Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Git Along Little Dogies

It was round-up time at the Fed’s conference in Jackson Hole, Wyoming

With Jackson Hole in the rear-view mirror, the second quarter almost over, and the Labor Day long weekend holiday just days ahead, investors will likely keep focus on Friday’s non-farm payroll number, looking for a clue as to when the Fed might raise or not raise its benchmark rate.

This year the Kansas City Fed’s meeting in Jackson Hole reminded us that there still are a large number of investors and market observers who don’t believe that the Janet Yellen-Bernanke-legacy Fed means what it says and says what it means..

After nearly eight years of a Fed-driven economic recovery process that’s led to a stateside economic expansion, we find that among Fed watchers the doubters of the Fed’s ability to communicate, maneuver, and manage the normalization process remain doubters. On the other hand, the believers in the Fed’s capabilities (based on the amount of success the Fed has had from the depths of the crisis through today) remain believers.

From our perspective on the radar screen the Fed’s message has remained pretty consistent all along─essentially that it will raise its benchmark rate again when it feels that the time is appropriate for the economy and the decision will be data-driven.

From what we’ve observed we expect the Fed will consider a host of factors before taking action, including the relative strength of the dollar to foreign currencies, the progress in job creation, the pace of wage gains, and evidence of a level of reflation that would justify raising rates.

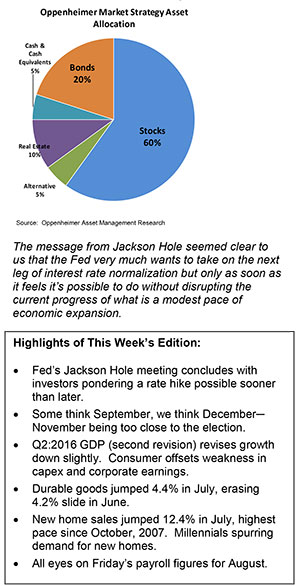

The message from Jackson Hole seemed clear to us: that the Fed very much wants to take on the next leg of interest rate normalization but only as soon as it feels it’s possible to do so without disrupting the current progress of what is a modest pace of economic expansion.

The fact that Fedspeak has been somewhat mixed of late is not surprising to us. It’s been the style of the Yellen Fed to have the more hawkish voices from among the Fed leadership speak out ahead of key meetings followed by less hawkish or even dovish comments by the Fed chair.

In effect, the chair’s comments in previous periods of Fedspeak have helped round out the sharper edges of hawkish Fedspeak voices from Regional Fed bank presidents.

Last Monday the Fed fund futures showed a 24% chance of a Fed hike in September, as well as a 30.5% chance of a Fed hike in November and a 51% chance of a Fed hike in December. By Friday after the Fed chair and others had spoken in Jackson Hole, the chances of a Fed hike for those same FOMC meeting dates had jumped respectively to: 42%, 47% and 64.7%.

Ironically, for all the steepness in the increased chances of a hike as measured by the Fed funds futures, the chances for a hike on those same dates stood substantially higher on the first day of 2015 at 86.5%, 89.4% and 93.3%.

Around the start of the year Fed Vice-Chair Stanley Fischer had said he was looking for four hikes by the Fed in 2016.

Now, well past the half-way mark of the year, it looks as if the data had other plans for the Fed. As of last week Mr. Fischer spoke of the possibility of two hikes before this year ends.

We continue to expect the Fed to raise once this year, in December, but not as early as September, nor in November ahead of the election. (We recall that the Fed ignored calls from outside the Fed to raise rates ahead of the UK’s Brexit vote, and we expect it to follow suit with the presidential election stateside.)

For now we’d think last week’s second-quarter GDP number (revised lower from 1.2% to 1.1%), mixed home sales data last week (a 12.4% jump in new home sales contrasted with a m-o-m 3.2% drop in existing home sales m-o-m), along with data in the GDP revision that showed strength from the consumer (consumer spending revised upward to an annual 4.4% rate) offset by continued weakness in corporate investment and corporate profits, will suffice to keep the Fed watchful but on hold in September.

With expectations for the non-farm payroll jobs report this week to show a gain of 180,000 jobs in August (down from 217,000 last month), a disappointment could turn expectations for two hikes this year down pretty quick. A large upside surprise, on the other hand, could raise market expectations for a Fed hike sooner than later. Ultimately we expect that the economic data crossing the transom in aggregate this week to show a continuation of growth in sufficient moderation to justify one rate hike from the Fed this year─in December.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.