Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Happy Birthday, USA!

Investors stateside seemed surprised to learn that US equities made gains in H1:2016

Two-hundred-forty years into the process of an adventure in human relationships, cooperation, negotiation and creativity, the nation is still vibrant and growing. Long may it thrive!

We find ourselves on the road across the pond this stateside holiday-abbreviated week, leaders, corporate spokespeople, policy experts as well as denizens of the markets around the world about the risks of a pro-Brexit vote, visiting with professional investors in meetings in the UK and on the Continent to discuss the issues of the day and review the global economy and investment landscape.

A key item on our agenda is to find what folks are thinking about the Brexit vote result and how they perceive it will impact the region and the markets.

Even though it’s too early to tell how the process of Brexit (Britain’s exit from the European Union) will unfold, the complexity of what lies ahead to be dealt with politically, structurally and economically is likely to be historically significant if not daunting. In the process ahead participants will learn what it is like to unwind a social and economic treaty of magnitude and tenure such as that of the UK’s membership in the EU.

We are reminded that in considering what might lie ahead history tells us that at the core of its existence, humanity’s role is to deal with the problems at hand.

Among the challenges people have faced in history there has seldom been a way around the greatest problems but usually there is a way to get through them.

As investors we have been taught by experience that it’s in this process where the risks as well as the opportunities lie.

Looking at the month and the first half of the year just ended, investors’ patience—particularly stateside—was rewarded when markets rebounded from a downdraft at the start of the year and again after a reaction to the outcome of the British referendum that resulted in a vote for the UK to exit its more than 40-year membership in the EU (European Union).

Sensing a degree of irony we were reminded by the global markets’ reaction to the Brexit vote outcome that no country is an island in a globalized and highly digitalized world—even if geography points to the contrary.

As June neared a close global markets were roiled, and once again we recalled the Great Crisis of 2008, when the concept of regional de-coupling was debunked, as illustrated by trillions of dollars in market capitalization losses across the globe after the UK’s vote to Brexit the EU.

We think it’s important for investors to realize that market declines in the pricing of asset classes during such pullbacks are often experienced and limited as “paper” or “screen” losses as they are left unrealized by investors even though loudly bemoaned and lamented.

The rebound that followed the recent attentiongrabbing drop in equity prices around the world has given us reason to believe that the bark of the catalyst that caused the decline may indeed be worse than its bite.

With the first half of the year now complete, it’s clear to us that equity markets showed significant resilience through a particularly nasty seven-week stretch at the start of the year that was followed by a sizable rally (Feb. 11-April 20) that took markets to near new highs and then was tested via Brexit (June 23-27), which itself was followed by the rally from June 27th through last Friday’s close.

We expect that a testing of the rally is not unlikely as short-term investors look for a catalyst to justify some profit-taking at these market levels.

There had been enough market turbulence in the first half 2016 that we found some investors in meetings last week on the West Coast stateside who were pleasantly surprised when we showed them how well stocks had fared in the first half of 2016.

Stocks tracked by the S&P 500 (large-caps), the S&P 400 (mid-caps) and the S&P 600 (smallcaps) indices had respectively advanced 2.7%, 7.0% and 5.5% in the first half of 2016, and performed even better on a total return basis (with dividends re-invested), respectively producing returns of 3.8%, 7.9% and 6.2% in the period.

(Return calculations exclude applicable costs, including interest and commissions.)

Investors we spoke with were also surprised to hear that internationally emerging markets as tracked by the MSCI Emerging Markets index had advanced 5.03% in the first half of the year (and by 6.52% with dividends reinvested).

International developed markets (ex-US and Canada) as tracked by MSCI EAFE didn’t fare as well; the EAFE index experienced declines as Europe and Japan’s respective economic recoveries came under pressure and as a number of benchmark yields in those regions moved to near record lows—including some negative interest rates. The MSCI EAFE declined 6.3% (to produce a -4.04% total return with dividends reinvested) in the first half of the year.

All in all as tough as things had seemed at times while slogging through the first half of the year, stocks overall managed to show considerable resilience.

Economic data, though often mixed in the first half of the year, overall continued to show evidence of a sustainable stateside economic recovery as the consumer, who drives 70% of the US economy, benefited from continuing job growth, improvement in the housing sector, strength in auto sales and manufacturing (likely aided by the dollar’s easing off last year’s levels).

With the Fed’s dovish tone overtaking earlier hawkish observations by some of its members, lower interest rates for longer than were expected just a few months ago by Fed watchers are likely to provide further wind under consumers’ wings.

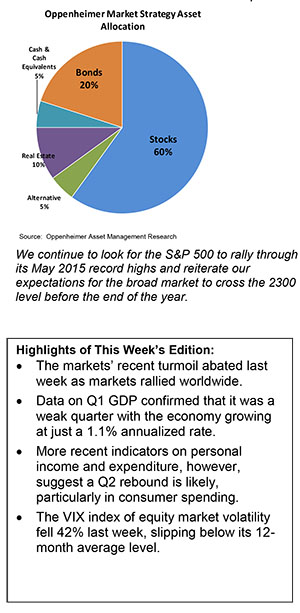

We continue to look for the S&P 500 to rally through its May 2015 record highs and reiterate our expectations for the broad market to cross the 2300 level before the end of the year.

We look for the dollar’s recent resurgence as a safe haven post the Brexit vote to moderate as UK and EU officials work to find a resolution in what will likely be a lengthier, more complex process of exiting than voters emerging from the polls on June 23rd might ever have expected.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.