Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Sleep Walk? No Way

Not likely to be a sleepy week ahead as traders and investors return from a three-day weekend.

While this holiday-abridged week will likely see the markets focused on the transition occurring in Washington with the Presidential Inauguration of Donald J. Trump on Friday as focal point, there’s plenty of things for them to consider leading into the week’s main event.

Stateside this week there’s a number of Fedspeak events on the calendar as Fed officials address audiences around the country throughout the week and even on Inauguration Day (see our Fedspeak calendar on page 3).

Fed officials’ speaking engagements in separate venues across the country this week include presentations by one Fed governor, two regional Fed presidents and Fed Chair Janet Yellen (speaking on two separate days).

In addition to a busy speaking calendar, the Federal Reserve releases its Beige Book (anecdotal summaries of the economies monitored by the Fed’s regional branches across the country) on Wednesday. With the next FOMC meeting scheduled for February 1st (just a little more than a week after the Presidential Inauguration), we’d expect each Fedspeak event to be well-covered, with comments parsed essentially in real time by journalists, pundits and market participants.

In addition to the aforementioned stateside calendar events, the fourth-quarter earnings calendar carries considerable weight this week as a number of widely followed corporate names representing key sectors report results and likely provide investors with a sense of what may lie ahead in 2017.

(Among the companies reporting this week are United Health Care, Morgan Stanley, CSX, United Airlines, Netflix, Goldman Sachs, Citigroup, American Express and IBM.)

In Europe, the World Economic Forum convenes in Davos, Switzerland today. The annual event, which brings together government officials, business leaders, educators, celebrities and the media, will likely provide a slew of commentary for investors to consider regarding the changing of the guard at 1600 Pennsylvania Avenue, along with varied projections of what the implications of the new administration’s anticipated policies might be for countries and regional economies around the world.

The ECB (European Central Bank) announces its benchmark rate decision on Thursday with ECB President Mario Draghi speaking at a press conference afterwards. Investors will be looking for cues as to the ECB’s positioning in the period that lies ahead and what it could mean for the European economies and the markets.

All of the above, and of course more in a globalized landscape, greets investors returning from the Martin Luther King three-day holiday weekend stateside.

Last week saw markets further digest the stock market rally that followed the stateside Presidential Election in November. US Stocks traded somewhat mixed with an overall positive bias last week as the Dow Jones Industrial Average, the S&P 500, the S&P 400 (mid-caps), the Russell 2000 (small-caps) and the NASDAQ Composite (a little more than 40% weighted in technology-related names) respectively returned - 0.39%, -0.10%, +0.32%, +0.35% and +0.96%.

The dollar slipped 1% against the DXY index (a basket of six major trading partner country currencies) last week through Friday. The 10- year Treasury rallied in price, sending its yield lower to 2.4% at last week's close.

With international markets open around the world Monday, the 10-year US Treasury yield slipped slightly lower from Friday’s close with the dollar easing against the yen and the euro in overseas trading.

From our perch on the market radar screen, the stateside equity markets over the last week appear to have moderated somewhat in momentum in response to the particularly strong post-election advance and in anticipation of the inauguration.

We’ll look for the market near term to seek out a catalyst for determining which direction it will take in the weeks ahead from a mix of Q4 earnings results, economic data crossing the transom on a day-today basis, comments from Fed officials, the direction of the bond market, the processing of administration appointments via congressional hearings as well as policy-related comments from the new administration and the new President’s tweets from the Oval Office.

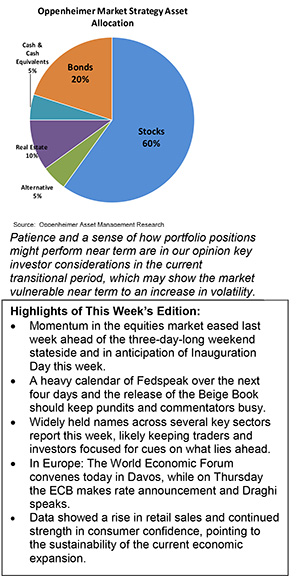

Patience and a sense of how portfolio positions might perform near term are in our opinion key investor considerations in the current transitional period, which may show the market vulnerable near term to an increase in volatility.

Prospects for tax reform (both individual and corporate), regulatory reform, fiscal policy stimulus, and for repatriation of at least some US multinational profits may well offset some level of near-term nervousness and risk tied to what will happen with the Affordable Care Act, and how the tenets of long-standing trade agreements will be addressed as the process of a transition of leadership and style takes place in Washington, DC.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.