Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Got to pay your dues if you wanna sing the blues

Even as the market had grown confident about the election result, trouble appeared on the horizon…

First the good news….

Third-quarter GDP came in better than expected last week at 2.9% versus expectations for 2.6% in a prerelease Bloomberg survey of economists. The annualized increase was the best in two years and nicely up from 1.4% growth in Q2 and 0.8% growth in the first quarter of the year.

A buildup in inventories and rise in exports tied to agriculture (soybeans) were among the positives that offset softer stateside household spending in the quarter and a fourth consecutive decline in corporate investment in equipment.

Consumer spending, which represents the largest percentage of the US economy (around 69%) came in under expectations rising about 2.1% in the period, or about half as much as it had grown in the prior quarter. The decline in corporate investment in equipment (the fourth in four quarters) marks the longest period of decline since the economic expansion began.

The combination of softer consumer spending, the decline in corporate investment combined with a recently resurgent dollar (on the back of Brexit and expectations that the greenback will gain in popularity among foreigners as the Fed works to normalize interest rates) fed into skepticism about the improvement in the GDP number pushing not a few pundits, observers and investors to project that Q3’s attractive 2.9% growth rate would unlikely be sustained.

However, from our perspective, we think best to wait for the next reading on Q3 growth which will include the results of the earnings season for the period which is still in progress. With some 58% of S&P 500 companies having reported thus far through the end of last week, earnings and revenues have been broadly better than expected at the beginning of the earnings season (see page 4 of this report for our current earnings scorecard).

For now, we’ll accept that risks to growth persist via the aforementioned challenges as well as others but remain prone to not looking a gift horse in the mouth. We’ll readily accept good economic news for what it is.

Progress not perfection has been a hallmark of the economic and market recovery that brought us to the current economic expansion which based on current data looks sustainable if “just too moderate” for the less impatient.

Last Friday stocks moved lower adding to weakness that had moved stocks lower from last Tuesday.

News last Friday posing new risk to what had been taken by many as the market’s expectation of a Democratic victory in the Presidential election on November 8th raised concerns among traders that fed stock price weakness as news that the FBI was reopening its Clinton email probe crossed the tape on Friday afternoon.

While the news (which seemed to spread in a digital global moment) may wind up having less or even perhaps more impact on the election outcome than the markets and observers were intimating on Friday, the VIX reflected an increase in uncertainty that impacted stock prices for the day.

The slip in stock prices which began on Tuesday took stocks down 1.2% from last Monday’s close through the close on Friday.

Investors will start the week focused on the Presidential election as Election Day a week from Tuesday bears down on the landscape.

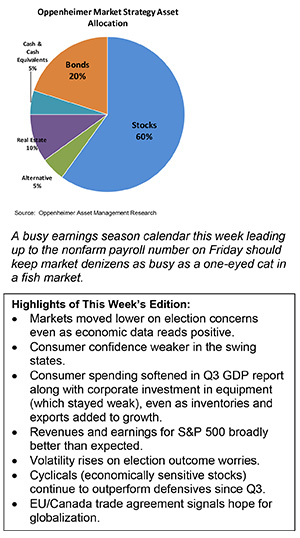

That notwithstanding, a busy earnings season calendar this week leading up to the nonfarm payroll number on Friday should keep market denizens as busy as a one eyed cat in a fish market.

On Sunday as we went to press Canada’s Prime Minister Justin Trudeau signed a free-trade pact with the European Union as earlier objections from a small region in Belgium that had threatened the agreement were resolved. The agreement which has been in negotiation since 2009 will reportedly reduce tariffs for EU manufacturers by just under $550 million and boost trade between the two markets.

The pact is expected to increase the EU’s economic output by about 12 billion euros a year and expand EU-Canada trade by upwards of 25%.

The agreement will end 98% of tariffs on goods traded from the start and 99% of tariffs by the seventh year. Each side will dismantle all industrial tariffs and more than 90% of agricultural duties.

The agreement comes at a time when globalization has come in question and is under pressure on the back of rising populism, trending nationalism and concerns about economic inequality around the world.

The signing of the agreement on Sunday provides hope that globalization will be able to weather and surpass the current headwinds it currently faces.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.