Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

We Can Work It Out

Unorthodox approach to the presidency shakes things up and generates dialog

Try to see it my way, Only time will tell if I am right or I am wrong While you see it your way There's a chance that we may fall apart before too long We can work it out, We can work it out... ─The Beatles

Traders, investors and pundits return to work today to a holiday-shortened week stateside in the markets.

The President’s Day three-day weekend gave market participants plenty of time to ponder the political news and opinions, the progress of cabinet appointments and relentless commentary that has become another key signpost to consider with some frequency in projecting how the tone of the markets might be altered whether by a Tweet, a response to a Tweet, a press conference (or a television show parody of such) or a political demonstration.

That said, so far so good for the equity markets in 2017. Stateside Q4 earnings season has surprised to the upside (with S&P 500 earnings through last week up 5.6% on revenue growth of 4.82% with 411 of 500 companies thus far having reported), the dollar has moved lower against ten of the G10 currencies and lower against 19 of 22 major emerging market currencies, and economic data crossing the transom persists in showing signs of improvement that point to the sustainability of the current economic expansion (see our data commentary on page 4).

The Federal Reserve continues to steer monetary policy with a steady hand in data-dependent fashion as it pursues a process of interest rate normalization.

In the US the major indexes posted gains last week with the Dow Jones Industrial Average, the S&P 500 and the NASDAQ Composite moving to new record highs as they advanced respectively on the week 1.75%, 1.51% and 1.82%. According to Barron’s the Dow and the S&P 500 each posted their 9th record high since the year started while the NASDAQ Composite crossed its 18th record high for 2017.

All of the above has led to the increased consternation of bears and skeptics who seem to call with greater frequency for the end of the bull market even as its eighth anniversary appears close on the horizon (March 9).

From our perspective on the market radar screen the rally in equities has appeared to find its source not so much in animal spirits, or in irrational exuberance, or from the results of the presidential election in November, but rather from a confluence of factors including:

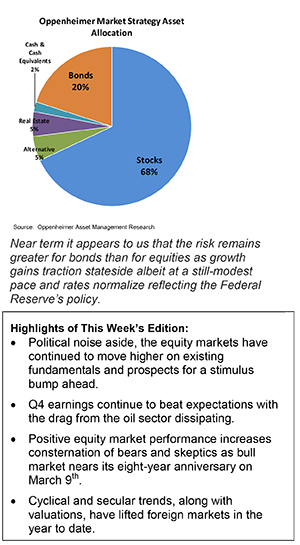

Near term it appears to us that the risk remains greater for bonds than for equities as growth gains traction stateside albeit at a still-modest pace and rates normalize reflecting the Federal Reserve’s stated policy goals.

Prospects for: tax reform at the corporate and personal levels, repatriation of at least a portion of US multinational profits currently held abroad, along with a significant infrastructure stimulus package all important parts of a pro-growth, job-centered and more business-friendly agenda from the new administration’s plans, have certainly helped to boost sentiment and the market’s outlook.

It will take considerable effort and time for both sides of the political aisle to hammer out what ultimately will be the design of all this with the final outcome even further out on the calendar, and with considerable execution risk in the meantime.

Outside of the US, improvements in economic conditions (albeit broadly modest) keep pointing to a recovery process that remains a work-in-progress across regions of the world from Europe to Asia. That process has thus far served as a source of positive offsets to cross-border challenges stemming from a wide variety of issues tied to geopolitical risk, populism, trade, along with election risks and more.

Last week the MSCI EAFE index (developed markets excluding the US and Canada), and the MSCI Emerging Markets index advanced 0.78% and 0.95% respectively while MSCI Frontier markets closed flat with a positive bias on the week. From the start of the year investors have shown increased interest in the international markets, evidenced by the performance of these broad gauges of regional equities (shown in the lower graph on page 8).

Cyclical and secular economic trends along with relatively attractive valuations of equity markets outside of the US appear to us poised to garner further investment attention as the year unfolds.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.