Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Patience and Diversification Remain Essential

As earnings season begins, fiscal stimulus remains on hold

Friday’s non-farm payroll at 98,000 (versus a survey estimate calling for 180,000) did not appear to us as an indicator of a reversal of a positive trend but rather a sign of the economy likely nearing full employment while also reflecting the impact of weather which was unseasonably warm in February and cold in March. It also served as a reminder that the monthly jobs number can diverge from trend from time to time. (For illustration see the vertical bars in our chart of the non-farm payroll number on page 3).

The headline unemployment number showed the rate fell to 4.5%—its lowest level in ten years and at a level the Fed was looking for by year end. Even as the jobless rate moved lower from the prior month, average hourly earnings increased just 2.7% yearon- year, in line with its average over the prior 12 months.

Last week, the economy continued to show evidence of sustainable growth even if at a moderate pace. While data showed construction spending eased somewhat along with domestic vehicle sales last month, durable goods orders rose and trade balance figures showed a pickup in US exports.

Q1 reporting season, which unofficially starts this week when the big banks report earnings, is likely to hold investor attention over politics near term.

Earnings, should they surprise to the upside, will add support to current equity market price levels as “vitamin e” (earnings) reduces P/E multiples if just a tad. A good Q1 earnings season would likely provide a platform to justify higher prices for stocks in the months ahead.

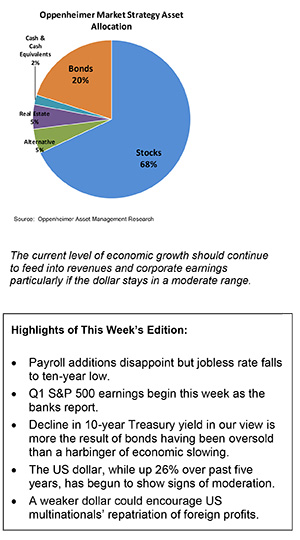

The current level of economic growth (even without the long-touted but too-soon-to-expect tax reform and fiscal stimulus) should continue to feed into revenues and corporate earnings, particularly if the dollar stays in a moderate range.

The dollar has weakened against nine of ten G10 currencies from the start of the year and fallen against 18 of 22 emerging market currencies.

While the dollar (as gauged by the trade-weighted DXY index) stands 26% higher from where it stood in April of 2012, its more recent moderation in upwards trajectory against the aforementioned developed and emerging markets appears to show a tempering of its strength taking place. Such moderation could provide support for US multinationals and even encourage an opportunity to repatriate earnings held abroad should the politicos in Washington finally get around to making a deal favoring repatriation.

Politics in Washington, geopolitics (and terrorist actions just last week in Russia and Sweden) resound loudly and rattle the local and global landscapes but have been met by the markets with considerable resilience and signs of determination. As of last Friday, the S&P 500 stood just 1.7% below its record high reached on March 1st.

The recent rally in the 10-year Treasury note (taking its yield from 2.6% on March 13th to 2.4% last Friday) does not indicate to us that the US economy is slowing as much as it reflects that Treasuries had been somewhat oversold ahead of the March FOMC meeting as well as on earlier expectations for fiscal stimulus that is likely to come later rather than sooner than some market participants are said to have expected.

In commodities, gold’s appeal (up over 8% YTD through Friday) persists among some investors as geopolitical tensions mounted and yields fell. However, in our opinion, gold’s recent glitter could fade as the Federal Reserve’s commitment to the process of interest rate normalization becomes more apparent and defined via action. We expect the Fed will raise rates two more times this year.

Sustainable economic expansion stateside and persistent signs of economic recoveries in foreign developed and emerging economies point to the potential for future upside for global equity prices and further risk for bond prices.

However, even as interest rates rise, we would expect that an apparent perennial appetite for fixed income yield by institutional, sovereign and private investors could cushion the downside in the process so long as central banks are able to normalize interest rates in modest increments and at moderate pace.

Diversification and patience should remain essential for investors to be rewarded. “Know what you own, why you own it and how it might perform under a variety of scenarios” should remain an operative phrase.

In a week bookended by two holidays of religious significance, markets are likely this week to feel the effects of lower volume and reduced information flow barring any unexpected news.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.