Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Let’s Give Them Something to Talk About

Comments from Yellen, Draghi, Cohn, and Trump gave the markets much to mull and digest

Stocks stateside last week bounced between gains and losses from the mid-point of the week after a strong rally on Monday and Tuesday driven by rising hopes for tax reform stalled after the president, while making a speech at a political event, appeared to call for a government shutdown if money wasn’t allocated for a border wall with Mexico.

Investors regained their composure on Friday and positive sentiment for a chance of tax reform returned and the broad market closed higher on Friday, up 0.72% on the week. It was the benchmark’s first weekly gain in two weeks. The S&P 400 (mid caps) and the Russell 2000 (small caps) moved higher as well rising 0.99% and 1.45%, respectively on the week. The mid and small caps outperformed large caps as hopes grew (based on remarks from within the Administration) for the likelihood for tax reform. (Mid and small cap stocks have underperformed large caps for most of this year as investors turned skeptical about the chance that tax reform as well as other stimulus items on the administration agenda would see the light of day).

As mid-term elections in 2018 grow closer on the horizon, we would expect those items on the White House’s agenda tied to stimulating the economy that are the least politically contentious (a tax cut if not tax reform; infrastructure spending; and a tax holiday to encourage repatriation of US multinational profits held abroad) will have a good chance to find political support from both sides of the aisle. Results at the polls since election day 2016 and so far this year have in our view signaled a strong desire among voters for action over gridlock and an end to the legislative stagnation in the halls of Congress.

While we expect nearer-term political rhetoric is likely to increase in volume, recent history suggests the political bark may be worse than the political bite.

“Anyone expecting earth shaking news from either Yellen or Draghi was disappointed as the respective chairs of the two central banks basically reiterated policy the market has long been privy to.”

No Surprises from Jackson Hole

The Kansas City Federal Reserve’s annual conference in Jackson Hole, Wyoming that took place last week provided a platform for Fed Chair Janet Yellen and the ECB’s President Mario Draghi. Anyone expecting earth shaking news from either central banker was disappointed as the respective chairs of the two central banks basically reiterated policy the market has long been privy to.

Bonds posted a modest rally last week with the US 10-year Treasury yield easing some to end the week at a yield of 2.17% or down around 11.4% in yield from a level of 2.45% at the start of the year.

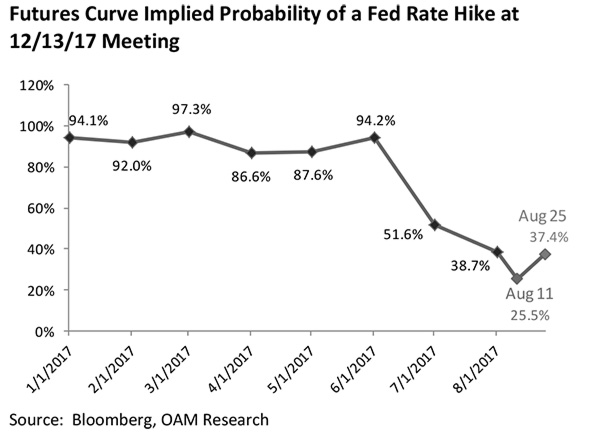

As of last Friday the Fed funds futures indicated a 37.4% implied probability of a Federal Reserve rate hike in December. That’s higher than two weeks but sharply lower from a 94.1% change priced into the futures curve at the beginning of this year (see figure below).

Comments in the financial press of late have indicated that the bond market is less worried about the possibility of change in Fed leadership in February when Fed Chair Yellen’s first term is up. The word in the market seems to say that if President Trump were to nominate White House advisor Gary Cohn to the Fed Chairmanship that it would be acceptable to investors with expectations that he’d call for little change in policy.

Assessing Harvey’s Effects

As we went to press on Sunday night concerns remained elevated as to the effects of Hurricane (and now Tropical Storm) Harvey on the city of Houston and the surrounding area.

The storm had already led to record flooding across a city that is no stranger to tropical storms.

State officials, meteorologists, and emergency managers were saying that the downpour in the aftermath of the hurricane could last for days and that the cost to human life, and the local, regional and national economies would take some time to determine.

President Donald Trump approved a major disaster declaration, and the EPA (US Environmental Protection Agency) waived certain fuel requirements for gasoline and diesel supplies in Texas after the storm struck.

While the storm has near-term implications for both the local and regional economies, the size of the US as well as the size and the diversity of the Texas economy indicate that the storm will have less impact on the markets than some reports from the front of the storm have suggested.

In our view the US stock market is reflective of both the domestic and the global economy. As a result, even hurricanes of enormity such as Katrina and Sandy whose damages totaled $108 billion and $75 billion respectively, though tragic on the personal level as well as traumatic for the local economies were digested and discounted by the markets and the national economy relatively quickly.

The US economy (the largest in the world in excess of $18 trillion annually) and US equity markets have proven in the past to be resilient when facing damage done by hurricanes and other natural disasters. We expect them to respond similarly to the current storm.

At the local level, housing, construction, consumer products, health care, as well as the insurance sector can suffer near term from the damaging effects of the storm but as has been the case historically, they are likely to benefit from the recovery process after the storm has passed.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.