results in the Q2 earnings season along with improved prospects for tax reform or at least a tax cut have boosted sentiment and expectations for the Fed to make further progress on the path to interest rate normalization.

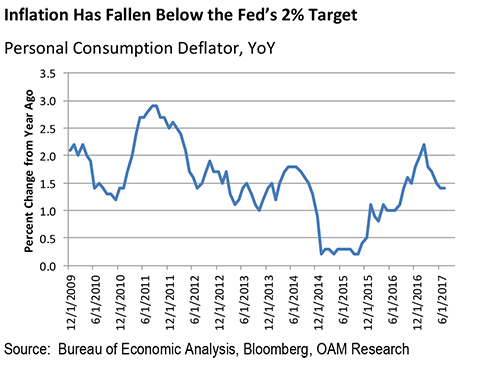

The stock market has thus far has been able to digest prospects of higher rates as inflation (particularly the Fed’s favored gauge, the personal consumption deflator) has remained shy of monetary officials’ 2% inflation target rate.

With wage growth remaining modest for now and likely to remain so (at least into the foreseeable future) and businesses concerned with lowered barriers of entry via technology and globalization the Fed is unlikely to be forced into making abrupt or rash decisions that could jar the markets.

For now at least, risks of worrisome inflation emerging are countered by the relentless march of technology (robotics and algorithms) and globalization.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.