Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Been There, Done That, Got the T-Shirt

US equity markets grind higher on fundamentals

In the week ahead, investors will have plenty to focus on even as a sense of the traditional wistful end of summer begins to make its presence felt across Wall Street and Main Street stateside and across the northern hemisphere as the days start getting shorter.

Midweek, the Federal Reserve releases minutes from its August FOMC meeting. Investors will follow their usual regimen of parsing the minutes for any change in tone by the Fed that could suggest a policy tweak or hint at a material change ahead.

Leading into this week, we aren’t expecting any big surprises from the minutes. The central bank, in our opinion, is more than likely to reiterate its commitment to interest rate normalization—which in our view implies a continuation of a policy sensitive to both strengths and vulnerabilities in the economy.

What we’ll be looking for is any clue as to whether or not the Fed plans on two more rate hikes or not in 2018. Stateside economic data and market expectations point to a total of four hikes in 2018 (with two more to come—one in September and one in December). However, the trade skirmish and uncertainty around the possible repercussions surrounding the crisis in Turkey could push the Fed to go with just one more rate hike this year.

Also on the investment calendar this week is the annual Jackson Hole Economic Symposium sponsored by the Federal Reserve Bank of Kansas City which convenes mid-week. For over 30 years, the gathering in Jackson Hole each August has drawn a diverse group of central bankers, business leaders, academics, denizens of the financial world, and select members of the press from across the US and around the world.

This year’s economic symposium is titled “Changing Market Structure and Implications for Monetary Policy” and takes place August 23rd to August 25th .

Investors can expect a wide variety of topics to be discussed including issues surrounding those tied to the ongoing trade war/skirmish and negotiation process.

“So far, stateside equity markets have exhibited a “been there, done that, got the T-shirt” resilience in the face of challenges that have been offset by economic data in the US . . . ”

In the Rear- View Mirror

Last week, US equity markets continued to show resilience in the face of global challenges from trade tensions and the currency crisis in Turkey.

The Dow Jones Industrials, S&P 500, the S&P 400 (mid-caps), and the Russell 2000 (small caps) respectively gained 1.4%, 0.6%, 0.7% and 0.4% on the week. The NASDAQ Composite (some 40% weighted in tech and tech related stocks) slipped 0.3%.

Last week’s activity in the stateside markets broadly favored defensive sectors over cyclical sectors with market action showing some profit-taking in growth issues and rotation into some value segments in stocks.

The major international and regional benchmarks showed weakness in the same period. In our view, this signals a continued concern for the potential greater negative impact that the trade skirmish or a protracted trade war on foreign could have on foreign economies and markets. This would particularly damage those trading partners whose revenues and earnings historically have greater dependence on exporting to the US.

In the week ended last Friday, MSCI EAFE (Developed markets ex-the US and Canada), MSCI Emerging markets, and MSCI Frontier markets respectively declined 1.2%, 3.7% and 1.4%.

How About Those Bonds?

The yield on the 10-year note closed the week at 2.86% on Friday (some distance from the 3.11% high so far for this year seen in mid-May).

The softer yield on the benchmark note seen last Friday reflected some “risk off” sentiment in the markets as well as the continued comparative attractiveness of the note’s yield for foreign investors that is further enhanced by the dollar’s strength.

So far, stateside equity markets have exhibited a “been there, done that, got the T-shirt” resilience in the face of challenges that have been offset by economic data in the US that points to the sustainability of domestic economic growth as well as solid revenue and earnings growth at the corporate level. As of last week, with around 93% of S&P 500 companies having reported in Q2 earnings season, earnings are up in excess of 25%. This performance comes on back of revenue growth just under 10% (for details, see p. 4).

With fundamentals not showing deterioration, the economy and the equity markets may have further space and time to surprise skeptics and bears in the quarters through the end of the year.

Should some resolution to the global trade dispute appear on the scene, international equity markets could reverse direction and move higher and follow the US stock market higher as well.

For now, we remain overweight the US but with sufficient exposure to the international markets should trade conditions and sentiment towards them improve.

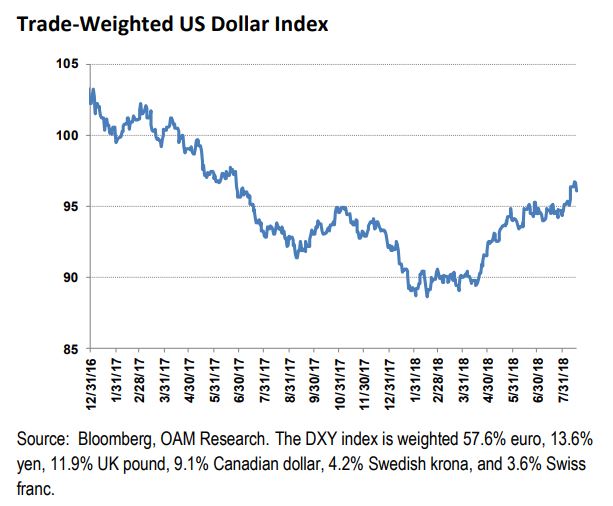

The trade-weighted US dollar index (DXY*) has risen 6.8% against a basket of six developed-nation currencies since the end of March 2018.

While the dollar’s renewed strength is a relatively recent phenomenon, the dollar index remains 5.4% below its level at the end of 2016.

Should the dollar extend its gains, the strong currency could become a headwind for the revenues and earnings of US multinational companies in future quarters.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.