Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

No Longer a Honeymoon

But not "burning down the house" either

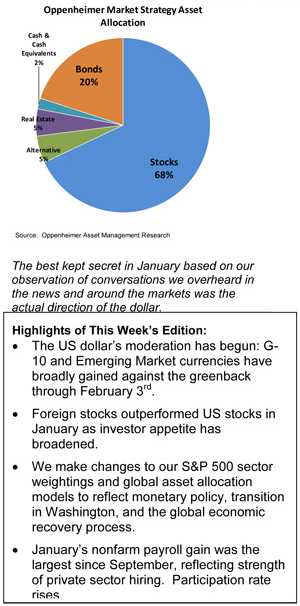

So far in 2017 the market is telling us it likes the transition occurring in Washington as well as the stronger economic data crossing the transom stateside and in the international realm.

January ended with the Fed holding its benchmark rate steady as expected as the US economy continued to show signs of sustainable if not robust activity. The S&P 500, the S&P 400 and the Russell 2000 added 1.8%, 1.6% and 0.35% respectively on the month. The NASDAQ Composite, which is weighted over 40% in technology-related stocks, bested the aforementioned indices—jumping 4.3% on the month as tech gained in popularity with investors.

Foreign stocks outpaced US stocks in January as investors continued to show increased interest in international equities with EAFE (developed markets ex-US and Canada), the MSCI Emerging Markets and the MSCI Frontier Markets respectively gaining 2.9%, 5.5%, and 6.62% on the month.

The yield on the 10-year Treasury ended the month not far from where it had started the year—just 1 basis point higher at 2.45%.

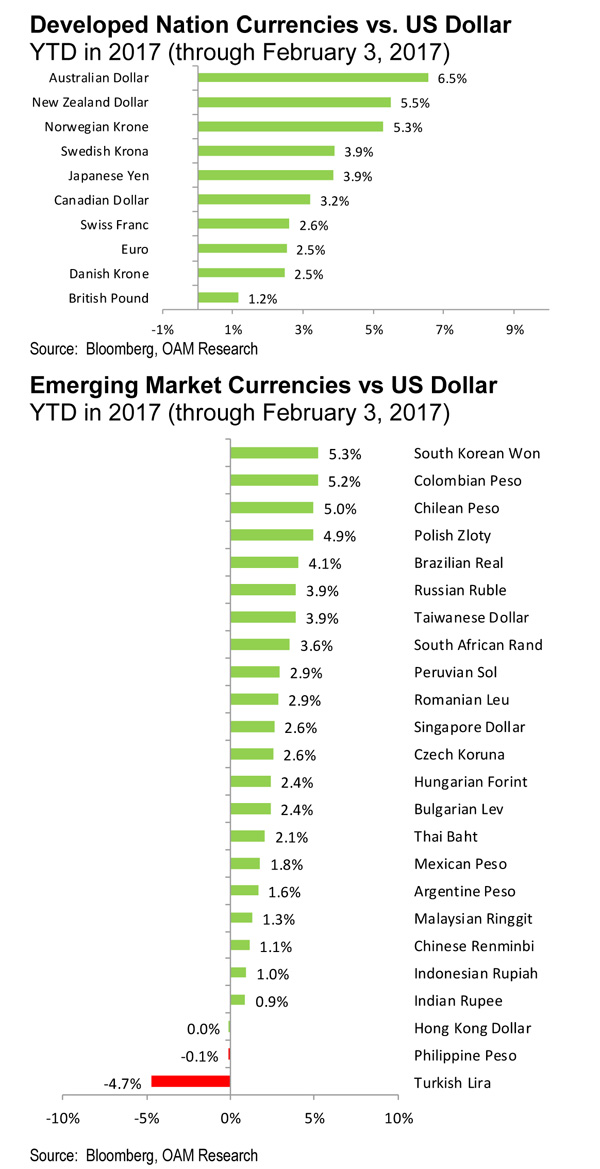

The best kept secret in January based on our observation of conversations we overheard in the news and around the markets was the actual direction of the dollar. While it seemed that most investors and market commentators were talking about risks due to dollar strength, the greenback actually declined in the first month of the year, slipping 3.2% to the end of January as tracked by the DXY index (which pegs the dollar against the currencies of six of the major US trading partners including the EMU, Japan, the UK, and Canada).

On a broader basis, the ten major developed currencies all appreciated against the dollar in January and early February (see top figure at right). In addition, 21 out of 24 emerging market currencies advanced against the greenback as well in the period (see figure at right).

As the calendar page turned the equity markets posted further gains into the first few days of February as the US Labor Department’s non-farm payroll number and the unemployment data showed the economy and the job market to be on a sustainable path for now.

In our conversations with portfolio managers in the UK and on the Continent in the week leading into the last week of January as well as in our conversations stateside last week, we sensed that cautious optimism appeared to remain a central theme with regard to the start of the year rally even as expectation of some type of modest pullback before too long seemed broadly held.

Since the inauguration, concerns about the pace and somewhat abrupt nature of the transition process occurring in D.C. and the beltway seemed to ebb and flow depending on the White House’s “agenda item of the day”.

Stimulus via much-needed infrastructure spending, lower taxes, less regulation and the possibility of repatriation of multinational profits held abroad seem to be gaining acceptance and support while issues around trade, geopolitical risk and immigration continue to serve as points of contention that offer opportunities to test communications between opposing parties. It looks to us like the gridlock that has held Washington hostage for decades might just get forced open.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.