Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

What a Difference a Day Makes

Election Day marked a key turning point for stocks and bonds

With the Thanksgiving holiday behind us traders and investors will return to their turrets and desks looking for “more.”

What they’ll be looking for “more of” will depend on the usual things that markets concern themselves with as well as developments and clues to outcomes centered around just a few key and central factors for the present time which could influence whether there’s further upside for stocks, more downside for bonds or just greater volatility for both with a sideways dance thrown in for good measure.

Pretty much for now until mid-December how 2016 ends will depend much on how the markets sort out and feel about the remaining economic data that crosses the transom in 2016, as well as clues leading to greater clarity around monetary policy that can be derived from “Fedspeak” as well as the goings on around the transition process that’s been under way since the day after election day running between 725 Fifth Avenue and 1600 Pennsylvania Avenue.

From now through December 14th when the Fed’s Open Market Committee (The FOMC) meets, the Fed’s decision will take center stage. The Fed funds futures as of the day after Thanksgiving indicated a 100% chance of a rate hike at the Fed’s December meeting. That’s up from a 93% chance at the start of the year and significantly higher than around a 20% probability it was showing at its low point of the year in late May.

With the stateside economic expansion now showing enough signs of sustainability that even skeptics are convinced the Fed will not back away from a hike in December any decision not to raise its rate could produce a market tantrum.

That said, we do not expect the Fed to disappoint the market on December 14th. We also do not anticipate an increase smaller or larger than what the markets expect and that it will indeed raise by what we and others believe is an easily-digestible 25 bps for the economy and the markets.

The transition of stateside Presidential leadership is not so much an issue for the markets as the process of selecting a cabinet and leadership at governmental agencies. Nonetheless the market will likely continue to show sensitivity, particularly as the candidate selection process works toward appointments and approvals ahead with some positions particularly sensitive for industry sectors. More will be revealed as the process unfolds.

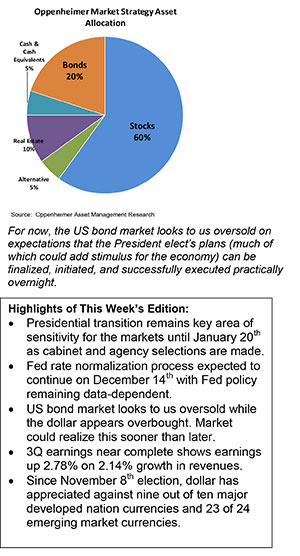

For now, the US bond market looks to us oversold on expectations that the President elect’s plans (much of which could add stimulus for the economy) can be finalized, initiated, and successfully executed practically overnight.

The very magnitude of the agenda is impressive, for it includes among other items:

The scope of the agenda and the market’s projection of its outcome repeatedly leads us to recall the phrase, “Rome wasn’t built in a day” and add to it “no matter how good a discount mechanism markets might be.”

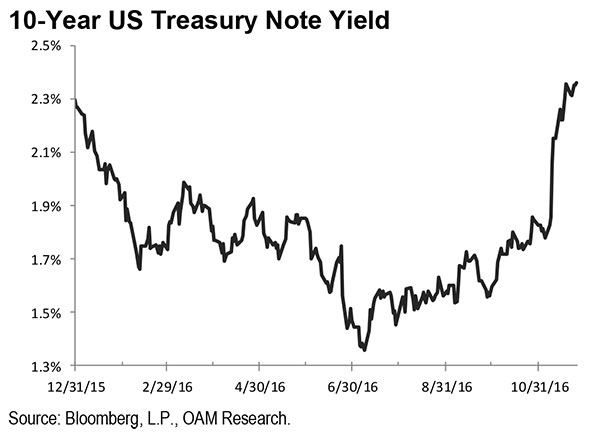

While the drop in bond prices and increase in yields from the lows in July of this year through Friday is quite dramatic we feel it needs to be taken in context from where rates stood at the beginning of the year, to what levels and why they fell, to what caused them to rise to levels that as of last Friday were just slightly above where they had started the year.

The 10-year US Treasury note started the year at 2.27%. Over the course of the seven months that followed the price of the bond surged and the yield fell dramatically to a historic low on July 8th of around 1.3% (see figure below).

What caused that dramatic drop in yield? A variety of things including lower and even negative yields on comparable maturities in Europe and Japan where quantitative easing was in progress. As a result, many foreign investors (individuals as well as institutions) bought US Treasuries for their higher yields, consequently causing our bond prices to rise and yields to move lower.

Events and conditions (Brexit, the Chinese economy, currency “wars”) raised uncertainty about the global economy and further pointed foreign investors as well as some US investors toward US Treasuries for their status as a “safe haven asset.” This also pushed yields lower.

By July 8th the yield on the 10-year Treasury had dropped some 40.2% from 2.27% on January 1st to 1.36%. From there the yield on the note has surged some 73.6% to 2.35% as fears about the outcome of Brexit as well as concerns about the Chinese economy and other geopolitical issues eased somewhat.

Looking at where interest rates were at the start of the year, where they fell to and where they have come from, we suggest that it has not been so much fundamentals that have moved the price and yield of the 10-year Treasury note down and up again as the misinterpretation of fundamentals that while improved (judging by economic data and third-quarter earnings results) remain modest. We believe there has also been an over-projection of the trajectory that yields will follow near term.

For now we “won’t fight the Fed” and expect the rate hike to occur on December 14th, possibly followed by a modest relief rally in bond prices.

We believe the process of interest rate normalization is back on course supported by a sustainable but moderate economic recovery.

That said, we believe that the noise and the drama heard in the markets of late about where rates are headed and how soon they will get there are overdone and are out of touch with the reality of where the stateside economy is today as well as how long the stimulus plans and projects of the new administration will take in getting us “there”.

The stock market’s run up since November 8th has produced a number of new record highs since then. On one day last week four major indices closed at new record highs, besting an earlier rally this year that saw three indexes post records in one day—a so called “trifecta.”

As of Friday the S&P 500, the S&P 400 (midcaps) and the S&P 600 (small caps) were up respectively 3.5%, 8.42% and 13.67% from Election Day.

The S&P 500 closed at 2213.35 on Friday or just under 4% away from our target of 2300 by year end. Even as the days remaining in the trading sessions for the year begin to dwindle we believe the index has a chance of attaining our target. When we initiated the target in December of last year we had said that we thought the level could be achieved from a combination of earnings and multiple expansion (as stock buyers pay more for each dollar of earnings).

So far in 2016 we have seen earnings fall for the first two quarters of the year and rebound in the third quarter with 3Q earnings up 2.78% as of last week.

We have also seen the trailing 12 month P/E (price earnings) multiple of the S&P 500 start the year at 18.7x and fall to a low of 16.7x on February 11th. From that low in February it advanced to a trailing P/E of 20.69x as of last Friday.

As of Friday our target for the S&P 500 of 2300 was closer in sight than it has been all year.

From our perch on the radar screen the risk for the bond market appears greater near term than that for the stock market as the Fed is poised to pursue normalization and a new administration anticipates a program of fiscal stimulus which may well reward stocks further.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.