Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Give Me Some Lovin’

Still unloved, this bull market climbs the wall of worry

Last week saw stocks rally on the back of signs of progress in global trade negotiation activities. Talks with Canada showed it might be willing to make a deal with the US around dairy products similar to the deal it made with Europe earlier this year. A few signs that Europe and the US could come to an agreement sooner rather than later lightened trade war concerns as well. There were also signs that China was warming up to the idea of making a deal with the US to avoid further challenges to its economy as it navigates domestic issues tied to debt and slower growth.

Even after President Trump threatened to extend the US tariff regime across most Chinese goods destined to the US stocks managed to “keep the faith” posting good gains across the major indices for the week. The Dow Jones Industrials, the S&P 500, the S&P 400 (midcaps), the Russell 2000 (small caps) and the NASDAQ Composite (some 40% weighted in technology or tech related stocks) respectively gained 0.92%, 1.2%, 0.95%, 0.50% and 1.4% on the week.

As of last Friday’s close the same indices on a year to date basis were up respectively 5.8%, 8.7%, 7.7%, 12.1% and 16.03%. (See pages 6 and 7 for details).

Not too shabby we’d say based on all the challenges and swings in sentiment stocks have faced from trade war risk, concerns about rising interest rates, interest rate differentials with foreign debt, along with the implications on US multinationals from a strong dollar.

It reminds us that when push comes to shove what matters most to stocks are good fundamentals related to the economy and corporate revenues and earnings.

In the international realm stocks broadly fared well last week as reflected by the MSCI EAFE (developed world ex-US and Canada), MSCI Emerging Markets and MSCI World ex-US indices reflecting the afore-mentioned improved signals on trade talk progress, which served to ease some worry in the international stock markets and point investors toward their attractive valuations.

“It’s the ubiquitous nature of tech that could help the technology sector extend its stay “in the winner’s circle” for longer than many skeptics think”

Concerns over the potential for a protracted trade skirmish have weighed heavily on international markets this year as foreign economies mostly tend toward greater dependency on the strength of their exports (much of which are destined for US ports) to drive their GDP (economic growth).

Among the sectors that have captured investors’ and observers’ attention this year stateside has been Information technology. Last week the S&P 500 Information Technology sector advanced 1.8% outperforming the underlying benchmark and ranking fourth among the 11 sectors as market participants argued the case for tech.

Stocks got a boost from Apple’s (AAPL) latest generation of iPhones introduced last week. Those appeared to pass muster with investors even as they gasped at the higher prices of the new models.

Semi-conductors, which had recently come under some pressure, rallied on the week in part on the new product news from Apple as well as the improved sentiment toward the possibility of trade issues getting resolved sooner rather than later.

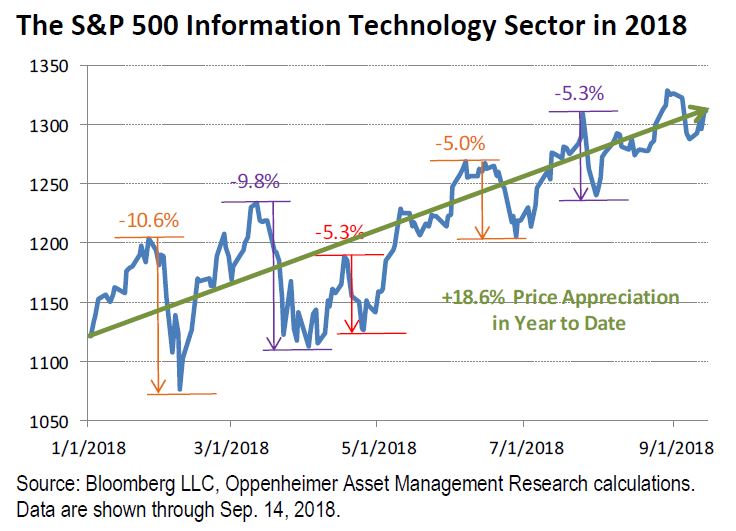

Technology like the broader averages this year has proved resilient even as it has been challenged several times. Consider that the Information Technology sector has bounced between gains and losses for much of this year declining a little over 10% from a high in January, then dropping 9.7% (from a higher level than it had achieved in January) and then falling over 5% respectively from three separate rally highs in April, June and July.

From each of these pullbacks tech stocks have rallied to achieve new highs. Last week the Information Technology sector appeared to begin yet another—a rally after a little more than 3% spill from late August.

Each time tech slipped this year bears and skeptics have shown up in droves predicting the demise of the bull-run in technology. Each time they have been proven wrong as fundamentals pertinent to the sector have so far countered the bears on each occasion.

From our perspective on the market radar screen it looks like the ubiquitous nature of technology persists in positioning it to serve both business and the consumer affecting the way individuals and corporations interact with each other in dramatic game changing manners. It’s the ubiquitous nature of tech that could help the technology sector extend its stay “in the winner’s circle” for longer than many skeptics think.

Consider that the advancements in technology today are affecting a myriad of transitions occurring in every sector of the S&P 500 and in every economy around the world (albeit to different degrees) perhaps as dramatically today as the invention of the automobile when it displaced the horse in the last century.

As we went to press with this week’s edition, news crossing the tape indicated stocks in Asia were wobbly in consideration of the potential for further escalation of the tariff situation. We believe that cooler heads will ultimately prevail. For now we suggest investors continue to practice patience while trade issues get worked out. In our view right sized expectations are key for investors to position for potential gains ahead. Expect progress not perfection.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.