Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Brexit vote likely to bring relief to markets

Europe and UK stocks are likely to benefit from a “Bremain” vote

With all the time and worry spent over the course of the last few weeks in and around the markets over the potential of a Brexit (the UK leaving the EU), historical parallels to other singular concerns in our opinion abound to help assuage anxiety ahead of this Thursday’s vote in the UK.

For those who were around a little more than 16 years ago, there was Y2K risk when concern peaked around prospects of a global computer crisis that had the potential to occur when the calendar on millions of computers around the world tried to turn from 1999 to 2000. A global computer meltdown was averted. Planes didn’t fall from the sky, electronic grids did not grow dark and a New Year turned the calendar page uneventfully.

More recently there was:

None of the aforementioned hurdles of concern and angst came to pass in a form that came near to sinking the markets, ending the world as we knew it, or negatively impacting the future of humanity as the darkest projections seemed to indicate in the day.

In hindsight the respective concerns raised ahead of the aforementioned events (or nonevents as they turned out to be) served at least in part to vet issues ahead of a crisis, mustered preparations in case the negative outcomes projected were realized and ultimately left markets and society intact and in good enough condition to move on unencumbered by what had been so feared to face whatever crisis perceived or otherwise lay around the corner waiting.

The potential impact of Great Britain’s upcoming referendum certainly carries the risk of what is commonly referred to as Brexit (the term refers to the possibility that Britain will withdraw from the European Union), but it also carries the potential for Bremain (the term chosen to define the likelihood that Britain will decide to remain in the EU).

The referendum in the UK comes to a vote this week, Thursday, June 23

The tragic death and senseless murder of Labour Party lawmaker Jo Cox (a proponent of Britain’s remaining in the EU) ironically may have served to jolt voters who were undecided or even leaning toward Brexit to consider the value of thoughtful consideration before jumping to conclusions and pulling the voting lever later this week on Thursday.

Over the weekend Bloomberg news reported:

Bloomberg went on to report, ”The probability of a vote to leave declined to just under 30 percent on Sunday from almost 40 percent on Wednesday, according to bookmaker odds processed by the Oddschecker website. It’s the biggest drop in almost two weeks.”

Now, after a short moratorium to show respect for the murdered MP, the argument for and against Brexit resumes and heads into the homestretch in the UK.

As we enter the week leading up to the vote in the UK on Thursday, we consider the risks of Brexit as outlined by proponents of the vote to remain in the EU. Among the risks which have gained our attention and raised our concern are:

Some risk would be tempered by the mechanism of a Brexit which would likely take some two years to effect in totality, but markets are known to be discounting mechanisms with a view to the future.

Should the results of the vote call for the UK to remain a part of the EU, the effect of the status quo remaining in place should augur well for the regional economies and the markets.

While the global markets as distant as Asia and the US have experienced resonance of the effects of Brexit risk, we would expect the UK and European Union bourses to rally the most from a Bremain vote on Thursday.

Year to date the UK’s Footsie 100 Index and the Stoxx Euro 600 are off 3.54% and 10.9% respectively in local terms. Translated in US dollars the UK’s Footsie 100 is off 6.3% while the Stocks Euro 600 is off 7.7% reflecting recent respective weakness and strengths of those currencies against the dollar.

A vote to exit EU will likely result in a further drop in the British pound against the dollar and some weakness in the euro versus the dollar on increased 3 growth concerns tied to the likely effects on trade to follow within the regions.

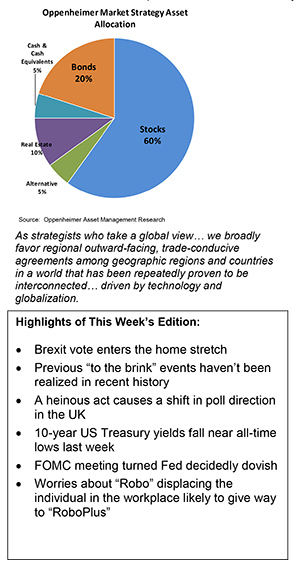

As strategists who take a global view to economics and the markets, we broadly favor regional outward-facing, trade-conducive agreements among geographic regions and specific countries in a world that has been repeatedly proven to be interconnected and driven by technology and globalization.

We do not believe that isolationist, protectionist and separatist policies are good for the markets, corporate interests, shareholders, workers, small business owners, entrepreneurs, governmental entities and the broad citizenry of the world.

History reminds us of the costs of isolationism and protectionism, particularly when giving consideration to the causes of the great depression that emerged in the 1930’s.

We are believers that multilateral trade agreements—even if not easy to produce or execute—are the most practical solutions to addressing the needs and challenges which emanate from a digitalized and globalized world landscape in which competition is often both a boon and a challenge. We also find that trade agreements can serve prospects for peace and cooperation among diverse nations.

In a world in which the genies of globalization and technology have decidedly emerged from the bottle, we believe that it is essential to remember that once the genie is out of the bottle, it never goes back in. As strategists we feel that thinking to the contrary of that fact is a costly exercise in denial and futility.

Stateside last week

As US markets reflected on last week’s more dovish than expected outcome to the FOMC meeting as well as on concerns of a potential Brexit across the pond, the yield on the 10-year Treasury note dropped as low as 1.52% intraday last Thursday before ending the week Friday at 1.61%.

Expectations of a Fed rate hike in July dropped to 6% last week with expectations of a hike after the next three meetings this year (September, November and December) falling to 19.2%, 22.6% and 37.9% respectively.

We still expect the Fed to raise once this year, most likely in December, and then no more than 0.25 bps. That said, we expect the Fed to remain data dependent, leaving the door open to further adjustments up or down as warranted by growth in the months ahead.

For now, still too modest wage growth to reflate the US economy enough to consistently beat targets, signs that the economy may be reaching full employment stateside for this cycle (considering last month’s jobs data) and the risks to growth outside the US support our view that normalization remains intact but at a slow and cautious pace.

Mothers of Invention—gaming the new technology

Major challenges on the economic landscape coming from advancements in technology, globalization and demographics are causing significant disruptions in businesses, the workplace and in society that are reflected in the markets, in business decisions, consumer preferences and on the political scene.

As disconcerting as the effects of technology are via robotics on the factory floor, algorithms in the offices and lower barriers for entry to competition in business, such disruption is not uncommon in the history of the world whenever major changes in innovation arrive on the scene.

Since the cave dweller invented the wheel humans have had to adapt to changes brought on by innovation. Initial disruption and dislocation driven by invention have historically over the course of time given in to adaptation and gaming of the new technology in the workplace that has benefited humanity in a myriad of ways.

From the printing press to the grain harvester to the electric lightbulb, the automobile, the PC to the laptop to the pad and the cloud, human beings have had to learn to game the new technology, harness its power and find ways to prosper from it. For all the dark projections of what the latest waves of technology will do to the workplace, the likelihood based on historical precedent is that the outcome will be positive for society.

We recall that the buggy whip maker and the blacksmith were displaced by the automobile and 4 the auto mechanic early in the last century. The elevator operator in the skyscrapers in the 1900s had to find new work when the elevator was automated.

We don’t think of this as a “let them eat cake” moment in history but rather as a practical progression that follows dramatic innovation.

Food for thought

A large part of the success experienced by Steve Jobs in the latter portion of his life was in matching cutting-edge technology for the consumer with customer service empowered by humans on the sales floor of a bricks-and-mortar store. His vision for the popular Apple Store and the creative execution of it pushed his competition to the sidelines and even out of business while boosting his company’s profits to levels his competitors could only dream of.

In today’s environment worries about how Robo will displace the individual in the workplace are likely to be overcome by RoboPlus as humanity learns once again to distinguish itself by gaming or harnessing the latest technology to its benefit and monetary gain.

Stay tuned.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.