Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

“Moderate” Remains the Operative Word

In a slow-growth environment, right-sizing expectations could augur a pleasant surprise for investors

Traders and investors returning from the Easter holiday stateside are likely to increasingly turn their focus on economic data tied to employment in a week that culminates with the non-farm payroll number on Friday.

Ahead of and concluding with the household survey of employment this week, investors and observers of the economy and the markets will be looking for clues that point to the health of the economy and the sustainability of the current expansion.

They’ll be checking each signpost along the way for what might influence Fed policy when it next meets near the end of April.

This week’s data starts off with trade balance numbers followed by personal income and spending as well as the PCE deflator which the Fed has long indicated it pays particular attention to in considering its inflation outlook.

Housing prices, mortgage applications, the ADP Employment Change number as the week progresses along with regional manufacturing data (the Chicago PMI and the ISM Milwaukee) and the weekly initial jobless claims on Thursday will lead into the main event on Friday which will include job growth in March (non-farm payrolls) and the unemployment numbers (the headline number and the broader U6 unemployment gauge).

A survey of economists looks for a read of 208,000 jobs added in March (down from an unexpectedly high 242,000 jobs in February) and for headline unemployment to remain at 4.9%.

Much hotter numbers than the aforementioned could cause a jump in market volatility with futures as of last week signaling market expectations for the Fed to raise rates near the end of April at around a 6% chance. Fed funds futures as of last week were also pricing in only one 25 bps hike in 2016 with odds of a hike at 60.3% in September and 73.4% by December.

Fed-speak last week from four Federal Reserve regional presidents signaled that at least some influential voices differed in opinion with the markets’ implied view per futures pricing. Comments by those Fed officials last week will likely add to the attention and weight given to this week’s data releases by market forces.

Last week’s Fed-speak from the St. Louis Fed’s James Bullard, Richmond Fed President Jeffrey Lacker, Atlanta Fed President Dennis Lockhart, and the Chicago Federal Reserve’s Charles Evans separately and in aggregate appeared to us to provide the market (unintentionally) the catalyst it seemed to be looking for to justify taking some profits from the recent rally off the table in the near term.

The aforementioned Fed presidents appear to favor the Fed making further upward adjustments to its benchmark rate sooner than the market has been anticipating.

Indeed, stocks gave back some of their gains last week from the rally that began after the market hit a low on February 11th.

Large-, mid-, and small cap stocks pared gains last week with the S&P 500, the S&P 400 (mid-cap) and the Russell 2000 (small caps) shedding 0.67%, 1.11% and 2.01%, respectively, by the market’s holiday-abridged close last Thursday.

Stocks also followed the price of oil and a broad group of other commodities lower last week as the dollar rallied, in large part on the thought that the Fed might find reason to raise its benchmark in the first half of this year as the economy improves.

From our perspective on the Market Radar Screen, we’d consider the last week’s respective “barks” from four outspoken Fed presidents to be worse than the Fed’s “bite” when it next meets.

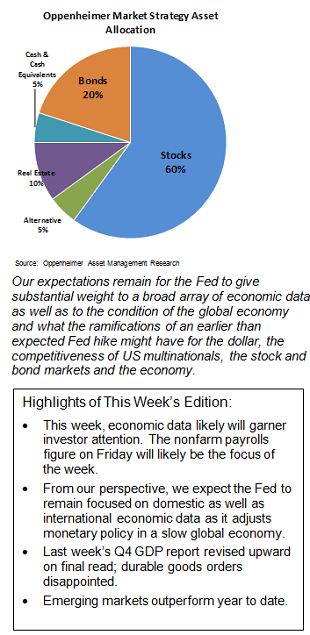

Our expectations remain for the Fed to give substantial weight to a broad array of stateside economic data as well as give consideration to the condition of the global economy and th what the ramifications of an earlier than expected Fed hike might have for the dollar, the competitiveness of US multinationals, the stock and bond markets and the economy.

As a result, we persist in thinking that the Fed will likely delay tweaking its benchmark higher until the second half of the year and then raise the rate only once and by just 0.25%.

From our perspective on the Market Radar Screen, risks to growth at home and abroad remain embedded in the landscape, driven by technology which disrupts employment and wage growth as well as by lower barriers to entry to competition in a myriad of businesses across the globe, from mom and pop operations to multinational enterprises.

In such an environment, central banks are likely to stay on heightened alert for deflationary and disinflationary risks as reflationary efforts continue to be challenged by cyclical and secular trends driven by technology, globalization and demographics which keep a lid on wages, prices of goods, services and commodities—around the world.

In such a landscape, interest rates and growth rates are likely to remain low for longer in a slow-growth environment. In such a scenario, “moderate” (as opposed to “robust”) will likely remain the operative word for the foreseeable future.

Quality dividend-paying stocks, which can provide cyclical exposure for upside potential, could find increased popularity with investors in such environs.

Stay tuned.

For the complete report, please contact your Oppenheimer Financial Advisor.

Potential Conflicts of Interest

Strategic analysts employed by Oppenheimer & Co. Inc. are compensated from revenues generated by the firm. Oppenheimer & Co. Inc. generally prohibits strategists and members of his or her households from executing trades in the securities of a company that is discussed in a strategy report. . Recipients of this report are advised that any or all of the foregoing as well as more specific disclosures set forth below, may at times give rise to potential conflicts of interest.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.