Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Here I Am, Stuck in the Middle with You

Markets look towards rally mode on news of French election

Markets around the world appeared to breathe a sigh of relief yesterday as French voters chose Centrist Emmanuel Macron and far-right nationalist Marine Le Pen in the first round of the French presidential election. A run-off election between Sunday's two winners is scheduled for May 7th. According to election officials, with over 90% of votes counted Macron, a centrist candidate and supporter of France's membership in the EU and EMU as well as a globalist, is expected to take 23.8% of the vote. Le Pen is expected to take around 21.78% of the votes after the remaining votes are counted. Le Pen's platform calls for France to exit the euro currency, reintroduce the franc, renegotiate France's role in the EU, take a harder tack on immigration (reducing immigration in France to 10,000 persons a year) and place a tax on foreign workers.

While there is no assurance that Macron will win in next week's runoff, Bloomberg news reported on Sunday that a snap poll indicated that Macron would receive 62% of the vote to defeat Le Pen by more than 20% in next week's runoff.

Ironically, the two parties considered to be the establishment parties in France were eliminated in the first round of the election on Sunday. French Republican candidate Francois Fillon conceded after he placed third with a projected 20% of the vote an hour after the polls closed. Fillon had been a front runner early on but saw his popularity ebb as questions tied to his hiring of his spouse arose during the campaign. Communist Party-backed Jean-Luc Melenchon with 19.4% had refused to concede as we prepared to go to press with this week's strategy report.

As market participants around the world digested the results of the French election stocks rallied in Asia with the futures markets broadly pointing toward gains in Europe and stateside as the sun rises across markets Monday. The euro advanced on news of the election's outcome and US bond prices eased some as “risk off” positioning put in place ahead of the election receded, and “risk on” mode moved back on.

Stocks stateside traded mixed during last week, but closed higher for the week as results for S&P 500 companies for the first quarter continued to broadly surprise to the upside even while mixed economic data and concern about current market valuations kept enthusiasm somewhat in check. As of last Friday the S&P 500 stood just 2% off its record high of 2395.96 reached on March 1.

With just under 20% of S&P 500 companies thus far having reported, 75.8% have beaten consensus earnings forecasts while 62.1% have beaten consensus revenue forecasts according to Thomson Reuters I/B/E/S.

Though it is still too early in the reporting season to jump to conclusions, Q1 earnings so far are up over 11% inclusive, of course, of an improvement in earnings from the oil sector which had been a significant drag on earnings for the benchmark in prior quarters.

For the week ended last Friday, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq respectively advanced 0.5%, 0.8% and 1.8%. The S&P 400 (mid-caps) and the Russell 2000 (small caps) respectively advanced 2.2% and 2.6% in the same period, indicating investor confidence in economic growth.

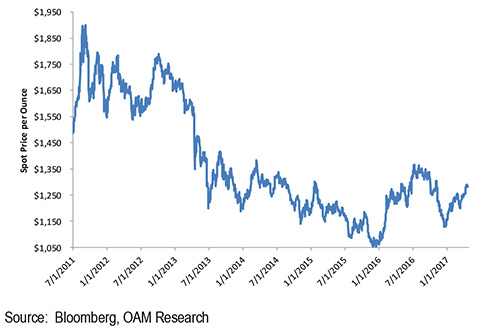

Gold has been on a roll in 2017 (up nearly 12% since the start of the year), but softened last week on improved equity earnings and expectations of details on tax reform. These boosted growth expectations. In the week prior to last it was up around 2.5% as the dollar weakened and prospects for tax reform and other fiscal stimulus agenda items of the new administration looked to be pushed out further. However, gold was flat with a negative bias on the week ended Friday as comments from the White House and the Treasury signaled that an update on tax reform could come this week.

In the week ahead look for earnings results and administration agenda updates stateside, geopolitical signposts abroad (France, North Korea, Middle East) and economic data to continue to keep investors focused and on their toes. Friday's US Q1 GDP update will likely have some influence as investors close the week.

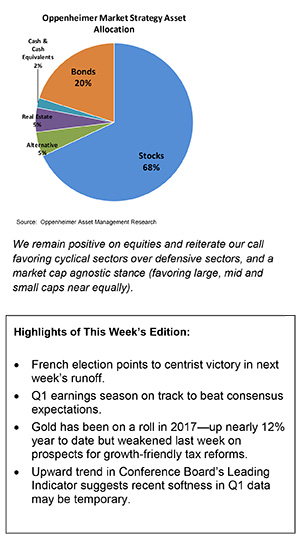

We remain positive on equities and reiterate our call favoring cyclical sectors over defensive sectors, a market cap agnostic stance (favoring large, mid and small caps near equally). This is based on our expectations for the US economic expansion to continue at a sustainable (if moderate) pace while the process of global economic recovery becomes more pronounced in the international realm. A steady but not heady pace of growth and reflation should help the Federal Reserve keep its process of interest rate normalization on track, but at a pace modest enough as to not jar the equity market. The bond market remains vulnerable to interest rate normalization though in our opinion with less drama likely in the foreseeable future as the Fed's pace and incremental increases remain measured.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.