Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

One Way Out

Seemingly insurmountable obstacles are overcome and markets grind higher

As we went to press this week equity futures signaled strong openings in Asia with markets there looking poised to rise on the back of last week’s gains in stocks even as geopolitical tensions remain at elevated levels from threats by North Korea (including a third missile test) and a frightful terrorist attack in London’s passenger rail system on Friday.

Hurricane Season

As governmental entities, businesses and individuals worked to find remedies to the destruction waged by Harvey and Irma across a large swath of land from islands in the Caribbean to Houston, Texas and Florida, two more hurricanes developed off shore raising warning levels and preparations on islands still reeling from prior storms.

The latest set of record highs reached last week by the Dow Jones Industrial Average (on Friday), the S&P 500 (on Friday) and the Nasdaq Composite (on Wednesday) suggests to us that investors remain focused on improved economic fundamentals stateside and elsewhere in the world as well as on relatively strong corporate earnings. Investors likely consider those factors currently as a positive offset and counterpoint to the substantial challenges and disruptions that lie across the global landscape today whether from geopolitics, domestic politics, as well as a potential myriad of generators of uncertainty and concern.

To us the markets at this juncture suggest that investors also are not daunted by uncertainty as some observers presume but rather are prone to embrace the uncertainty and open to acknowledging evidence of possible offsets and solutions to problems. In effect, investors are supporting the bull market’s continued climb of the proverbial “wall of worry” that it has traversed for over eight years.

Perhaps it is the collective experience that markets and investors have gained over nearly two decades from having dealt with terrorist attacks, economic and market implosions, pandemic threats, and cybersecurity events of magnitude all delivered and discounted at digital speed on a global basis.

“most of the substantial “sizzle” in returns experienced by US investors in foreign stocks this year has come from the dollar’s weakening”

The aforementioned factors as well as challenges to society and business caused by outsized progress and development in trends driving globalization and technology, (which are often as disruptive as they are constructive), force us to ponder whether the markets and investors have simply become numb or have instead become fortified by the very scale of the challenges they have had to face and move through. For now we think it is the latter and invoke the adage, “what doesn’t kill you makes you stronger…”

In the week ahead

It’s expected that all eyes will be focused on the outcome of the Federal Reserve’s FOMC (Federal Open Market Committee) meeting this Wednesday. While the markets don’t expect a September rate hike to come out of this week’s meeting there are expectations for an announcement tied to and offering some clarity about the Fed’s plans for reducing its balance sheet. Any disappointment of that market expectation could lead to some profit-taking near term.

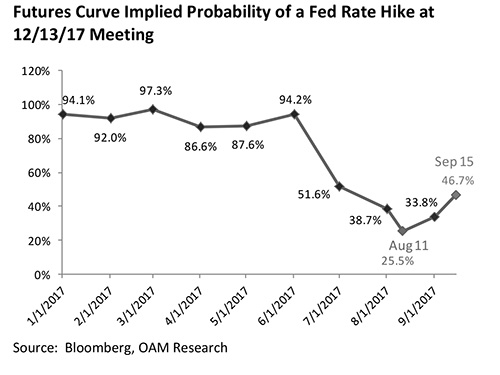

In addition investors will likely look for some confirmation of expectations of a Fed rate hike in December, which rose sharply last week after the release of consumer price inflation data for August. As of Friday Fed funds futures were indicating a 46.7% probability of a rate hike at the Fed’s Dec. 13 meeting (see below).

The probability of a rate hike has been on the rise of late on mixed data after having fallen as low at 25.5% on August 11 when investors were concerned about economic data that had seemed unexpectedly soft.

Other than the Fed’s announcement on Wednesday afternoon a mix of economic releases scheduled for this week will provide investors updates on housing, foreign investment flows and import/export conditions.

Politics count in a deal-prone environment

The recent progress President Donald Trump made with the Democratic leadership in seeking to advance his tax reform agenda has in some part contributed to the market’s improved tone seen in the week just ended. Any further advancement or set back to getting beyond Washington’s usual gridlock and toward the deployment of stimulus agenda items could have an impact on the market’s tone day to day.

Don’t forget where the sizzle on the steak is coming from

Foreign equity benchmarks (Developed, Emerging and Frontier) continue to broadly outperform US equity benchmarks this year (please see charts on page 5).

A mix of attractive market forward valuations around the globe supported by progress in international economic recoveries has drawn US investors to seek opportunities abroad.

However, it’s worth considering that in many cases most of the substantial “sizzle” in returns experienced by US investors in foreign stocks this year has come from the dollar’s weakening against foreign currencies from the start of this year.

On a year to date basis through last Friday the dollar has moved lower against all of the G10 currencies as well as lower against 21 major emerging market currencies. As a result the weaker dollar has boosted the value of foreign assets including stocks and bonds, earnings and dividend and fixed income.

A “gained in translation” effect is evident in considering that as of last Friday a 9.0% rise year to date in the DAX (Germany’s major equity index) in local currency terms, i.e. the euro) pales in comparison to its 23.8% gain in US dollar terms for the DAX over the same period.

Similarly, Japan’s Nikkei 225 equity benchmark has risen 4.2% year to date through last Friday in yen terms, but is up 9.6% when converted to dollars.

This currency affect is repeated across many foreign markets and currencies so far this year.

A strengthening of the dollar would change the currency advantage that US investors currently have. While we do not expect that the dollar will rally sharply this year we do think it is important for investors to recognize where the current outsized boost from foreign holdings in stocks and other assets has come from so far this year.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.