Everyday, Everyday I Have the Blues

By John Stoltzfus,

Chief Investment Strategist

Here We Go Again…Taking a Chance on Love

With apologies to Frank Sinatra, we paraphrase him as we reflect on the Bull

We’ve been riding this bull market now for nearly eight years. It’s the most unloved and denied bull market we have ever experienced in an investment career that spans over three decades.

It’s not just the existence of this bull that’s regularly denied by its detractors, but its very purposefulness via the further denial of the importance and usefulness of the efforts of the Federal Reserve to save our society financially from itself that initially propelled this bull market into existence.

And so we find ourselves singing (or at least humming) at the start of the first day of stateside trading in 2017 the old Sinatra standard, “Here I go again…taking a chance on love.”

Bears and skeptics to this market have sought out black swans, bolts from the blue, and even Armageddon itself only to come up short and be proven wrong repeatedly since March 9, 2009, as the bull has climbed a wall of worry. It’s not been an easy hike up the wall for the bull market as it’s come with detours and some doubtful moments along the way, a near eight-year journey of thrills and spills of varying degrees and proportions.

There’ve been recoveries, rebounds, reversals and turnarounds─and all with the participation (willing or otherwise) of a cast of billions of people around the world affected in one way or another by the vacillations and inter-market relationships among asset classes and their valuations.

Capitalists, socialists, communists, anarchists and populists, iconoclasts and ideologists mixed by nationalities as diverse as Russian, Brazilian, English, French, Japanese, Korean, Chinese, Mexican, Israeli, Saudi, South African and Nigerian (and too many more to mention)─the whole world embroiled in a process of global and technological transitions, complicated by layers of global politics, and even demographics to boot.

The mere complexity of the process explains why the arguments for and against the process of economic success or failure are so convoluted.

Trojan horses, thousand-year wars, rivalries and political bifurcation of such rancidness with deeply embedded risks have raised their respective heads with regularity over the last eight years and been amplified on a globally digitalized grid of information. And despite it all, the stock market has managed to move nicely higher.

And so here we stand on day one of trading: dateline 2017, New York.

We expect investors will once again benefit from patience, right-sized expectations, knowing what they own, why they own it, and having a general idea of how their assets are likely to perform over the day-to-day action that will encompass the year ahead.

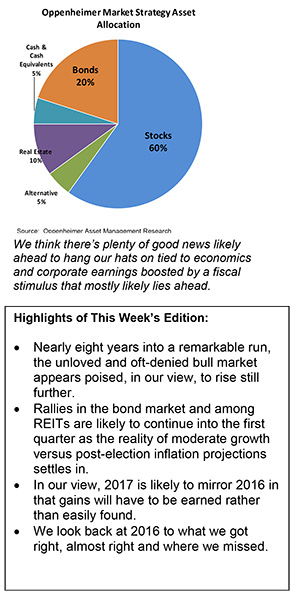

We think there’s plenty of good news likely ahead to hang our hats on tied to economics and corporate earnings boosted by a fiscal stimulus that mostly likely lies ahead.

So far whenever the term “animal spirits” has appeared in market commentators’ prose, we’d note that almost instantly these said animal spirits tend to disappear

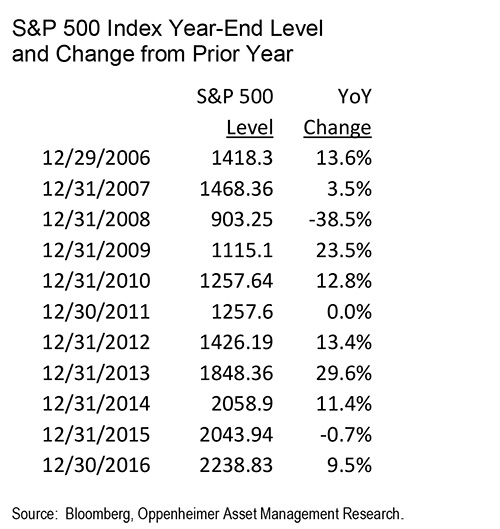

Consider the fourth-quarter momentum, which took the Dow close to 20,000 and the S&P 500 close to our 2016 target of 2300 in the waning days of the year, only to see that year-end rally fizzle out as rebalancing by institutional managers trimmed the sails and escorted in an interlude of a “risk-off” stance for stocks but provided a modest rally in bonds and REITs (we were happy with this as we thought both asset categories had become oversold in the fourth-quarter surge higher as inflation was projected to run higher than it now appears to be running near term).

There is still too much worry and responsible rotational action surrounding this bull market to think that it is about to end.

Usually it is when the crowd “dances naked around the maypole” (also once famously called “irrational exuberance”) that lightning strikes.

For now the fundamentals continue to improve and appear to support sufficiently the sustainability of the current economic expansion stateside.

Beyond that, signs are gradually becoming apparent on our radar screen that a global economic recovery is beginning, following in a path parallel if not similar to that of the earlier US recovery.

For now, we anticipate that the markets in the near term will settle into a first-quarter process of price discovery among asset classes that will take several weeks (assuming no unforeseen economic, market, or geopolitical catalysts) that could apply further definition.

We plan to keep a close watch on what we believe will be a further rally in bonds and REITS ahead as the inflation and growth projected in the postpresidential rally fade into the reality of a potentially many months-long transitional period before the actual effects of stimulus programs that are yet to be launched (and in some cases yet to be defined).

Once the markets can configure the timeline that lies ahead for the stimulus programs (their approval processes, launch dates, etc.), the markets will begin to discount more accurately or with more clarity perhaps what lies ahead.

We continue to believe that the market as reflected by the S&P 500 has a good chance to reach a level of 2450 by the end of this year with earnings in 2017 potentially rising around 15% (over 2016) with a P/E market multiple at close to 19.5x.

In our view, 2017 is likely to mirror 2016 in that gains will have to be earned rather than easily found.

At the start of this year we’ll keep the party hats in the box and the shoulder to the wheel with a commitment to exercise patience and have a readiness to improvise as the calendar pages turn.

For the complete report, please contact your Oppenheimer Financial Advisor.

Other Disclosures

This report is issued and approved by Oppenheimer & Co. Inc., a member of all Principal Exchanges, and SIPC. This report is distributed by Oppenheimer & Co. Inc., for informational purposes only, to its institutional and retail investor clients. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client of Oppenheimer & Co. Inc. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. The strategist writing this report is not a person or company with actual, implied or apparent authority to act on behalf of any issuer mentioned in the report. Before making an investment decision with respect to any security discussed in this report, the recipient should consider whether such investment is appropriate given the recipient's particular investment needs, objectives and financial circumstances. We recommend that investors independently evaluate particular investments and strategies, and encourage investors to seek the advice of a financial advisor. Oppenheimer & Co. Inc. will not treat non-client recipients as its clients solely by virtue of their receiving this report. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report. The price of the securities mentioned in this report and the income they produce may fluctuate and/or be adversely affected by exchange rates, and investors may realize losses on investments in such securities, including the loss of investment principal.

Oppenheimer & Co. Inc. accepts no liability for any loss arising from the use of information contained in this report. All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such information, opinion or statistical data is accurate or complete and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgments as of the date of this report and are subject to change without notice. Nothing in this report constitutes legal, accounting or tax advice. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation

INVESTMENT STRATEGY

should not be construed as offering tax advice on the tax consequences of investments. As with any investment having potential tax implications, clients should consult with their own independent tax adviser.

This report may provide addresses of, or contain hyperlinks to, Internet web sites. Oppenheimer & Co. Inc. has not reviewed the linked Internet web site of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the recipient's convenience and information, and the content of linked third party web sites is not in any way incorporated into this document. Recipients who choose to access such third-party web sites or follow such hyperlinks do so at their own risk. The S&P 500 Index is an unmanaged value-weighted index of 500 common stocks that is generally considered representative of the U.S. stock market. The S&P 500 index figures do not reflect any fees, expenses or taxes. This research is distributed in the UK and elsewhere throughout Europe, as third party research by Oppenheimer Europe Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA). This research is for information purposes only and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This report is for distribution only to persons who are eligible counterparties or professional clients and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the UK only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) High Net Worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. In particular, this material is not for distribution to, and should not be relied upon by, retail clients, as defined under the rules of the FCA. Neither the FCA’s protection rules nor compensation scheme may be applied. This report or any portion hereof may not be reprinted, sold, or redistributed without the written consent of Oppenheimer & Co. Inc. Copyright © Oppenheimer & Co. Inc. 2015.