Due Diligence

The Value of Due Diligence

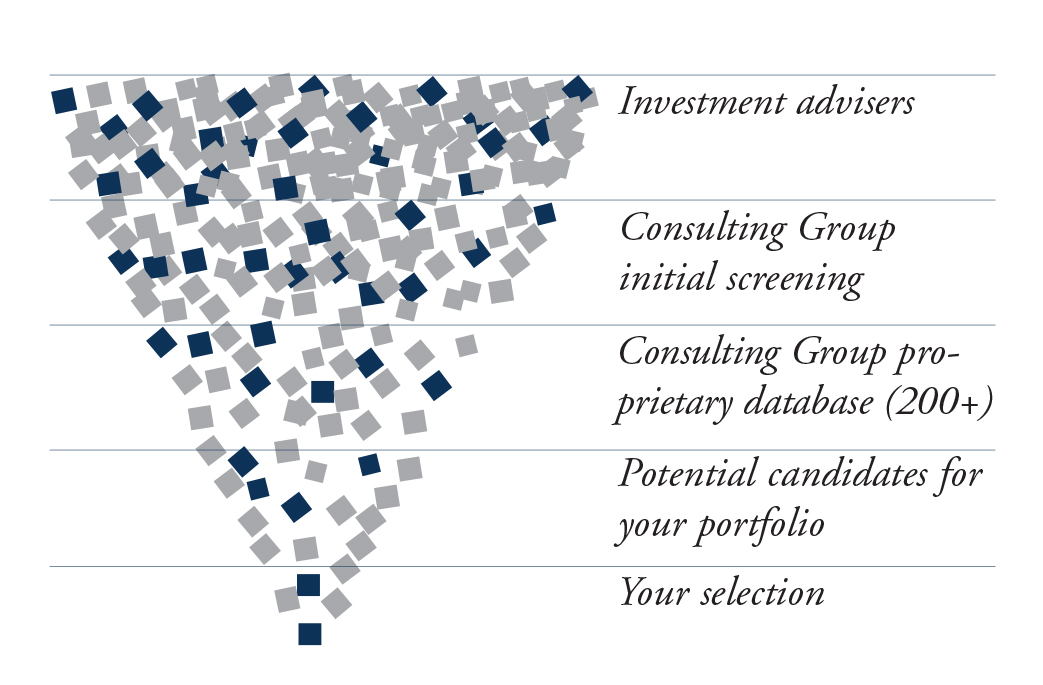

Disciplined due diligence is the backbone of the Consulting Group – through comprehensive research, quantitative and qualitative analysis, and review, we narrow the scope of the investment landscape from the thousands of managers and funds that exist to a select group that match the standards of quality and performance our clients expect from us. Through this extensive process, we have constructed and maintained a roster of premier managers and funds that we believe can add significant value to our clients' portfolios.

The due diligence process is not complete when a manager or fund is approved for inclusion in Consulting Group programs; the manager or fund must consistently demonstrate high standards of quality and performance. We continue to monitor each manager and fund to ensure they maintain the standards and objectives that led to their initial inclusion in the Consulting Group's select universe.

Initial Information Gathering

The consulting group continuously seeks out new investment management firms that will enhance our programs, searching through thousands of managers and funds to identify those that have attractive risk-reward characteristics. Initial screening narrows the vast universe to a smaller number of candidates. The screens include historical returns on an absolute and risk-adjusted basis, as well as the value added byt he manager over time.

Consulting Group review

After analysis of the initial data, the Due Diligence Team decides whether the candidate warrants futher consideration. If a manager or fund is deemed attractive, a formal research profile is compiled by a due diligence analyst. Included in the research profile is information such as assets under management, staff and size of organziation, portfolio performance data, and strategy.

Site visit

One or more members of the Due Diligence Team examine the manager or fund's organization through intensive, formal meetings with key management and other personnel. The face-to-face interviews are intended to gain more in-depth understanding of: the overriding firm philosophy; the breadth and depth of products offered; the process that leads to security selection and portfolio construction; protfolio positioning in terms of sector, regional and country allocations; asset size and liquidty; current and historical cash positions; credit quality; and portfolio turnover.

Performance audit

The Consulting Group examines the historical performance of the manager or fund. They look at which securities were bought and sold and the timing of the transactions, in order to understand the strategy and evaluate its application.

Questionnaire

All new candidates for inclusion in our select universe must complete a questionnaire, which covers the candidate's strategy, holdings, analytical performance data, organizational history and structure, and strengths and weaknesses of the business. The questionnaire confirms in writing much of the information that was obtained through the interview process.

Final approval

The Due Diligence Team, composed of Due Diligence analysts and Consulting Group management, determines whether the manager or fund is appropriate for inclusion in the consulting programs. In its final consideration, the committee often requires additional questions to be answered or information that may extend the review process further.

- Consulting Group

- Strategic Asset Allocation

- Investment Programs

Additonal Links

WHY CHOOSE OPPENHEIMER?

Learn MoreWe are Deeply committed to our clients and offer the same level of service to investors of all sizes

We foster a culture of independence and autonomy and offer clients direct access to decision-makers.

For more than 125 years we have provided our clients with the financial expertise and insight to meet their goals.