Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

The Beat Goes On

Markets breathe a sigh of relief on French election and as economic data firm worldwide

Election results in France on Sunday served to remove another cloud of worry that had hung over the European Union, the EMU and the global markets for some time. With the victory of the French center-right’s pro-business and pro-EMU candidate Emmanuel Macron over the National Front’s Marine Le Pen, voters in France expressed their desire for a change politically but not to any extreme.

Worries of the potential for a populist victory were pretty much dispelled two weeks ago in the first part of France’s Presidential election that indicated that Emmanuel Macron would be the likely victor in the runoff. That said, all too fresh were memories tied to surprise results when voters chose in favor of Brexit last June and the stateside Presidential election outcome last November.

With the European region broadly showing signs of improving economic conditions and earnings growth and with the elections in the Netherlands and France resolved and in the rearview mirror, stocks in Europe could get bid higher.

As we went to press on Sunday futures markets were pointing to higher prices from Asia to Europe to the US as markets open around the globe on Monday.

Stateside the S&P 500 reached another high last week closing at 2,399.29 last Friday though it wasn’t received with much fanfare. Q1 earnings season so far has delivered good results that have broadly surprised to the upside. With 411 of the benchmark’s current 498 companies thus far having reported results, earnings are up 15.3% on the back of 8.63% revenue growth.

The energy sector has seen earnings turn dramatically positive in the first quarter, rebounding from a string of prior quarterly declines in earnings tied to the dramatic drop in oil from its last peak of $107 bbl. in June of 2014.

The financials sector along with information technology and the Materials sector thus far show double digit growth this earnings season. For details on sector earnings see page 4 of this report.

The week just ended provided numerous “hurdle clearing” moments including: a reiteration of monetary policy by the Fed at its FOMC meeting; a better than expected non-farm payroll number (211,000 jobs added in April); headline unemployment at 4.4% (the lowest since pre-crisis in May of 2007); the postponement of a government shutdown stateside (as Congressional leaders reached a bipartisan agreement to fund the government through September). This weekend added the positive results of the French run-off election.

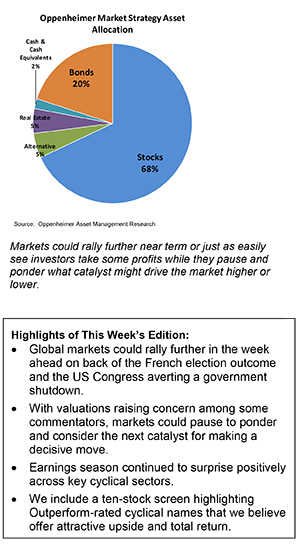

Markets could rally further near term or just as easily see investors take some profits while they pause and ponder what catalyst might drive the market higher or lower.

With so much good news crossing the tape many investors have been concerned about valuations as the S&P 500 and the NASDAQ both reached new record highs on Friday. A wait and see, or an “I’m from Missouri—show me” attitude could develop until earnings show continued improvement in next quarter’s reporting season.

Last week’s economic data while positive on the jobs front was less robust in manufacturing— particularly autos as well as in terms of wage growth.

From our perspective on the radar screen prospects look good for the economy to continue growing modestly (at an annual rate of 2% to 2.5%) and the equity market looks poised to grind higher.

Stateside interest rates remain low but not low enough to worry the Fed about the economy. Oil prices have gotten cheaper due to production and supply even as demand improves with economic growth.

The world economy is showing signs of a recovery and international markets are rebounding. In our opinion things are getting better rather than worse stateside, in Europe and Japan, as well as in the emerging markets including Asia, Europe and parts of Latin America.

US and international multinationals could see business continue to improve as the recovery spreads across the globe. Mid-cap and small-cap companies worldwide could benefit further as domestic economies share in the improvement in a world wherein decoupling of the world’s regional economies from one another remains firmly debunked.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.