Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Hooked on a Feeling

Markets found a catalyst for profit taking in last week’s headlines

The market found its catalyst last week and took it. Stocks around the world gave up some of their record and near record gains on back of a spike in geopolitical tensions centered around an escalation of threats against the US from North Korea, a few disappointing earnings season results among some stateside household names in the consumer discretionary sector, and continued concerns about the pace of stateside economic expansion as the Consumer Price Index pointed to a continuation of reflationary softness rather than a level of inflation that might provide a compelling reason for the Fed to hike rates another time before the end of the year.

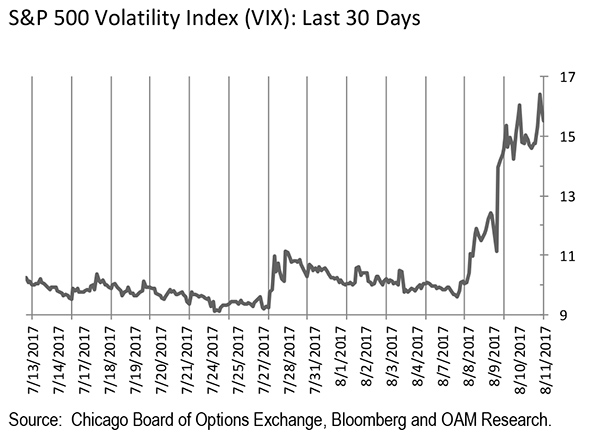

Intensified geopolitical risk goosed the VIX (a gauge of market volatility) last week, causing it to jump 61.5% from Tuesday through Thursday’s market close with the index reaching its highest level since November 8th (Election Day) last year. On Friday as traders regained their composure and stocks rallied, the VIX edged lower but remained at an elevated level relative to the near-historical lows where it has traded most of this year. For the week, the VIX advanced 54.6%, reminding investors of the adage that one is supposed to buy household insurance before there’s a fire in the kitchen (see figure on next page).

Stocks reflected last week’s drama in a manner that suggested the market had found the catalyst it had been looking for to justify at least some profit taking after this year’s remarkable run-up in the price of the major stock indices on back of improving fundamentals.

On the week, the Dow Industrial Average, the S&P 500, the S&P 400 (mid-caps) and the Russell 2000 (small caps) closed respectively lower by 1.06%, 2.31%, 2.7%, and 1.5%. We’d note that those same indices after last week’s selling were up respectively on a year to date basis by the following: 10.6%, 9.04%, 3.04%, 1.26% and 16.23%. The performance particularly of the large-cap indices leads us to believe that last week’s action was more investors taking advantage of news that justified some profit taking, rotation and rebalancing rather than a market rout or harbinger of worse things to come.

“…while markets may be rattled by spikes in tensions between nations and even war, the unsettling periods for the bourses around these occurrences tend to be short in duration and with fleeting effect.”

The bond market rallied on the jump in nervousness last week. The yield on the 10-year Treasury moved lower in the course of the week from 2.26% to 2.19% by Friday afternoon.

Gold last week rose 2.43% on investor appetite for some safe haven exposure. The precious metal moved from $1,258.77 to $1,289.35 from Friday to Friday.

Comparisons made by many sources in the financial media and among market commentators and participants regarding the current geopolitical condition versus other periods in history when geopolitical tension became elevated (including the Cuban Missile Crisis in 1962 and the Gulf War in 1990) helped remind investors that while markets may be rattled by spikes in tensions between nations and even war, the unsettling periods for the bourses around these occurrences tend to be short in duration and with fleeting effect.

The markets look to economic, revenue and earnings growth as key to what course they will take. As Mark Twain is credited with having said, “History may not repeat itself but it often rhymes.”

In the week ahead, investors are likely to focus on the companies that remain to report in the current S&P 500 earnings season, economic data including the July retail sales numbers, the NY Federal Reserve’s Empire State Manufacturing report, along with data on housing.

On the regional front, NAFTA negotiations begin in Washington on Wednesday with the US, Canada and Mexico looking to renegotiate terms of the treaty.

Should the negotiations that are getting underway lead to the modernization of the original NAFTA agreement to take into account a myriad of changes wrought by globalization and technology on labor, business and governments in this region of the world, a more equitable and economically efficient agreement could emerge.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.