Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Yippie Yi Yo Ki Yay

All eyes on the Fed as officials meet in the Wild West

All eyes (and ears too) are trained this week on Jackson Hole, Wyoming as policy makers, ministers of finance from around the world along with business leaders, “masters of the universe,” economists, academics and the press corps gather at a mountain resort for three days to talk about the world economy in a comparatively relaxed setting.

The event is part of a series of conferences held by the Fed’s 12 regional banks around the country during the course of the year.

The annual event in Jackson Hole is the Federal Reserve of Kansas City’s annual “Economic Symposium.” Over the years it has gained importance as a highly visible assemblage of movers and shakers from around the country and around the world meet off the beaten path in a special setting of nature.

Attendance to the conference is by invitation only. The conference has served and gained respect as an important sounding board for ideas over the years.

Among the denizens of the economic and market persuasion Jackson Hole is considered by many to be the stateside equivalent of the event hosted by the World Economic Forum in Davos, Switzerland each year.

The theme of this year’s event in Jackson Hole (apropos central bankers’ current agenda to rekindle economic growth, employment and wage growth) is “Re-Evaluating Labor Market Dynamics.”

Fed Chair Janet Yellen will deliver this year’s opening speech on Friday (August 26th). European Central Bank President Mario Draghi will speak at lunch.

Market participants around the world will be watching televised events and interviews of attendees from the conference for any clues on monetary policy that might signal when and if the Fed might raise rates next. The market’s reaction on remarks and speeches from the conference will be tracked live by the media and by some investors like a medical technician tracks a patient’s electrocardiogram (an EKG).

While stateside economic data is showing signs that the current economic expansion is sustainable, opinion remains somewhat mixed as to when and if the Fed will raise its benchmark rate this year as economic and job growth remain overall modest rather than robust.

Over the course of the last week members of the Federal Reserve including New York Fed President William Dudley and San Francisco Fed President John Williams have made comments and expressed their respective opinions as to how soon the Fed should begin raising rates.

The San Francisco Fed’s John Williams said on Thursday that the economy is strong enough to warrant an increase in interest rates and expressed concern that if the Fed waits too long, unwanted levels of inflation and asset bubbles could hurt growth.

New York Fed President William Dudley said last Thursday that he felt the time for another interest rate hike by the Fed “is getting closer.” He also said that he expected second-half GDP would be stronger than the 1% annual rate experienced in the first half of the year and “should be more than 2%.”

On Sunday Vice Chairman Stanley Fisher said in a speech in Colorado that he expected “GDP growth to pick up in coming quarters, as investment recovers from a surprisingly weak patch and the drag from past dollar appreciation diminishes.” Speaking about employment Mr. Fisher said it has been “remarkably resilient.” He rated GDP growth so far this year as “mediocre at best.”

Last week’s Fedspeak from such senior officials reminds us of previous Fed leadership comments this year and last year. From our perspective an increase in hawkish tone is the Fed reminding the markets that even though it has not yet seen reason for raising rates yet this year, the process of normalization is on. The effect of such comments can serve as a dampener on animal spirits that might emanate from the market as US equities hit new record highs. To us such commentary as we heard last week from Fed officials serves as a message to the markets to “curb your enthusiasm” and avoid any outbreak of irrational exuberance.

From our perch on the market radar screen we are not expecting much real drama to come from the Jackson Hole conference but rather expect a reiteration and continuation of the policy and sensitivity the Fed has utilized and shown over the last seven and a half years in guiding the US economy from crisis to recovery into the current expansion.

We do expect that the interaction among monetary policy makers and other luminaries over the course of the Jackson Hole conference (particularly the dialogue between US and foreign officials) will provide significant and valuable color about the world’s regional economies and the efforts to rekindle economic growth and stave off deflationary pressures.

Look for the effects (current and projected) of robotics, algorithms, big data, the cloud, artificial intelligence and virtual reality as well as more traditional factors as globalization, nationalism and populism to be a central part of the conversational mix.

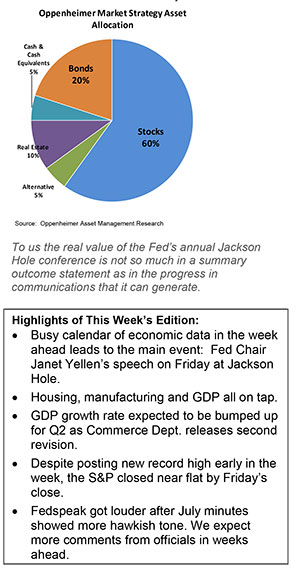

To us the real value of the Fed’s annual Jackson Hole conference is not so much in a summary outcome statement as in the progress in communications that it can generate.

Look for the markets to surf the news flow and direction of opinions ahead of Janet Yellen’s speech on Friday while keeping a closer eye on economic data and corporate news items until the latter part of the week.

The juxtaposition of last week’s release of July’s FOMC minutes, which showed a split among officials, and the subsequent Fedspeak in the days that followed tells us that the Fed’s decision on a rate hike for now remains a work in progress.

We continue to expect that the Fed will raise its benchmark rate by 25 bps in December. We expect that the hike will be digestible and perhaps even well received by the markets when it happens. For many investors it will serve as confirmation by the Fed that things are getting better. For those who worry that the Fed has fallen behind the curve, it will provide some action to soothe their worries.

The general perception that the economy is doing better if not great and that job growth and wages are in similar stead leads us to expect the process of interest rate normalization will resume, if at a pace slower than many would expect.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.