Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

2017: Too Early to Tell…

But so far, so good.

Last week economic data crossing the transom along with market action provided support to the view for a continued sustainable economic expansion stateside that could deliver further upside for stocks in the months ahead.

In a four-session holiday-abridged first trading week of 2017 US stocks posted gains with the S&P 500, the S&P 400 (mid-caps) and the Russell 2000 (small caps) posting respective gains of 1.7%, 1.29% and 0.75%.

The S&P 500 and the NASDAQ closed last Friday at new record highs even as the Dow Jones Industrial Averagelike a closely watched pot of heating waternarrowly missed (at one point intraday by just 0.37pts) crossing the 20,000 threshold.

Economic data points released over the course of last week broadly pointed to continued improvement evidenced in the ISM manufacturing PMI, ISM non- Manufacturing PMI, construction numbers for November, and December job growth, wage growth Y-o-Y and motor vehicle sales (to a new record high since October, 2001).

Minutes of the Fed’s FOMC December meeting released mid-week showed monetary policy makers positive on the US economy’s strength and the likelihood that the process of interest rate normalization would continue.

The FOMC minutes showed that the Fed sees uncertainty regarding the new administration’s fiscal agenda and Congressional follow-through.

The dollar eased against foreign currencies early last week and then regained some strength as the first trading week of 2017 neared a close. The yield on the 10-Year Treasury eased some falling to as low as 2.35% on Thursday only to close at 2.42% on Friday, just slightly lower from where it ended last year.

For the week the dollar moved lower against eight of the G-10 currencies and 16 of 23 Emerging market currencies.

Foreign equity markets as tracked by the MSCI EAFE (developed ex-US and Canada), MSCI Emerging markets and MSCI Frontier Markets advanced 1.77%, 2.18% and 2.05% respectively to broadly outperform the US equity benchmarks in the first week of the New Year.

We continue to expect that the dollar will moderate in strength as the year unfolds and economies outside the US will move forward in their respective economic recoveries.

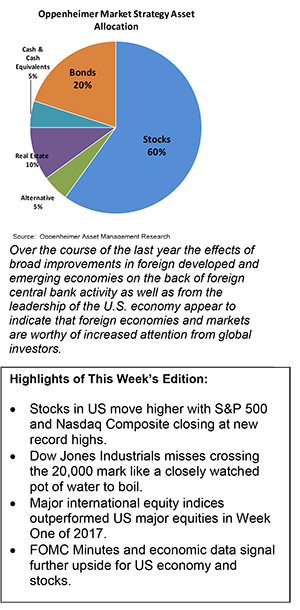

Over the course of the last year the effects of broad improvements in foreign developed and emerging economies on the back of foreign central bank activity as well as from the leadership of the US economy appear to indicate that foreign economies and markets are worthy of increased attention from global investors.

On the stateside political front, President-elect Donald Trump’s tweets and running commentary on auto manufacturing trends garnered the attention of several major auto manufacturers, who in responding, provided further evidence that the Presidential elect’s “tweets” carry substantial weight not just in grabbing the public’s attention but in sparking dialogue and thus far influencing the automakers’ decision-making processes in investments tied to stateside manufacturing efforts.

With the non-farm payroll number and the December FOMC minutes behind it, the market will likely focus on portfolio-positioning ahead of inauguration day (January 20th) and the unofficial start of fourth-quarter earnings season when Alcoa (AA) reports results on January 24th.

From here forward we expect The Fed’s FOMC meetings to take on increasing importance to market behavior and outlook as traders and portfolio managers ramp up their Fed plays ahead of each meeting.

The volatility that could come with such projecting and positioning ahead of and after the Fed’s meetings in the months ahead could present opportunities as well as raise near-term risk levels as rotational shifts and tactical moves take place.

It’s our opinion that patience will continue to be rewarded as the markets do what they do they: fluctuate.

From our perch on the market radar screen prospects for fiscal policy infrastructure spending, corporate tax reform, tax cuts for individuals, a reduction in onerous regulation and the possibility of US multinational funds repatriation along with positive economic trends that were already working themselves through the system prior to the election should help investors weather interim storms that could come up as the Beltway, Main Street, Wall Street and Capitol Hill work through the process and details of administration appointments and the fiscal agenda yet to be fully defined and launched.

We suggest a mantra of “Rome wasn’t built in a day” to get through it all. We expect some increase in volatility likely to occur as the inevitable uncertainties of a transitional period surface in the day to drama likely to unfold on the road to the first 100 days of the new Presidency.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.