Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Don't Rock The Boat, Baby

Followers of the latest "trend of the day" often get whipsawed mid-trend

In our market strategy commentary last week we noted the risk investors take on when they choose to chase the latest short-term trend, which we termed “running from one side of the boat to the other.”

Too often this year investors have got caught up in the chase only to find that once they “get to the other side,” the early adaptors of whatever the trend happened to be had turned tail and headed back to the other side of the boat. The late arrivals then found themselves dispirited and anxious from wasting their time and money chasing the flavor of the day trend in the market.

From our perch on the market radar screen we’ve seen the herd mentality run from one crowded trade to the next several times already this year attached to:

At the start of the year the “flavor of the day” crowded trade (just before the dollar declined) was to anticipate the dollar trending higher only to watch the buck fall a little over 7% against a broad array of currencies (including nine of the ten G-10 currencies as well as against some 20 or so emerging currencies) from the end of January through the beginning of May.

As the dollar weakened, late arrivals to the trade crowded on deck into the weak dollar trade only to get caught in the crosshairs of a strengthening in the dollar that began at the start of May as economic data and Fed speak suggested with growing emphasis that higher rates were likely to come sooner, with the Fed likely to raise its benchmark rates by July if not at its June meeting.

By the end of May, the dollar (as tracked by the DXY index) had rallied a little over three and a half percent only to inspire “crowd think” to anticipate further gains in the dollar just as the dollar reversed direction, falling nearly 2% through last Friday (see graph on next page).

The majority of the dollar’s most recent decline came last Friday after the non-farm payroll number crossed the tape. What had beenthe trade of “the Fed’ll raise rates sooner than later to keep the economy from running too hot,” faded fast as trend chasers found themselves once again on the wrong side of the boat.

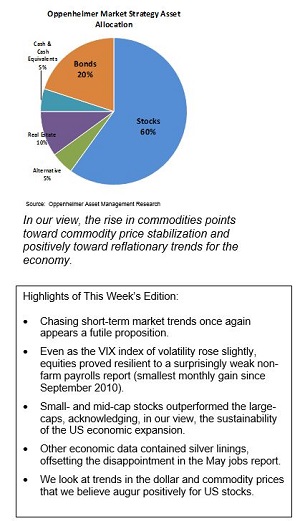

For now we’ll stick with commitment and patience to the idea that the economy will continue to expand at a sustainable rate (if too modest a pace) and that equities for now will remain the most attractive asset class for investors to consider when seeking vehicles to meet their mid-term and longer term investment goals and objectives.

Strategic musings on last week’s action

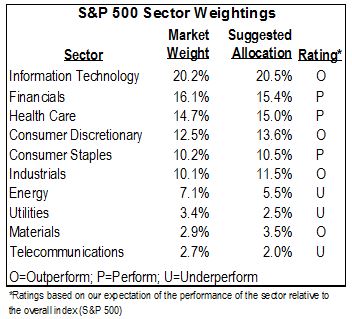

What most stood out to us in the miss of May’s nonfarm payroll number released last Friday wasn’t as much as the size of the miss (at 38,000 versus expectations of 160,000 jobs) but the resilience of the market in digesting the disappointment and subsequent concerns that morning and as the day unfolded.

In the first hour of trading the market backtracked nearly one percent from the prior’s day close of 2,105.26 and then rallied through most of the remainder of the day to close a modest 0.3% lower on the day at 2,099.13.

While some bemoaned the observation that the market had not been able to maintain a close over 2,100 for more than a day, we opt to marvel at the resilience in light of the size of the miss (notwithstanding the Verizon strike settlement, which skewed the numbers negatively for May by around 35,000 workers when the Labor Department termed the strikers unemployed; likely this will be reversed in the June report).

We ponder that this latest example of stock market resilience─along with the very modest backtracking that occurred post the market’s run-up through April 20th from the low on February 11th─ might be the market signaling that better things lie ahead for stocks.

That cooler heads prevailed in the face of last week’s disappointment as well as the dollar’s renewed weakness both augur well for stocks, in our opinion.

It’s not so much that we’re out of the woods

Plenty of challenges remain on the landscape.

We could see a test of last week’s action today post the Memorial Day holiday as a fuller Wall Street contingent than were at their desks last week returns to consider last week’s resilience.

That said, with the Fed likely to delay a rate hike at least a month or two and perhaps even longer (until the fall or even ‘till the end of the year)─a weaker dollar, modest growth stateside, less denial about just how little rates may normalize this year, along with signs of some improvements in foreign economies around the globe could prove supportive to better revenue and earnings growth for the S&P 500 in earnings seasons yet to come this year.

Stay tuned.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.