Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Take It Easy

Don’t let the sound of your own wheels make you crazy

We’re looking for a front-end-loaded week stateside where most if any activity (short of unanticipated surprises negative or positive) in the market happens early rather than later in the week.

It’s a holiday abridged week with markets closed on Thursday Thanksgiving Day and closing early (at 1pm) on Friday.

With more people expected to travel this Thanksgiving in the US than in recent years business people and politicians from Wall Street to Main Street and Capitol Hill are likely to take to the holiday week (outside of the “Bricks and Mortar” crowd who will be busy ahead of Black Friday and cyber Monday) as early as possible to gather with family and friends after a “year to date” that has hurled just about “everything and the kitchen sink” onto the landscape.

A gathering of family and friends, the Thanksgiving Day Parade and a Football game along with a start to holiday shopping should provide some respite over the Thanksgiving holiday weekend—at least until next Monday.

A burst of activity in the markets post-US elections as well as heightened emotional reactions elsewhere by a good number of folks on either side of the political aisle would seem to call for a few days of quiet and pleasant distraction before things pick up for a mad dash to the end of the year ahead of crossing the threshold into the New Year.

The week just ended saw further rotation in stocks as the post-election rally momentum slowed in some sectors on the realization that the outcome of tax cuts, infrastructure spend and less regulation aren’t about to happen overnight and will take quite some time to have effect even after they are implemented (notwithstanding execution risk).

The day to day news items on the ongoing selection process of cabinet members and other appointments in the new administration underscored the fact that “Rome wasn’t built in a day.”

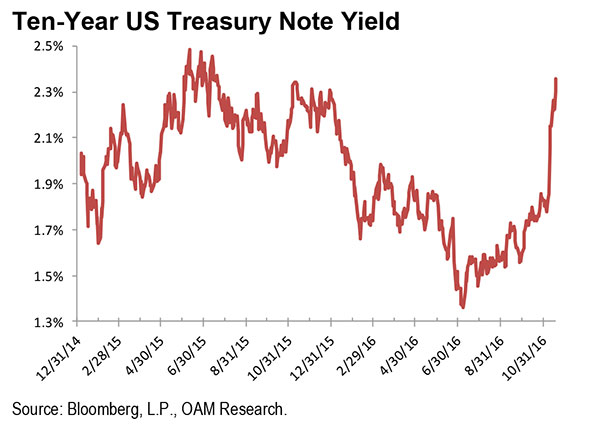

The bond market’s drubbing persisted through last week with the 10-year treasury yield ending last week at 2.36%, its highest level since the summer of 2015 (see figure below).

The run up in yields came on the back of the market’s anticipation of the effects of fiscal stimulus programs that ironically are still on the drawing boards, and still “a twinkle in the eyes” of their likely progenitors while months if not years

from having the opportunity to attempt to produce their intended effect on the economy.

To those who might be unfamiliar with the bourses and their sometimes “knee jerk machinations,” we say, “welcome to the markets”.

Last week’s rotative process amongst the sectors of the S&P 500 saw some momentum leaving materials, industrials, health care and financial stocks (which had starred in the days immediately following the election). We saw no ominous or big

sell off in those respective spaces mind you, but rather a loss of momentum near term as money flowed back into technology, which had been somewhat ignored and fretted about post the Trump victory.

Perhaps denizens of Silicon Valley had worried some about their lack of support during the campaign for the winning team though perhaps they were at first too modest in recognizing how much the President elect depended on and valued the assorted tech tools that helped the Trump campaign “win the day”—and we’d add at significantly less cost to the campaign coffers than his opponent’s more traditional media-rooted campaign.

We expect that in the days ahead the bond market may experience a rally should it care to recognize that reflation at this early stage of what appears to be ahead will not begat “some kind of wicked” inflation as central banks worldwide (not

just stateside) stay vigilant against both deflation and inflation and as technology and globalization remain not just entrenched but deeply embedded in business and in the lives of global consumers.

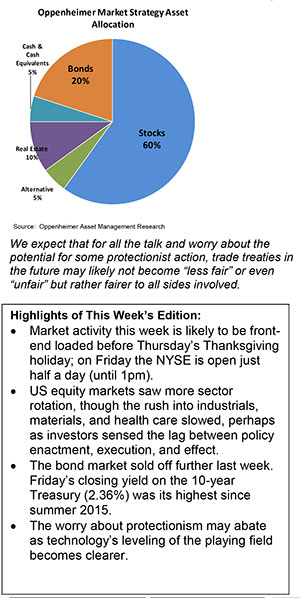

We expect that for all the talk and worry about the potential for some protectionist action, trade treaties in the future may likely not become “less fair” or even “unfair” but rather fairer to all sides involved. This is particularly probable in a world in which technology has leveled the competitive playing field to such a degree that an emerging market player can readily compete

with long-established, century-old developed market multinationals.

In a world in which outsourcing and reshoring of capacity can happen at near lightning speed countries may find that the benefit of trade treaties lies in a mutually fair, globally-improved competitive landscape rather than in outdated treaties that barter promises of prosperity in exchange for foreign intervention and power and influence over domestic issues.

Stay tuned, and Happy Thanksgiving!

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.